Michael Saylor’s Bitcoin accumulation machine continues to be working at full velocity – even because the market dips.

In a brand new replace shared on social media, Saylor revealed that Technique has added 8,178 BTC to its treasury, spending roughly $835.6 million at a mean worth of $102,171 per bitcoin.

The purchase pushes the agency’s complete holdings to a unprecedented 649,870 BTC, acquired at a mean value of about $74,433 per coin. Technique’s year-to-date bitcoin yield now sits at 27.8%, even after the most recent market pullback.

The size of the acquisition leaves little doubt: Saylor continues to view main dips as alternatives fairly than threats.

Bitcoin Drops as Saylor Buys

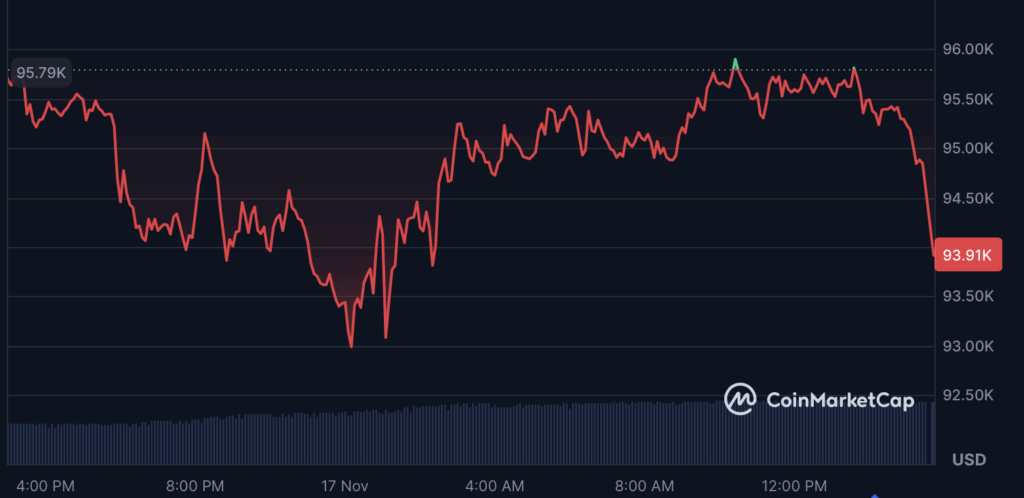

The aggressive accumulation comes at a second when the crypto market is underneath renewed stress. On the time of writing, Bitcoin is buying and selling round $93,910, down greater than 1.5% over the past 24 hours, and 11.5% on the week.

The main crypto has shed momentum in November, with its worth trending downward after a sequence of macro-driven sell-offs, ETF outflows, and government-shutdown turbulence. Regardless of the weak point, Saylor seems unfazed – persevering with to purchase into the volatility as BTC assessments the mid-$90K vary.

Technique’s Large Stack Nears 650K BTC

With the most recent buy, Technique’s holdings are approaching an unprecedented 650,000 BTC, a quantity rivaling the reserves of some early crypto exchanges and even nation-state treasuries. The agency stays the only largest company holder of bitcoin globally.

Saylor emphasised the long-term thesis: accumulating as a lot BTC as doable whereas provide tightens and institutional demand accelerates.

readmore id=”180273″]

Market Eyes BTC’s Subsequent Transfer

Bitcoin’s wrestle to carry help close to $94K has merchants cautious, however Saylor’s continued shopping for highlights a rising divide between long-term conviction and short-term sentiment.

If BTC rebounds, Technique’s huge place may develop into much more dominant. If the downturn continues, the corporate seems able to hold stacking.

For now, the message from Saylor is obvious: dips usually are not risks — they’re invites.