After a promising begin to October, bitcoin’s worth has plunged arduous within the following weeks, dropping by roughly 30% to dip under $90,000 yesterday.

Some analysts imagine this marks the beginning of a bear market, so we determined to verify whether or not two of the preferred AI-powered chatbots share this view.

Not Absolutely Confirmed

Based on ChatGPT, robust indicators are pointing in that path, however it’s too early to assert that BTC’s bull run is over. Whereas the chatbot famous the double-digit worth plunge over the previous week, it stated this doesn’t assure a sustained bear market, as it will possibly typically be only a momentary correction.

“Bear markets sometimes contain sustained declines over months and even years, together with broad investor capitulation – we might solely be within the early part,” it added.

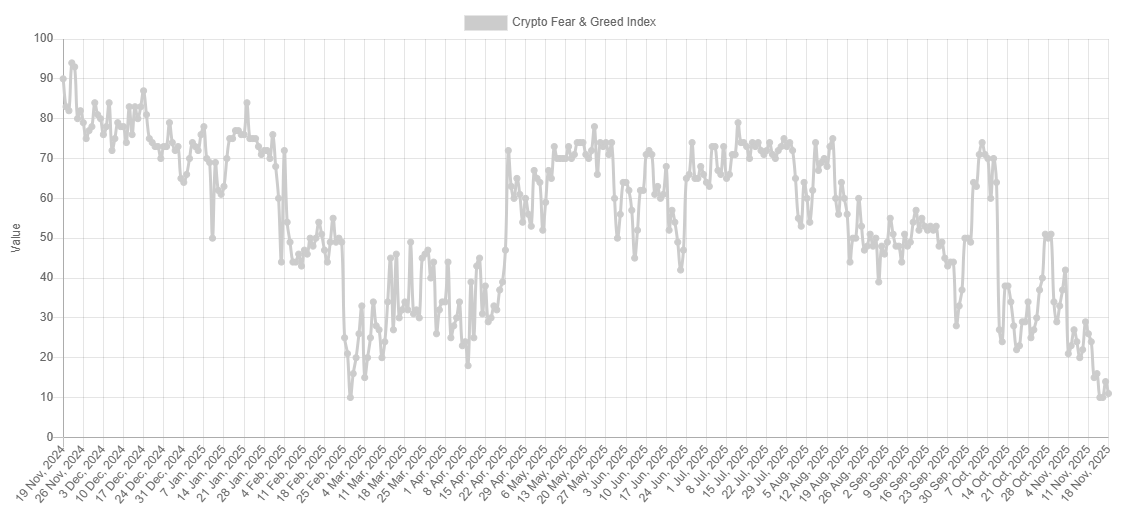

ChatGPT additionally revealed different regarding elements, together with weak institutional demand, outflows from spot BTC ETFs, and heightened investor panic. The Worry and Greed Index just lately dropped to 10, which is an “Excessive Worry” zone and the bottom level since February this 12 months.

This would possibly sound disturbing, however it might additionally mark the sunshine on the finish of the tunnel. Traditionally, a number of the greatest shopping for alternatives have emerged when the mass of traders capitulates. The state of “Excessive Worry” would possibly point out that the market has overreacted to the draw back, making a second the place the asset is briefly cheaper than its long-term worth suggests.

In moments like this, it’s all the time useful to cite the legendary investor Warren Buffett, who as soon as stated: “Be fearful when others are grasping and grasping when others are fearful.”

Not Crypto Winter But

Google’s Gemini famous that BTC’s worth tumbled by virtually 30%% since its all-time excessive of over $126,000 final month, which may be interpreted as the beginning of a bear market.

“A drop of 20% or extra from a peak is the standard definition of coming into bear market territory.”

The chatbot additionally outlined a number of technical alerts that help that thesis, together with the value falling under the psychological stage of $100,000 and the formation of a “demise cross.” These keen to discover this technical sample intimately can check out our detailed article right here.

In conclusion, Gemini argued that BTC has technically entered bear market territory primarily based on the value collapse and the breakdown of key indicators, and will probably be fascinating to see whether or not this evolves into a chronic crypto winter.

The submit We Requested 2 AIs if Bitcoin’s Bear Market Has Formally Began appeared first on CryptoPotato.