Sunday closes with the type of motion that doesn’t appear to be the tip of every week in any respect, as a result of as a substitute of the same old low-energy drift you get a market that retains producing new factors of pressure.

From outsized shorts opened with most leverage and virtually zero respiratory room to a clear technical setup on the XRP/BTC chart which will recreate the July’s 40% surge sample, all the best way to the heaviest long-term holder promoting wave for the reason that begin of 2024, which now defines the macro image excess of any intraday swing on Binance or Coinbase.

TL;DR

- One dealer has opened a $196 million leveraged brief basket throughout BTC/XRP/ZEC.

- XRP/BTC has recreated July’s crossover setup.

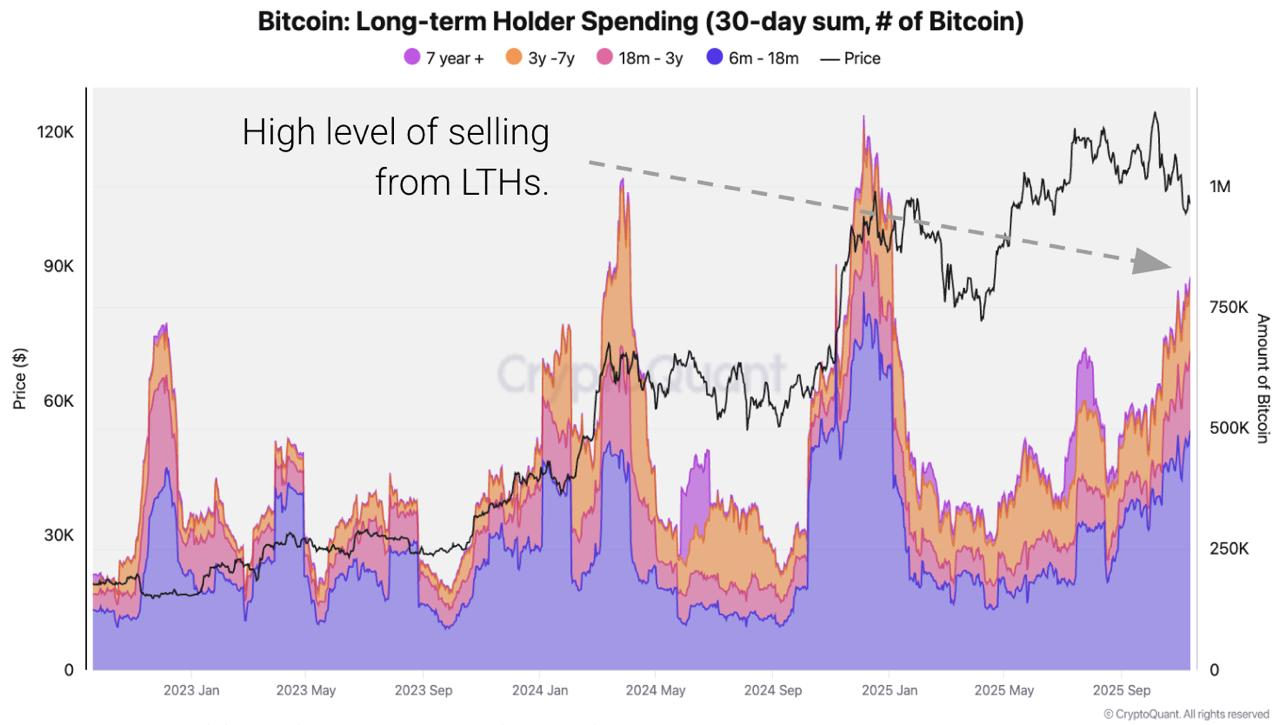

- Lengthy-term holders have unloaded 815,000 BTC in 30 days.

