Bitcoin can’t catch a break for the previous a number of days because the bears appear in full management of the market, staging one other nosedive to a contemporary multi-month low of slightly below $92,000.

Ethereum has additionally dipped to an important round-numbered help, and the liquidations are on the rise because of extreme leverage utilized by merchants.

It wasn’t that way back when BTC stood firmly above $100,000. Actually, lower than per week in the past, it had simply jumped previous $107,000 following some constructive developments on US soil.

Nevertheless, that was short-lived, and the following rejection and correction have been fairly violent. Bitcoin plummeted to a five-digit worth territory final Thursday and has not been capable of stage any kind of restoration.

Simply the alternative, the hits carry on coming, and the newest happened minutes in the past when it dipped beneath $92,000. That is the bottom price ticket it has seen since April 24, making it a seven-month low.

What’s fascinating and completely different concerning the ongoing crash is the truth that there’s no evident offender behind it. Not like earlier events, resembling trade blowouts, international pandemics, or macro uncertainty, this correction seems to be pushed by extreme leverage, as defined by the Kobeissi Letter earlier.

Furthermore, the analysts decided that BTC has entered a brand new structural bear market, and the panorama has solely worsened since then.

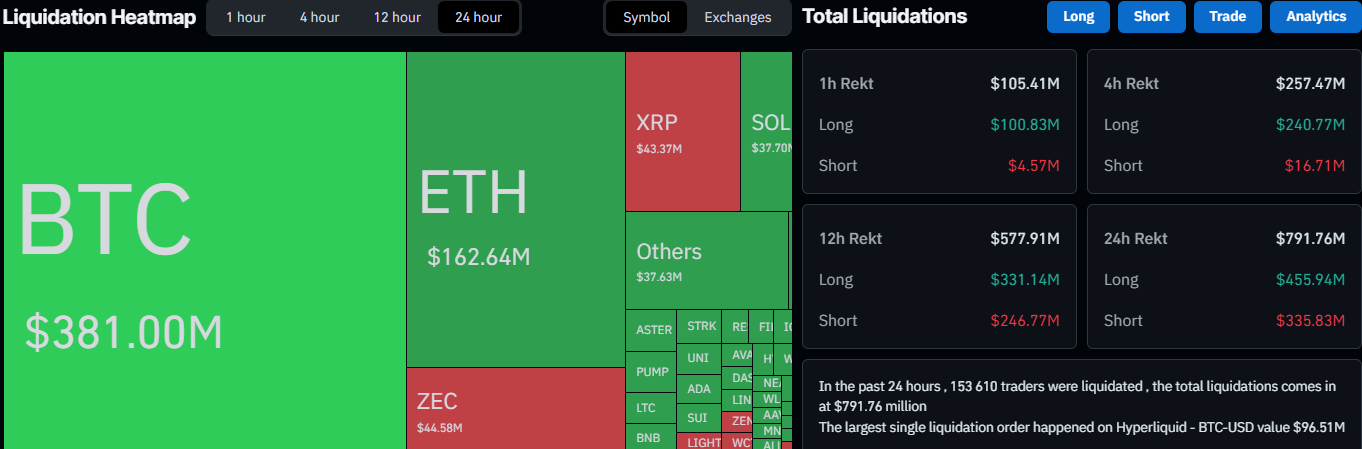

ETH is in no higher form because it dipped beneath $3,000 minutes in the past as properly. Ethereum is down by greater than 15% weekly and over 22% in a month. Most different altcoins are in a dire state as properly, with XRP dropping by 3.6% each day and SOL plunging by over 5%.

Naturally, the excessive ranges of leverage utilized by merchants have harmed a major quantity, with greater than 150,000 such market individuals wrecked each day. The entire worth of liquidated positions has risen to nearly $800 million inside the similar timeframe.

The one-biggest wrecked order was a whopping one. It happened on Hyperliquid and was price $96.51 million, knowledge from CoinGlass reveals.

The put up Bitcoin Crashes Beneath $92K, Ethereum Beneath $3K—Liquidations Surge to $800M appeared first on CryptoPotato.