Ray Dalio’s newest 13F has landed, and Bridgewater Associates seems nothing prefer it did 1 / 4 in the past.

The world’s largest hedge fund has made a few of its sharpest cuts in years, dumping large chunks of the identical mega-cap tech names that powered the market’s rally – and redirecting capital into areas Dalio has been hinting at for months.

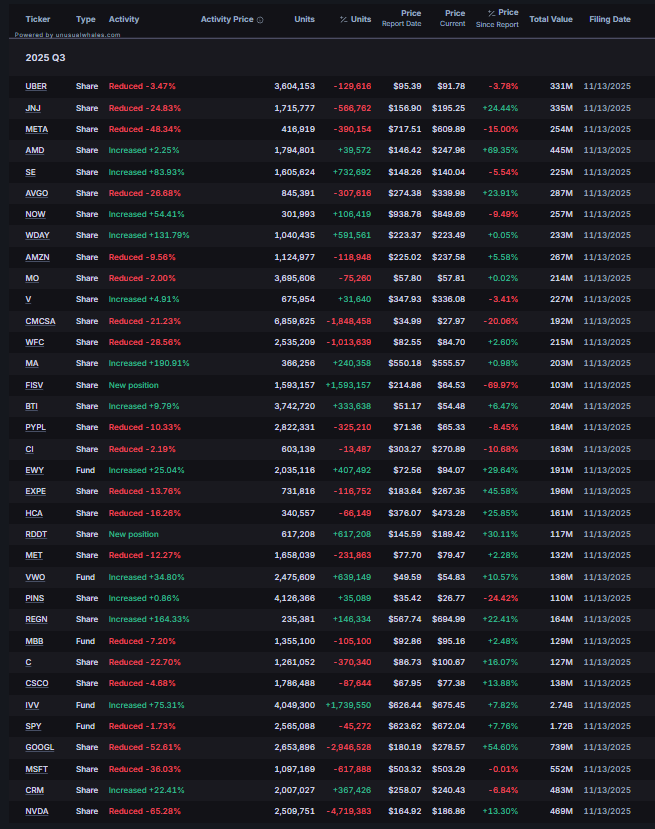

Probably the most eye-catching strikes got here from a deep retreat from Silicon Valley’s largest gamers. Bridgewater trimmed Meta to almost half its earlier measurement and executed a fair harsher discount on Nvidia, slashing the place by greater than 65%.

Alphabet and Microsoft – longtime portfolio staples – have been lowered by roughly a 3rd to half. Even positions in Uber, PayPal, and main U.S. banks have been lightened, suggesting Dalio is pulling capital away from the corners of the market most uncovered to tightening monetary circumstances.

But the submitting doesn’t present a hedge fund working from threat – solely shifting the place it needs to take it. Bridgewater concurrently ramped up publicity to a set of high-conviction names: Sea Restricted soared greater than 80%, Mastercard almost tripled, Workday and Regeneron noticed triple-digit proportion boosts, and AMD edged increased as properly. The addition of Fiserv and Reddit introduces a brand new mixture of digital funds and social-ad-driven development.

Bridgewater additionally broadened its world footprint. Positions tied to rising markets – together with South Korea’s EWY and the broad VWO ETF – have been elevated considerably. Even the agency’s S&P 500 tracker was expanded, a reminder that Dalio isn’t exiting U.S. publicity however redistributing it with extra warning.

The form of the portfolio aligns with the warnings Dalio has issued all year long. He has repeatedly confused that the U.S. is coming into a interval he calls a “hazard zone” – a convergence of heavy debt burdens, political pressure, and valuations that depart little room for error. In an atmosphere the place he sees recession threat rising and geopolitical tensions including new layers of uncertainty, Bridgewater’s Q3 strikes seem like a preparation play: scale back the belongings most weak to a pointy repricing, and lean into companies – from biotech to software program to emerging-market development — that will maintain up higher if the cycle turns.