The crypto market has skilled a difficult interval, marked by excessive volatility and uncertainty. Worry and panic have dominated sentiment, driving vital worth swings and cautious conduct available in the market.

Regardless of this, there’s proof that the market is just not essentially damaged, although manipulation stays an element, primarily benefiting these accumulating giant positions in Bitcoin, XRP, and different main property.

Historic context gives perception, as earlier authorities shutdowns have been adopted by sharp recoveries in Bitcoin, typically exceeding 700% good points, suggesting that durations of uncertainty can precede substantial upside when liquidity returns.

Will the Federal Reserve Maintain Off on a December Charge Reduce?

At present, key financial components, together with Federal Reserve selections, contribute to market uncertainty. With the current authorities shutdown, essential financial experiences resembling CPI, PPI, and employment knowledge had been delayed, creating uncertainty throughout the market.

Traders now see lower than a 50% likelihood of a Fed price reduce in December, in line with a publish from DustyBC Crypto on X. Federal Reserve Chair Jerome Powell was clear when he just lately warned {that a} December reduce is just not assured.

Feedback from different Fed officers mirror rising hesitation about whether or not the central financial institution ought to transfer ahead with a 3rd straight coverage easing on the Dec. 9–10 assembly.

In consequence, market expectations have shifted. Just some days in the past, merchants had been assigning stronger odds to a quarter-point reduce, however these expectations have now settled right into a extremely unsure outlook, in line with futures knowledge from the CME Group’s FedWatch device.

General, the combined indicators from policymakers are holding buyers cautious as they anticipate clearer path from upcoming financial knowledge.

Bitcoin Faces Breakdown: Can $BTC Rebound After Closing Under the 50-Week Common?

In response to the crypto YouTube channel Crypto Underground, Bitcoin is going through growing bearish strain after closing beneath the 50-week transferring common for the primary time within the present bull cycle.

The weekly candle settled at round $94,400, bringing the asset nearer to filling the remaining hole close to $91,000. Regardless of this weak point, technical indicators on the every day chart present deeply oversold circumstances, suggesting a aid bounce could happen quickly.

Key resistance lies close to $110,000, the place a rally into the creating dying cross will decide whether or not a full bear market is confirmed. Failure to reclaim that stage on each every day and weekly closes would point out a decisive shift into bearish territory.

Till this important bounce unfolds, Bitcoin stays at a pivotal second that may decide whether or not the bull pattern resumes or the broader downtrend takes management.

Supply – Crypto Underground YouTube Channel

Harvard Strikes $443M Into IBIT, Making Bitcoin Its Largest ETF Funding

In the meantime, Harvard College’s endowment has revealed a $443 million holding in BlackRock’s iShares Bitcoin Belief (IBIT), making it the fund’s largest identified fairness stake in a spot bitcoin ETF.

Bloomberg senior ETF analyst Eric Balchunas highlighted that it’s unusual for main endowments to put money into exchange-traded funds, notably at elite establishments resembling Harvard or Yale.

Though the place accounts for about 1% of Harvard’s whole property, it’s adequate to put the college sixteenth amongst IBIT shareholders. The funding additionally turned Harvard’s largest reported holding in its 13F submitting and represented its most substantial enhance in Q3.

Institutional buyers like Harvard normally avoid ETFs, favoring personal fairness, actual property, and direct investments, making this IBIT allocation particularly noteworthy.

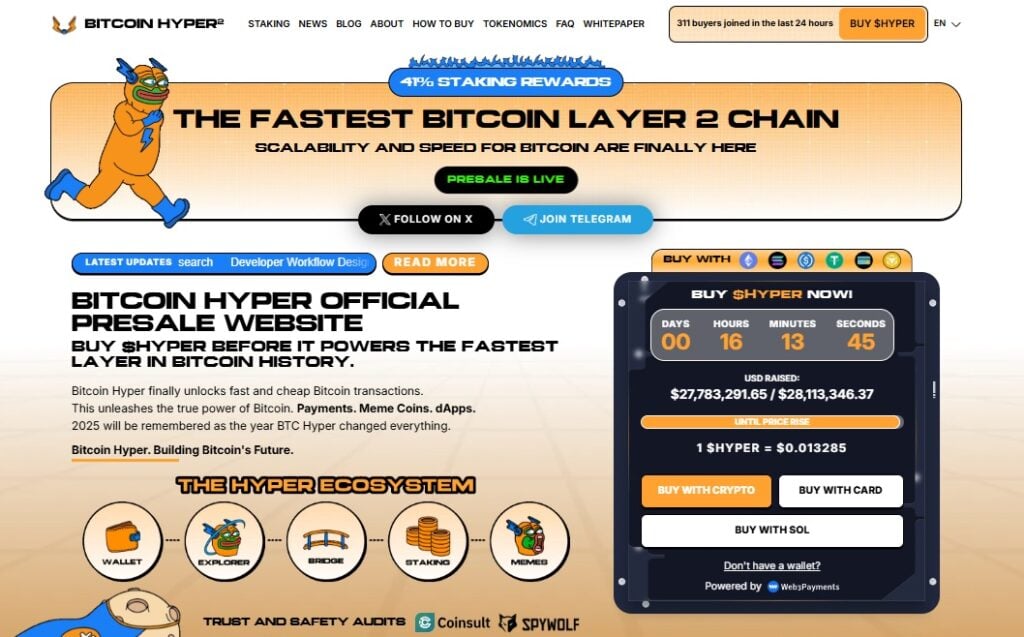

Layer-2 Crypto Presale Boosts Bitcoin Pace, Lowers Charges, and Permits DeFi

Whereas many retail buyers have exited, some are nonetheless searching for high-upside alternatives alongside Bitcoin. One instance is the Bitcoin Hyper presale, which just lately recorded a large on-chain buy of round $502K, pushing its whole funds raised to almost $28 million.

Bitcoin Hyper is a Bitcoin Layer-2 answer designed to offer the pace and scalability that the unique blockchain lacks. The undertaking permits quick, low-cost Bitcoin transactions, addressing long-standing points with sluggish processing instances and excessive charges.

Through the use of a canonical bridge and sensible contract verification, Bitcoin could be seamlessly minted onto the Layer-2 community, permitting near-instant transfers and minimal transaction prices.

The system helps superior capabilities resembling DeFi, staking, decentralized exchanges, and meme coin exercise, all powered by Solana’s high-throughput digital machine. Safety is bolstered by way of zero-knowledge proofs and common settlement commitments to Bitcoin’s Layer-1.

With sturdy technical foundations and growing visibility throughout main crypto media retailers, Bitcoin Hyper is positioning itself as a significant enlargement of Bitcoin’s utility. To participate the HYPER token presale, go to bitcoinhyper.com.

This text has been supplied by one in every of our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please remember our industrial companions could use affiliate packages to generate revenues by way of the hyperlinks on this text.