- LINK breakdown pressured a serious help zone, however accumulation developments stay sturdy.

- Trade outflows, rising Taker Purchase CVD, and long-heavy positioning help a rebound case.

- Reclaiming $16.64 is the important thing set off for momentum towards $19.13 and doubtlessly increased.

Chainlink’s drop beneath that large $16 help stage positively shook issues up, placing round 53.8 million amassed LINK beneath strain and shifting the entire psychology of the chart. Merchants had anticipated continuation, not rejection, so the breakdown felt heavier than normal and the zone flipped straight into resistance. Nonetheless, LINK continues hovering round a dense exercise cluster — a kind of areas the place affected person holders dig of their heels and watch for a restoration spark. Despite the fact that sentiment dipped, the market construction hasn’t totally collapsed, which leaves room for a bounce if situations line up proper.

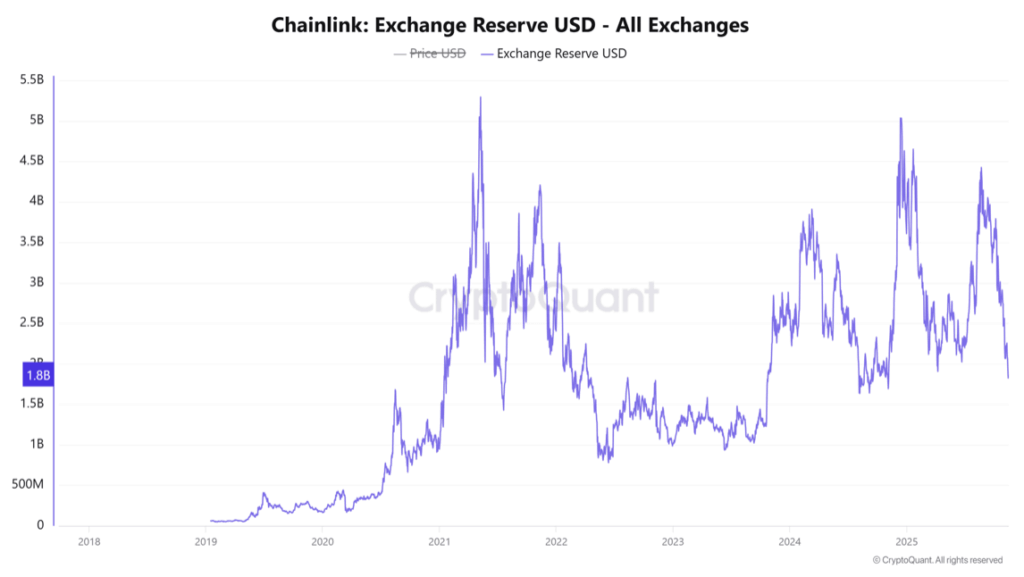

Trade Reserves Proceed Falling, Hinting at Quiet Accumulation

One of many extra attention-grabbing alerts right here: LINK alternate reserves maintain slipping. One other 2.26% drop — taking the full towards 1.8 billion — leans bullish reasonably than bearish, because it suggests holders are eradicating tokens from exchanges as an alternative of prepping to promote them. Much less sell-side liquidity signifies that, every time patrons return, upside can transfer sooner. Outflows like these usually present up earlier than stabilization phases too, as a result of shrinking provide strain makes the following push smoother. Even so, the break under $16 nonetheless weighs on short-term confidence; merchants need a firmer base earlier than leaning too arduous into the bullish narrative.

