Bitcoin is below extreme stress because the market slips into what many analysts now describe as a harmful zone. The lack of the $90,000 assist degree — a key psychological and structural threshold — has intensified concern throughout the crypto panorama. Bulls, who beforehand defended this area all year long, at the moment are dropping management as value volatility accelerates and liquidity thins out.

Because of this, a rising variety of market commentators are starting to name for the beginning of a possible bear market, arguing that the development has shifted decisively.

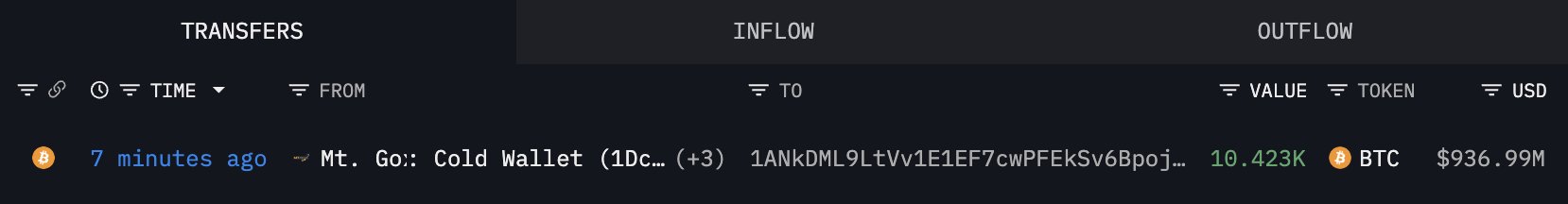

Including to the panic, new on-chain information exhibits an surprising improvement that has additional rattled buyers: after eight months of inactivity, Mt. Gox has simply transferred 10,423 BTC (value roughly $936 million) to a brand new pockets. These actions usually precede distributions to collectors, and traditionally, any switch from Mt. Gox has triggered sell-off issues because of the quantity of provide that might enter the market.

The timing couldn’t be worse. With sentiment already fragile and Bitcoin struggling to seek out assist, the sudden look of almost a billion {dollars}’ value of BTC on the transfer has amplified uncertainty. Whether or not this sparks a deeper breakdown or turns into one other shakeout earlier than restoration stays the query driving right now’s market narrative.

What the Mt. Gox Switch Alerts — And Why Markets Are on Edge

Traditionally, any on-chain motion from Mt. Gox wallets has been interpreted as a precursor to creditor distributions. Even when the cash will not be instantly destined for exchanges, the risk of that offer ultimately hitting the market is sufficient to amplify concern — particularly when Bitcoin has simply misplaced the essential $90K degree.

Merchants fear {that a} portion of those funds might be offered, including tens or a whole lot of hundreds of thousands in promote stress at a second when liquidity is already skinny.

This stress is intensifying as a result of the market just isn’t solely coping with inner crypto dynamics but in addition main macroeconomic fractures. Japan’s financial system is rising as a stress level, with the Yen carry commerce starting to unwind once more. For years, buyers borrowed low-cost yen to purchase higher-yielding belongings, together with US Treasuries and even crypto. Now, with Japan below pressure and the yen strengthening, these leveraged positions are being pressured to deleverage. That unwinding drains liquidity from world markets and places oblique stress on threat belongings like Bitcoin.

Mixed — Mt. Gox provide threat, misplaced assist ranges, and macro contagion — the atmosphere is primed for elevated volatility. Whether or not this turns into a deeper breakdown or a capitulation backside relies on how the market absorbs the approaching days.

Weekly Chart Alerts Deep Stress however Key Help Nonetheless Holding

Bitcoin’s weekly chart exhibits a decisive shift in market construction as BTC trades round $90,877, marking considered one of its sharpest multi-week declines since mid-2024. The breakdown from the $100K–$105K consolidation vary pushed value immediately into the weekly 50-period transferring common, a degree that beforehand acted as dynamic assist throughout a number of pullbacks all through the cycle.

Dropping this degree decisively would improve the likelihood of a deeper retracement towards the $85K–$88K liquidity zone, the place the 100-week MA presently aligns.

Quantity confirms the severity of the transfer: crimson candles have expanded considerably over the previous two weeks, suggesting that sellers are in management and that pressured liquidations could also be accelerating the drop. Nevertheless, the wick rejections close to $89K point out that patrons are nonetheless energetic at decrease ranges, absorbing a portion of the promote stress and stopping a whole breakdown up to now.

Structurally, BTC stays above its long-term 200-week transferring common, however the distance is narrowing rapidly. Traditionally, when Bitcoin enters this part — sharp corrections into main weekly helps — it typically transitions right into a high-volatility atmosphere earlier than selecting a path.

If bulls can defend the present area and reclaim the $95K–$98K band, momentum may stabilize. If not, the market dangers revisiting deeper demand zones.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.