The crypto selloff simply bought an entire lot worse. Bitcoin plummeted under $90,000 for the primary time since April on Tuesday, dealing one other blow to an already painful market. Is the crypto bull run lastly over?

If it had been, it’d align with the four-year cycle principle. However what’s fascinating is that as Bitcoin slips under $90,000, many merchants have began rotating into another play, signaling that there’s nonetheless hope and investor urge for food available in the market.

The challenge, Bitcoin Hyper (HYPER), has added 351 new holders prior to now 24 hours. Proper now, HYPER is in a presale, having raised $27.8 million to this point – making it one of many strongest-performing ICOs presently underway.

However this raises the query: why are crypto whales shopping for HYPER, even whereas Bitcoin is dumping? Is that this a traditional case of early-stage, hype-driven momentum? Or might we be wanting on the subsequent long-term breakout play?

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Bitcoin’s Potential Largest Month-to-month Market Cap Loss Ever

Bitcoin opened in November at $109,500 and fell to $90,000 by this morning. This represents a market capitalization lack of $386 million, or 17.8% of BTC’s complete worth.

It’s not the biggest percentile correction in Bitcoin’s historical past – however it might be the biggest market-cap loss on report if BTC closes the month right here. At the moment, Might 2021 holds the title with a $376 million decline.

Might 2021’s downfall was attributable to China’s crackdown on Bitcoin mining, Tesla’s suspension of BTC funds, and a cascade of leveraged liquidations that accelerated the sell-off.

This time, BitMine co-founder Tom Lee argues there are two core drivers behind Bitcoin’s demise: the $19 billion liquidation occasion on October 10, and uncertainty surrounding whether or not the Fed will lower rates of interest on the subsequent FOMC assembly.

And whereas Lee believes {that a} rebound might ensue any day, many traders aren’t so certain. BlackRock’s IBIT fund, for example, has shed $902.2 million prior to now 4 buying and selling days. But as Bitcoin plummets, Bitcoin Hyper (HYPER) is experiencing large success with enormous capital inflows to its presale.

HYPER Attracts Whale Curiosity as Bitcoin Craters

Bitcoin Hyper’s presale has attracted roughly $1 million in inflows over the previous week and over $27 million since fundraising started. It’s a transparent testomony to HYPER’s standing as a reputable participant within the altcoin area, able to carving its personal narrative even because the broader market is in disarray.

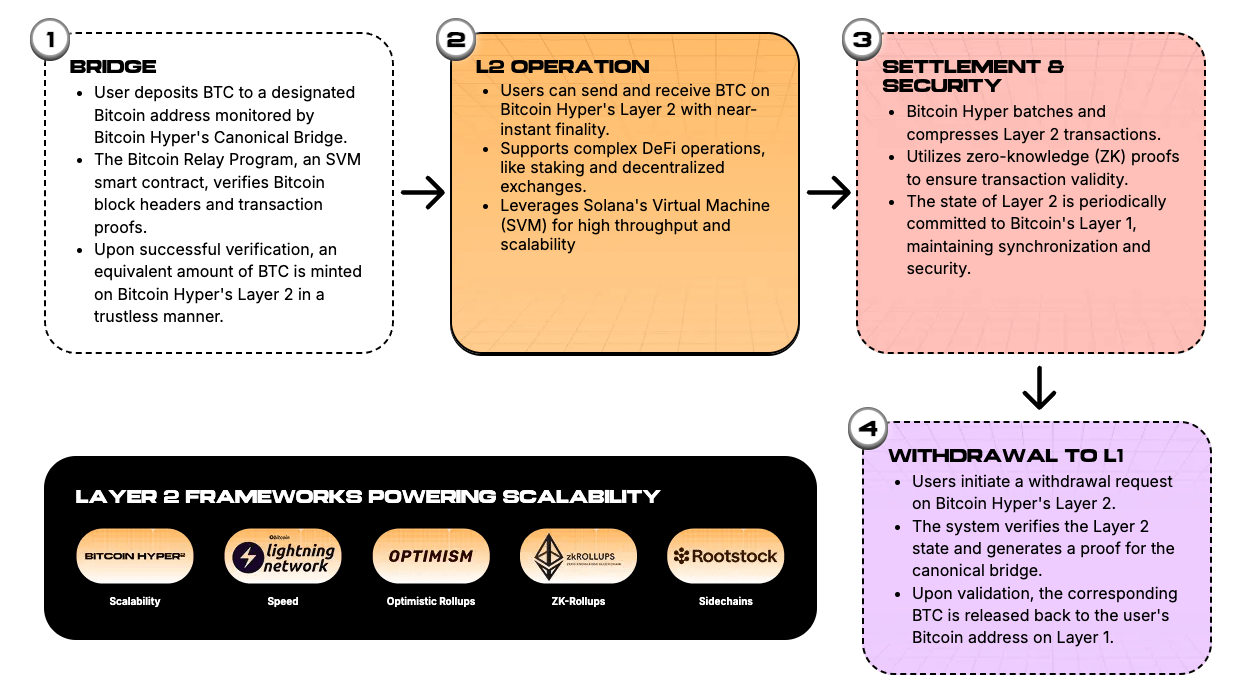

The challenge is a Bitcoin Layer 2 with one core aim: making Bitcoin extra usable. Bitcoin has traditionally been used as a retailer of worth, with minimal utility outdoors of hoarding wealth and preventing inflation. Bitcoin Hyper, however, turns Bitcoin right into a extra energetic ecosystem.

It may course of hundreds of transactions per second and helps sensible contracts, paving the best way for a similar sorts of use circumstances Ethereum helps, solely with a lot quicker execution. That’s as a result of it runs on the Solana Digital Machine (SVM), identified for its market-leading efficiency.

Bitcoin Hyper’s mixture of a promising use case, early-stage standing, and investor enchantment is catching the eye of high trade gamers, with Borch Crypto just lately predicting a 100x rally.

May Bitcoin Hyper Realistically Explode 100x?

Let’s face it: till the market returns to risk-on mode, or a breakout narrative captivates investor consideration, it’s going to be onerous to seek out cryptos that would realistically ship 100x good points. However as seen with Zcash just lately, there’s tons of potential for tasks to ship 10x ROI or extra if they’ve robust use circumstances and group assist.

Bitcoin Hyper, with its ambition of reshaping Bitcoin, is already attracting large investor curiosity. Ought to Bitcoin proceed exhibiting weak point from right here, extra traders could begin to promote, and plenty of will search for the brand new sizzling crypto – and that may simply be HYPER.

Alternatively, think about the market rebounds right here and Bitcoin returns to new highs. As Tom Lee predicts, investor threat urge for food might return – and people tasks that confirmed power within the dip may very well be set to outperform. That’s when Borch Crypto’s 100x forecast would come into play.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, straight or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.