- Whales dumped practically 200M XRP in 48 hours, sending the value beneath $2.20 and triggering a pointy wave of promote strain.

- Analysts say the drop seems to be extra like a basic “shakeout,” with sentiment flashing excessive worry ranges that beforehand marked main XRP rebounds.

- Key help sits at $2.10; shedding it may ship XRP towards $1.90, although long-term construction and ETF demand nonetheless recommend a potential restoration forward.

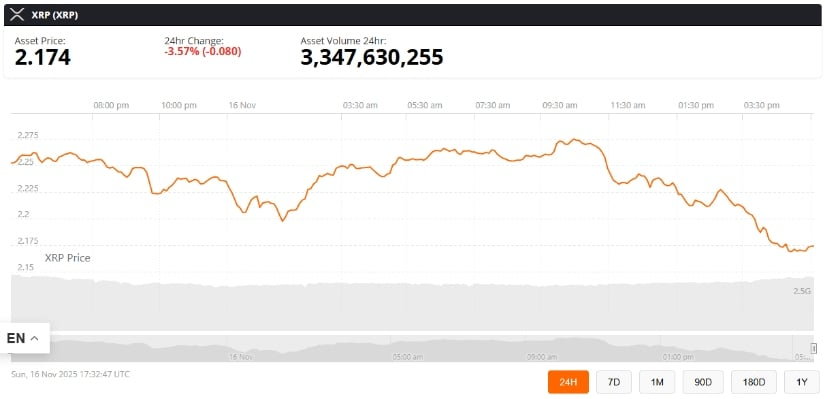

XRP slid below $2.20 immediately, drifting round $2.17 after a sudden burst of heavy whale exercise despatched greater than 200 million tokens towards exchanges. The chart seems to be shaky within the quick time period, with a 3.5% drop up to now 24 hours, however oddly sufficient, a handful of analysts insist the broader construction continues to be holding collectively. They’re pointing to outdated liquidity patterns that normally pop up proper earlier than XRP does its basic snap-back rally… even when the market feels a bit messy proper now.

Whales Dump 200M XRP, Stirring Up Panic

During the last 48 hours, high-value wallets have been unloading XRP at one of many quickest paces seen this 12 months. On-chain information from Santiment reveals practically 200 million XRP exiting whale-controlled addresses between November 13 and 15. Researcher Ali (@ali_charts) flagged the motion, noting how the dump lined up virtually completely with XRP’s slide from round $3 to roughly $2.25 — a drop that shocked even long-time XRP holders.

A number of enormous transfers headed straight for main centralized exchanges like Binance and Coinbase, totalling greater than $400M value of XRP. Strikes like this normally level to promoting preparation as a result of cash circulation from chilly storage into extra liquid venues. Humorous timing too, as a result of it got here proper after the launch of the Canary Capital XRP ETF — which, surprisingly, posted a monster $58 million in day-one buying and selling quantity. Institutional curiosity is clearly alive, even when the value chart doesn’t look too pleasant in the meanwhile.

Analysts Declare This Is Only a “Shakeout”

Whereas retail merchants are bracing for a breakdown, not everybody sees this as a catastrophe. Crypto analyst Steph Is Crypto (@Steph_iscrypto) says the dip seems to be extra like a basic shakeout — the type that flushes out impatient merchants earlier than a rebound. In a barely chaotic chart he posted, Steph overlays sentiment information from the Worry & Greed Index, stating how excessive worry readings (just like the “10” zone we’re sitting close to now) have matched up with main reversals in 2020, 2021 and now probably 2025.

His chart additionally reveals XRP nonetheless shifting inside a long-term vary, with present costs scraping the identical decrease band that triggered earlier rebounds. A bunch of group members echoed the concept, saying whale sell-offs typically occur proper earlier than accumulation resumes — principally the “calm earlier than the coil snaps again,” as one dealer put it.

Key Technical Ranges Coming Into Play

A extra cautious outlook comes from a TradingView technician who warns XRP is perhaps forming a double-top sample on the month-to-month chart — a formation that normally hints at fading momentum. In line with their evaluation, $2.10 is the important thing weekly help that’s holding the ground proper now. Dropping that might drop XRP towards the $1.90–$1.88 zone, which traces up with mid-range liquidity pockets that whales prefer to poke at.

In addition they spotlight how XRP continues sliding alongside a slow-descending channel, which isn’t precisely bullish… however not full-on bearish both. It’s the sort of construction that always reveals up throughout lengthy accumulation phases. The actual hazard degree sits below $2.00; fall by there, and value may check the deeper $1.60 demand area. Nonetheless, the analyst maintains a constructive long-term view due to the strengthened XRP Ledger ecosystem and the recent ETF participation that might provide help as soon as the promoting cools off.

Sentiment Break up, however a Bounce Is Nonetheless on the Desk

The group is fairly divided proper now. Some merchants say this dip reveals how fragile XRP nonetheless is, even with ETF inflows pushing quantity increased earlier within the week. Others argue it’s simply one other cycle the place whales shake the tree, scooping up liquidity earlier than the following transfer upward.

Proper now, XRP is sitting round $2.17, down roughly 3.5% on the day. Quick-term path hinges on whether or not $2.10 holds and if shopping for quantity returns. If sentiment stabilizes — and ETF demand stays regular — XRP may stage a restoration try, but it surely actually wants recent quantity and a supportive construction to verify something.

For now, the market is just adjusting to an enormous blast of whale-driven provide. As new on-chain information and ETF figures roll in, they’ll form expectations for a way XRP behaves heading into the ultimate stretch of 2025.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.