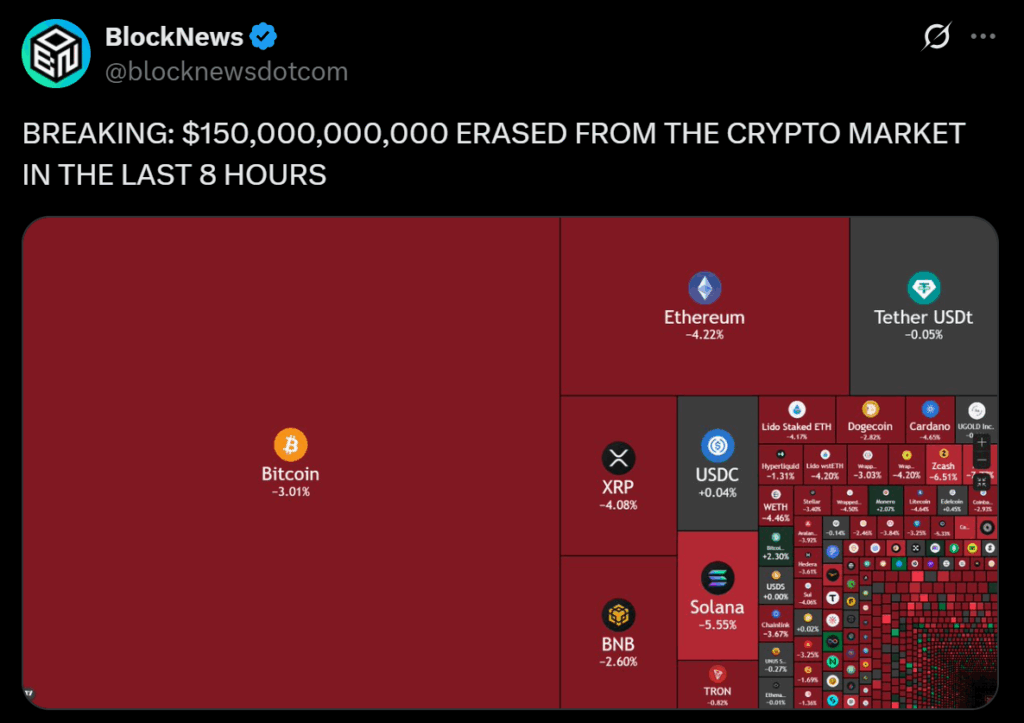

- Bitcoin’s slide towards the 90K area helped erase over $150B from the crypto market in simply eight hours.

- Breaking under 100K confirmed a descending channel, with merchants now watching the 89K–94K and 72K–74K zones as vital ranges.

- Analysts are cut up between calling this a violent however “wholesome” flush or the start of a deeper, multi-leg correction.

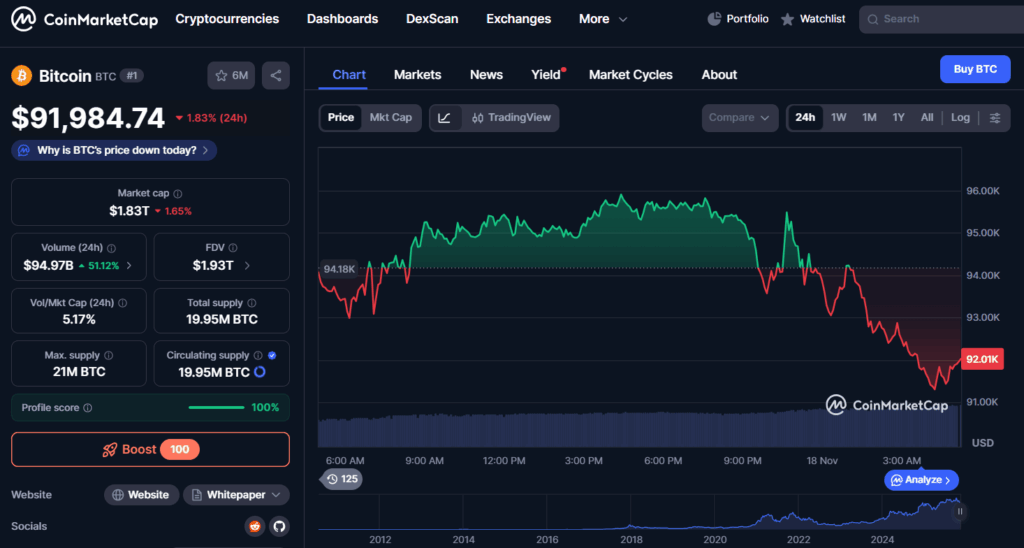

The crypto market simply had a type of brutal periods that folks bear in mind for a very long time. In precisely eight hours, greater than $150 billion was worn out from complete market worth as Bitcoin slid towards the 90K area and concern unfold throughout each main asset. BTC has now fallen laborious from its $126,000 all-time excessive in October, and what began as a normal-looking pullback has become a quick, synchronized sell-off. Liquidity is being pulled on each centralized exchanges and DeFi venues, which is making each leg down really feel heavier than the final.

A Regular Decline That Lastly Snapped

This crash didn’t simply seem out of nowhere. Analysts have been mentioning for weeks that the complete market has been grinding decrease since early October. Complete crypto market cap now sits close to $3.26 trillion, its lowest level since midsummer. That sluggish sequence of decrease lows has lastly added up, pushing Bitcoin virtually 30 p.c under its peak and technically into bear-market territory. When you mix that with shaky macro sentiment, it’s not shocking {that a} “regular” dip flipped right into a rush for the exits.

The Key Ranges Everybody Is Watching Now

The actual emotional break got here when Bitcoin misplaced the $100,000 stage. That line was extra psychological than something, however as soon as worth closed convincingly under it, it confirmed a descending channel that has been forming for the reason that October liquidations. Proper now, merchants are laser-focused on the $89,000–$94,000 vary. It’s a liquidity-heavy zone and acts like a call level: if patrons defend it, we would see a aid bounce; in the event that they don’t, issues may get ugly quick. Under that, some analysts are already eyeing the $72,000–$74,000 space as a possible retest — the identical area the place BTC started its large run to new highs earlier this 12 months.

Is This the Begin of a Full Breakdown or Only a Violent Flush?

Even with $150 billion erased in a single window, not everybody is looking for doom simply but. Just a few analysts are nonetheless framing this as “wholesome consolidation” after an overheated run, so long as Bitcoin doesn’t lose its main structural helps. That mentioned, the longer the market stays pinned close to the lows, the more durable it turns into to argue for a straightforward bounce. Proper now, crypto is caught in a clumsy center zone: approach off the highs, however not but in complete free-fall. Sentiment feels fragile, and the subsequent transfer out of this vary is more likely to set the tone for the remainder of the cycle.

The Greater Image Going Ahead

In the long run, right this moment’s transfer is a mixture of stretched valuations, fading liquidity, and merchants lastly shedding their nerve after weeks of sluggish bleed. Whether or not this sharp $150 billion drop seems to be a ultimate flush earlier than restoration, or the opening act of a deeper leg down, relies on how Bitcoin behaves round these key assist zones.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.