Bitcoin briefly dipped under the extent at which it entered 2025, erasing its year-to-date features over a risky weekend that caught many merchants off guard.

The transfer got here regardless of a sequence of business wins and the long-awaited reopening of the U.S. authorities, which many had hoped would stabilize sentiment.

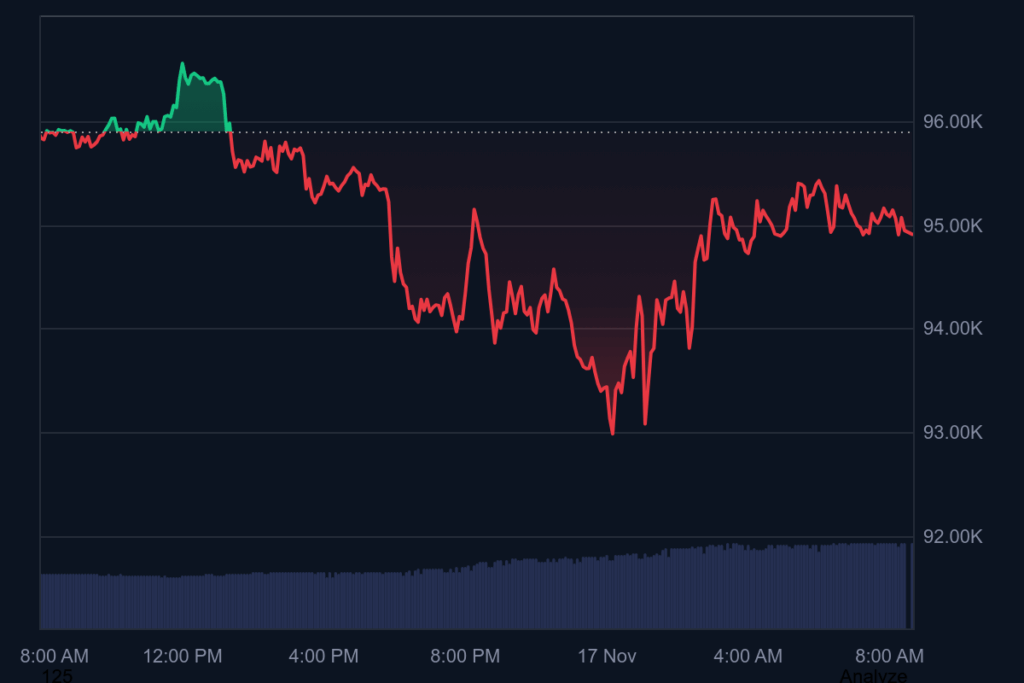

BTC slid to $93,100, falling marking a 25% drop from its October all-time excessive. Whereas Bitcoin rapidly bounced again to the $94,500 vary, the pullback highlights a rising disconnect between robust structural developments within the crypto sector and the market’s present value motion.

The 12 months started with optimism. President Donald Trump entered workplace with what many have referred to as essentially the most explicitly pro-crypto administration in U.S. historical past, delivering speedy regulatory readability, easing restrictions, and fueling a flood of company Bitcoin treasury allocations. Spot Bitcoin ETFs additionally recorded constant inflows via a lot of the 12 months.

However macro headwinds have repeatedly outweighed these positives. Trump’s tariff battles and the record-long 43-day authorities shutdown have each created bouts of risk-off sentiment, contributing to a number of double-digit corrections in Bitcoin all through 2025.

readmore id=”180227″]

One other stress level has been promoting from long-time holders. Some analysts initially blamed “OG whales” for blocking upside momentum, however blockchain knowledge companies argue the pattern is per typical late-cycle distribution – seasoned buyers taking income, not abandoning the market.

Regardless of the turbulence, some analysts stay assured that Bitcoin’s broader cycle is unbroken. Bitwise CIO Matt Hougan believes the following explosive section is extra prone to unfold in 2026, pointing to a macro atmosphere outlined by forex debasement and the rising adoption of stablecoins, tokenized belongings, and decentralized finance.

For now, Bitcoin’s trajectory will depend on whether or not it could actually solidify help within the mid-$90,000 vary and shake off the most recent spherical of macro-driven volatility – a reminder that even in a 12 months of robust structural progress, the market can nonetheless transfer unpredictably.