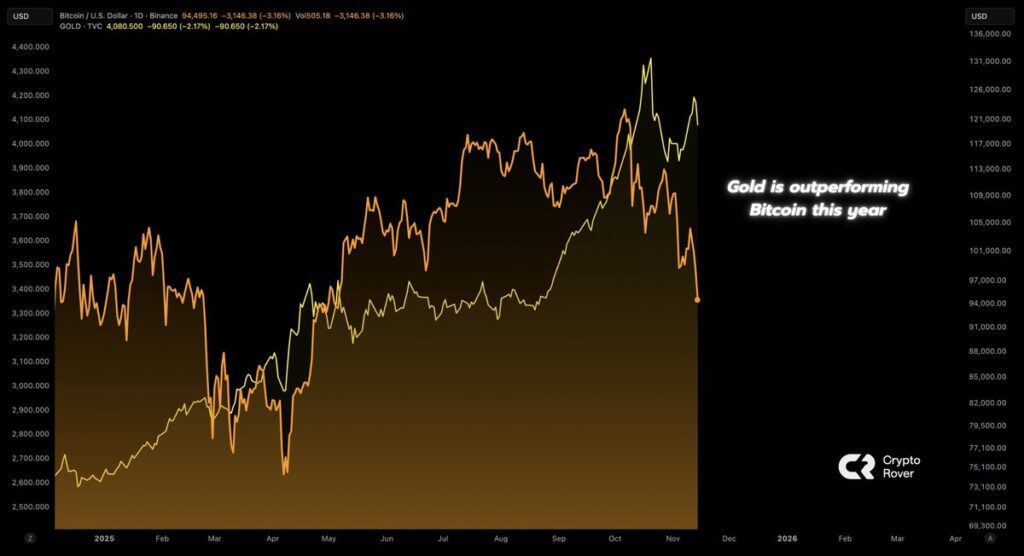

A shocking shift has taken form in world markets this quarter: gold is now dramatically outperforming Bitcoin in 2025, one thing that hasn’t occurred since BTC entered the mainstream funding panorama.

Contemporary knowledge from mid-November reveals gold up roughly 36% year-to-date, pushed by relentless geopolitical threat, report central-bank purchases, and a broad flight to security. Bitcoin, regardless of posting robust positive aspects earlier within the 12 months, is forward solely about 15%–16% after a number of extreme pullbacks and heavy ETF outflows.

A Uncommon Flip within the Market’s “Laborious Asset” Hierarchy

Aspect-by-side efficiency charts inform the story clearly: each property rank among the many strongest performers of the 12 months – however for the primary time, gold is firmly main, reversing a development that held for greater than a decade.

The distinction comes right down to how every asset dealt with 2025’s unstable macro backdrop. Gold climbed steadily, largely uninterrupted, as traders rotated into defensive positioning amid political uncertainty and rising world debt stress.

Bitcoin, in the meantime, surged to new highs earlier than giving again a big portion of its positive aspects throughout a collection of sharp corrections that left the asset struggling to take care of momentum.

Not a Bitcoin Breakdown – a Security Bid

Analysts be aware that Bitcoin’s slower efficiency doesn’t indicate a collapse in confidence. As an alternative, 2025’s setting has rewarded property with low volatility and excessive liquidity. With price cuts delayed and financial uncertainty rising, safety-first capital has poured into conventional shops of worth – and gold has been the most important beneficiary.

Bitcoin continues to behave as a high-beta macro asset: highly effective in growth, susceptible throughout liquidity squeezes.

Two Winners – However Solely One Market Chief

Each gold and Bitcoin stay key barometers for investor sentiment. But because the 12 months enters its closing stretch, gold is setting the tempo, leaving Bitcoin to chase from behind – a twist few would have predicted when the 12 months started.