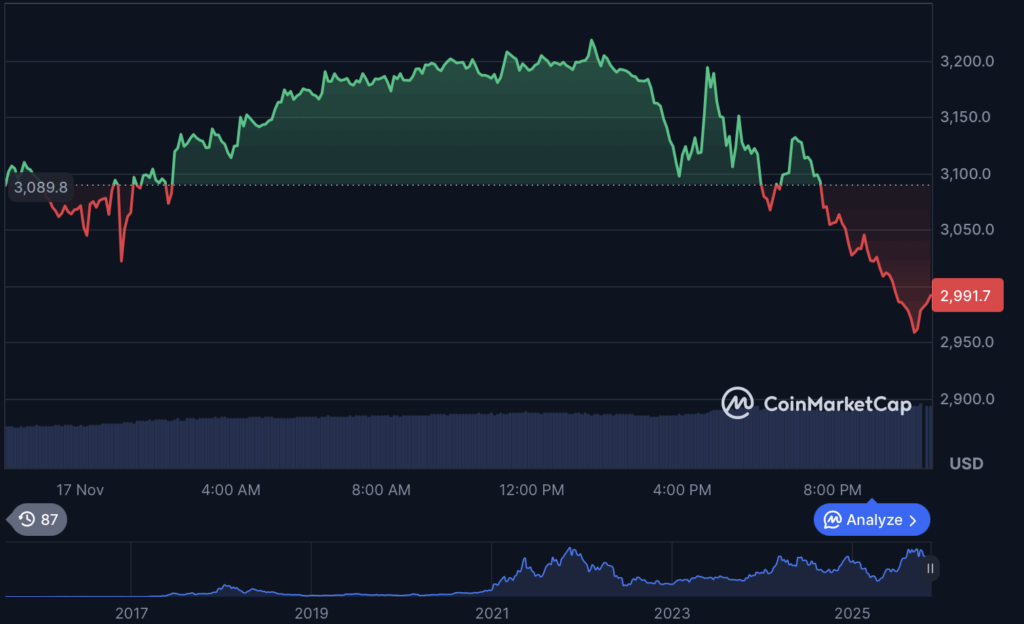

Ethereum has slipped beneath the $3,000 mark and is now hovering close to $2,966, capping off a brutal 17% slide over the previous week.

A lot of the optimism from the earlier quarter has evaporated because the broader crypto market turns defensive, with merchants displaying little curiosity in taking up new lengthy publicity – even on majors like ETH.

The drop has been amplified by a wave of liquidations and fading retail confidence. Many market members had anticipated a robust year-end push from Ethereum after months of elevated community exercise and stable staking metrics.

As a substitute, sentiment has swung sharply, leaving ETH in one in all its most unsure stretches for the reason that summer time downturn.

On the technical facet, Ethereum is flashing heavy oversold indicators. The day by day RSI has collapsed to roughly 30, a stage that usually precedes short-lived restoration rallies however doesn’t assure them – particularly in a macro setting that is still shaky.

Bitcoin is displaying related weak point, now buying and selling round $91,579, extending an almost 14% decline over the previous week. The drop has pushed BTC deep into risk-off territory, with sellers dominating order books and upward momentum evaporating. Though Bitcoin has traditionally attracted dip patrons throughout sharp retracements, the present setting exhibits little urgency from bulls, suggesting that macro uncertainty and fading ETF inflows are weighing closely on sentiment. Till BTC can reclaim key ranges above $95,000, analysts warn that volatility might proceed to accentuate.