$27.4 million XRP brief opened

The derivatives board opened the weekend with a place block that instantly stood out, not as a result of the market has not seen massive leveraged trades earlier than however as a result of this one was constructed with absolute disregard for volatility. The mix of 40x BTC, 20x XRP and 10x ZEC inside a $196 million block leaves no operational runway — the dealer basically tied their destiny to the following candle fairly than any midterm time-frame.

Even the unrealized revenue sitting in inexperienced doesn’t present consolation, as a result of with this diploma of leverage, the gap between revenue and liquidation is measured in ticks.

Concurrently, the sooner dealer who mirrored this aggressive posture is already underwater and has misplaced a large portion of their e book by way of pressured liquidation. The timing — lower than a full day after opening — exhibits how fragile leveraged shorts stay within the present surroundings, the place Bitcoin can erase or add a number of share factors in minutes and XRP trades in fast bursts fairly than managed waves.

XRP within the meantime has been leaping round so much just lately, hitting $2.34-$2.36, then dropping straight again to $2.20-$2.22 once more. There isn’t a orderly sample to it, so it isn’t a spot the place you may simply sit again and calm down.

XRP readies 40% transfer towards Bitcoin

Whereas the liquidations and outsized shorts dominate the headlines, XRP presents one of many few structured setups in your complete market. The XRP/BTC pair is replicating the identical 23-day and 50-day transferring common interplay that outlined the July rally, when the pair moved from 0.0000218 BTC to 0.00003073 BTC in a straight 12-day stretch, gaining 40.91% with none significant interruption.

This time the alignment is nearly similar: the transferring averages compress, the slope matches the summer time profile, and the value sits immediately on the initiation zone. A full replication of the July transfer will not be assured, however even a partial repeat locations a 25-30% extension on the desk, particularly since BTC dominance continues to lose definition and might not suppress alt pairs by default.

The present Bitcoin value motion across the $96,400 space strengthens the setup much more. When Bitcoin fails to impose course, relative-strength property like XRP/BTC achieve freedom to ascertain unbiased traits, and this specific configuration carries sufficient historic backing to deal with it as greater than coincidence.

815,000 BTC bought in simply 30 days

The macro image turns into inconceivable to disregard as soon as long-term holder habits enters the body. In response to CryptoQuant, long-term holders have bought 815,000 BTC within the final 30 days, marking the heaviest distribution wave since January 2024.

Traditionally, when long-term holders promote at this magnitude, the market doesn’t collapse immediately. As a substitute, it enters a drifting state the place technical alerts lose reliability, bounces fade shortly and dips fail to escalate as a result of each transfer is competing with a steady provide injection.

This section forces misreads: merchants mistake pauses for reversals and volatility spikes for pattern modifications, however the underlying mechanic is just absorption of long-term provide.

This promoting wave additionally aligns with a seasonally weak quarter. CoinGlass knowledge already locations This fall, 2025 in worse territory than This fall, 2022 and This fall, 2019, each remembered for drawn-out draw back phases that continued regardless of pockets of intraday energy. The mix of heavy LTH outflows and weak seasonal efficiency creates a gridlock the place even logical bounce zones fail to create pattern shifts.

However there’s a competing interpretation. Bitwise CEO Hunter Horsley argues that the market has already been in a bear section for six months, not coming into one now, and that the construction is near decision as ETF-driven liquidity reshapes the cycle. If that’s appropriate, this 815,000 BTC wave represents the ultimate stage of transition fairly than its onset.

Crypto market outlook

The market heads into the brand new week wanting precisely just like the type of panorama the place nothing strikes cleanly anymore: Bitcoin is drifting round $96,000, alts are attempting to construct course, and the entire market feels pushed extra by whoever will get liquidated subsequent than by any actual narrative.

- Bitcoin (BTC): Trades close to $96,400, unable to translate volatility into pattern.

- Ethereum (ETH): Nonetheless reactive, nonetheless shadowing BTC with out creating unbiased energy.

- XRP: Holds the clearest catalyst by way of the XRP/BTC crossover construction.