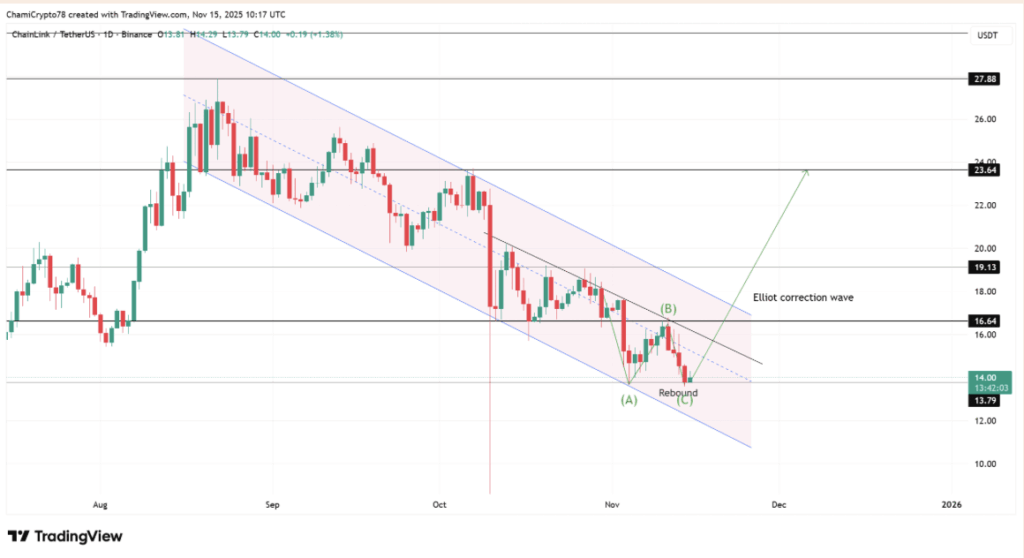

A Rebound Types Contained in the Descending Channel

LINK has been transferring inside a descending channel since early September, shaping its corrective pattern. The worth now sits close to the decrease fringe of that channel, the place patrons stepped in after finishing a full Elliott A-B-C correction. The response from the “C” leg hints that the market nonetheless respects that decrease boundary as help. However for sentiment to actually shift, LINK must reclaim the mid-channel area. A clear break above that space opens room towards $16.64 — which traces up with a earlier provide block. If bulls maintain that stage afterward, $19.13 turns into the following goal, with a extra optimistic projection stretching towards $23.64. If worth rejects on the midpoint once more although, the setup weakens and decrease lows come again into play.

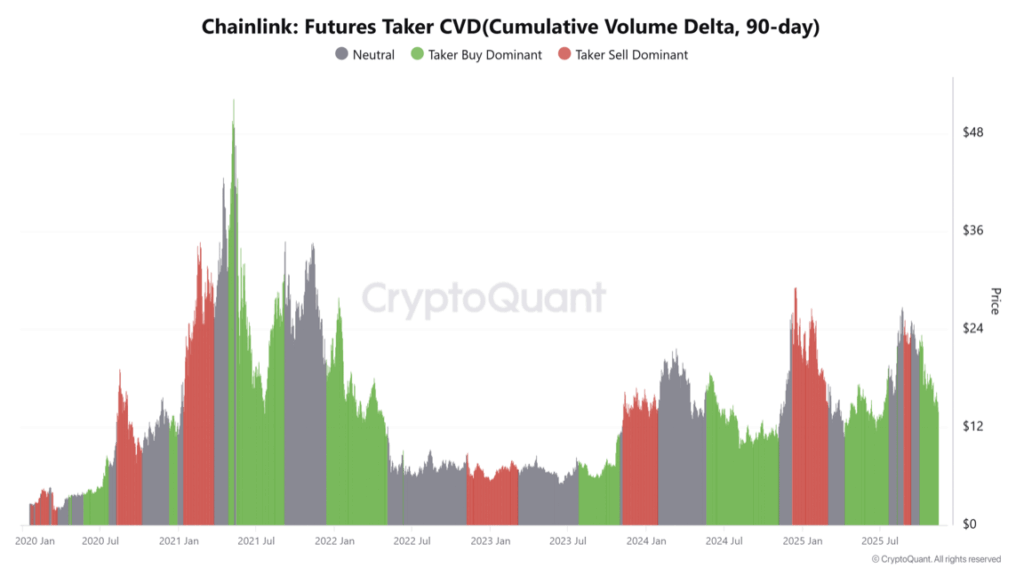

Taker Purchase Dominance Jumps as Prime Merchants Lean Lengthy

Futures information provides one other layer to the story: Taker Purchase CVD has been climbing steadily, displaying aggressive patrons stepping in in the course of the correction as an alternative of sitting on the sidelines. The rising curve matches the “C” leg rebound on the charts, which supplies the transfer some additional credibility — it’s not only a passive bounce. On the similar time, Binance’s top-trader positioning reveals 74.32% of positions leaning lengthy, in comparison with solely 25.68% quick. That 2.89 ratio suggests skilled merchants are anticipating a mid-channel reclaim and a doable pattern shift. Nonetheless, all this futures energy wants Spot affirmation to hold any actual weight. With out that, momentum can fade quick.

Will LINK Reclaim $16.64 and Reverse?

All indicators level towards early stabilization: alternate reserves falling, Taker Purchase dominance rising, and high merchants stacking lengthy publicity. Mix that with the Elliott rebound and channel help, and the technical backdrop seems… cautiously constructive. However the actual take a look at sits at $16.64. If patrons push LINK again above that stage and maintain it, the trail towards $19.13 turns into very lifelike. The following few periods ought to reveal whether or not accumulation strain outweighs the lingering bearish temper or if LINK wants extra time earlier than a full reversal.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.