Arthur Hayes, BitMEX co-founder, accelerates the promoting of ETH, ENA, and ETHFI as BTC plunges to a six-month low.

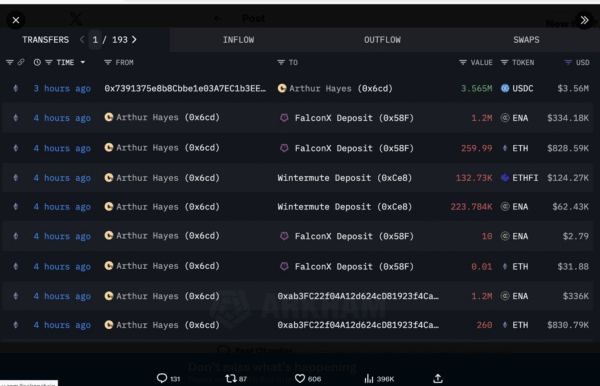

In a significant transfer, information from Lookonchain signifies Arthur Hayes had gone on one other promoting spree. He’s a former CEO and co-founder of BitMEX. He dumped a number of altcoins. This transfer occurred within the face of enormous market volatility.

Hayes Dumps Altcoins Amid Crypto Market Crash

The primary batch of this that was reported by the analytics firm confirmed his disposals. He removed 520 ETH, 2.62 million ENA, and 132,730 ETHFI. This occurred in a matter of some hours. This fast liquidation brings out his fast response to market situations.

Arthur Hayes(@CryptoHayes) seems to have bought 520 $ETH($1.66M), 2.62M $ENA($733K), and 132,730 $ETHFI($124K) 4 hours in the past.https://t.co/loeYKUb9rN pic.twitter.com/NDEJlxGiWn

— Lookonchain (@lookonchain) November 16, 2025

Arthur Hayes appears to have bought 520 $ETH ($1.66M). He additionally bought 2.62M $ENA ($733K). The overall variety of tokens bought was 132,730 $ETHFI ($124K) as well as. These figures underline the extent of his current buying and selling exercise.

Bitcoin reached a six-month low in mid-November of 2025. It dropped to $94K on November 14, 2025. This was within the midst of a broader sell-off in danger belongings. This market downturn resulted in plenty of stress all through the crypto area.

Associated Studying: Crypto Information: Arthur Hayes Predicts Multi-12 months Crypto Bull Run | Stay Bitcoin Information

Causes for the drop are sophisticated. The sell-off had been pushed by receding hopes for a Federal Reserve rate of interest reduce. Some policymakers recommended that there’s an unwillingness to loosen financial coverage. In line with one analyst, long-term holders of Bitcoin have been cashing out. They bought a document variety of 815,000 BTC up to now 30 days.

His newest promoting strikes have come on the heels of the most recent crypto market crash. Recall that BTC, together with practically all the altcoins, dumped onerous on Friday. Bitcoin fell to a six-month low of $94,000. In the meantime, ETH dipped to $3,100. Apparently, there may be one apparent exception from the alts. Hayes has been out and about in help of this one for the previous a number of weeks.

Bitcoin’s Six-Month Low and Macroeconomic Influences

Bitcoin’s current dive to $94,000 is a significant milestone. It marks the underside worth for the final six months. This drop signifies a bigger market correction. It’s also a mirrored image of the rising investor warning.

The position of the macroeconomic atmosphere is of essential significance. Expectations of Federal Reserve rate of interest cuts are disappearing. This has contributed to a “risk-off” sentiment. Buyers are withdrawing from riskier belongings. Historically, unstable cryptocurrencies are sometimes first hit.

The promoting behaviour of the long-term Bitcoin holders can be fascinating. Their determination to take earnings is a sign of a strategic re-evaluation. This might point out fears of downtrends forward. It could even be merely a response to assembly private funding targets.

Hayes’s actions being a outstanding determine will typically entice market consideration. His determination to unload substantial quantities of altcoins may have an effect on different traders. It could possibly be an indication of perception in further weak point for these belongings within the quick time period. His extended help for a specific altcoin, although, is one other story.

Finally, this suggests selective perception even within the midst of a widespread sell-off. The crypto market is a really dynamic one. It reacts to each micro-level dealer selections and macro-level adjustments within the financial system.