- ETH is now buying and selling beneath key transferring averages, confirming a shift into bearish momentum.

- Spot ETH ETFs have recorded over $1.4B in outflows this month, weakening institutional help.

- Lengthy-term holders are promoting at their quickest fee since 2021, whereas whales accumulate — however not sufficient to offset the strain.

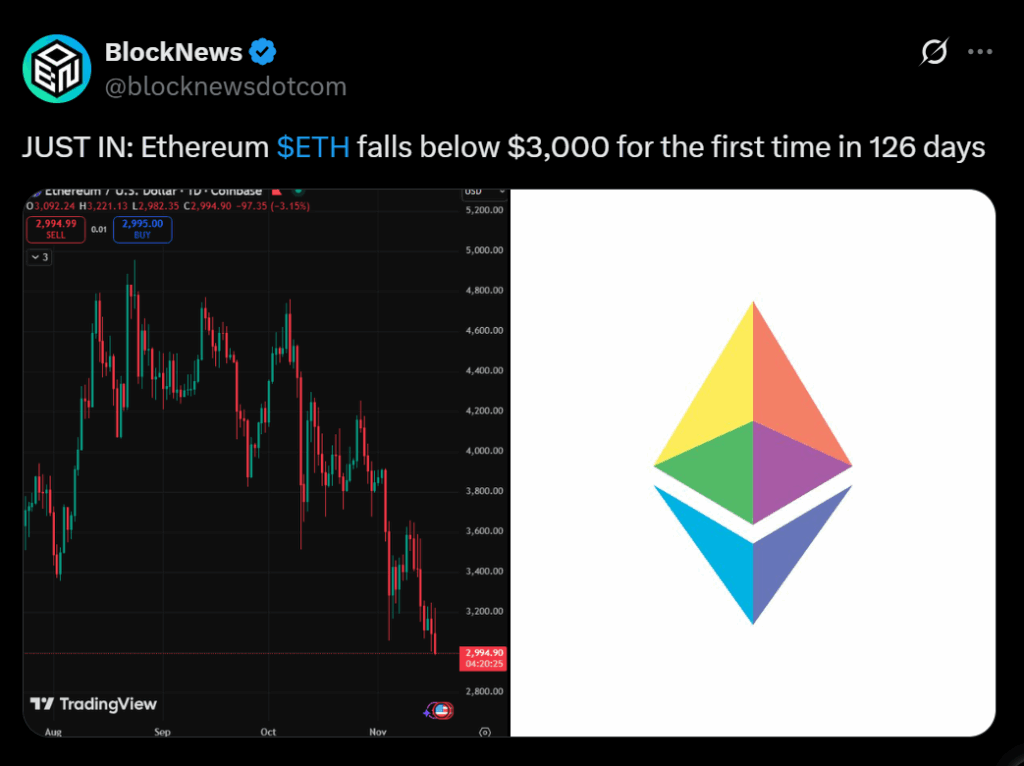

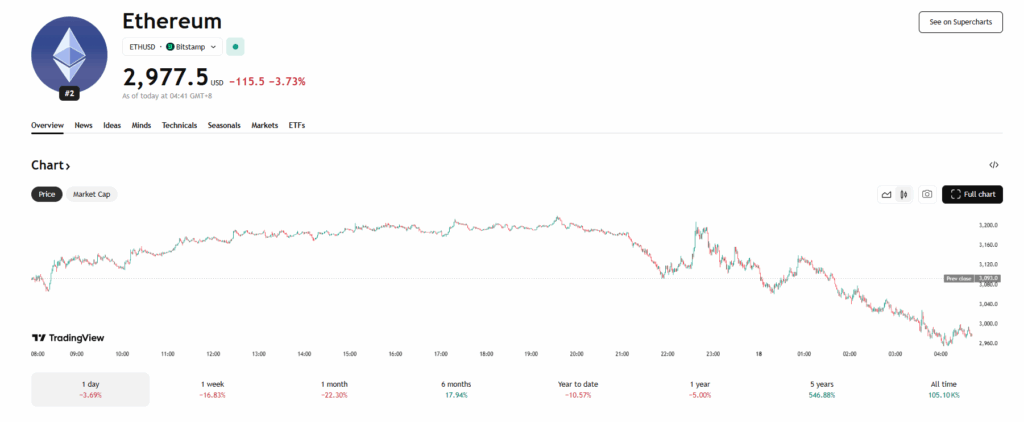

Ethereum’s worth has damaged deeper right into a bearish construction that’s strengthened all through the previous week. With momentum weakening, ETF outflows accelerating, and long-term holders dumping on the quickest tempo seen since 2021, ETH is now sliding towards a essential degree: the $3,000 help zone. The tempo of the decline has raised the query many merchants are asking — is Ethereum making ready for an excellent deeper correction?

ETH Breaks Under Key Shifting Averages as ETF Outflows Surge

Contemporary information from 10x Analysis reveals Ethereum now buying and selling firmly beneath each the 7-day and 30-day transferring averages, signaling a clear shift into bearish territory. ETH has fallen 6.6% over the previous week, failing at each try and reclaim its short-term trendline. The transferring averages have curled downward, confirming a transparent rollover that started in early November.

On the similar time, spot ETH ETFs are seeing a few of their heaviest redemptions ever recorded. SoSoValue information reveals greater than $1.4 billion in outflows since early November — a decisive sign that institutional urge for food has weakened sharply. Collectively, these elements have created a suggestions loop: as every help degree breaks, sellers speed up, and falling ETF demand removes a significant supply of purchase strain.

Lengthy-Time period Holders Promote Quickest Since 2021 — However Whales Are Shopping for

On-chain tendencies add one other layer to the story. Lengthy-term ETH holders — wallets which have been inactive for 3 to 10 years — are promoting at their quickest tempo because the 2021 bull cycle. These holders hardly ever transfer their cash, so after they do, the market sometimes feels it. Their promoting has added a big provide wave, contributing to downward strain.

Nonetheless, not all giant gamers are bearish. Whale wallets have stepped in aggressively, accumulating over $1 billion value of ETH throughout the downturn. Even so, the size of whale shopping for nonetheless isn’t sufficient to counter ETF outflows and long-term holder promoting. With these forces mixed, Ethereum stays caught in a downward-sloping development channel.

$3,000 Now in Sight as Downtrend Tightens

ETH is at present buying and selling close to $3,182 after hitting an intraday low of $3,023 — leaving virtually no room between present costs and the essential $3,000 help zone. If sellers proceed to dominate and ETH fails to interrupt above the $3,150–$3,200 vary, a direct slide into $3,000 turns into more and more seemingly this week.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.