Algorand and Noah have partnered to ship institutional-grade, regulated fee infrastructure on-chain. This key integration permits Algorand companies to entry digital USD and EUR financial institution accounts.

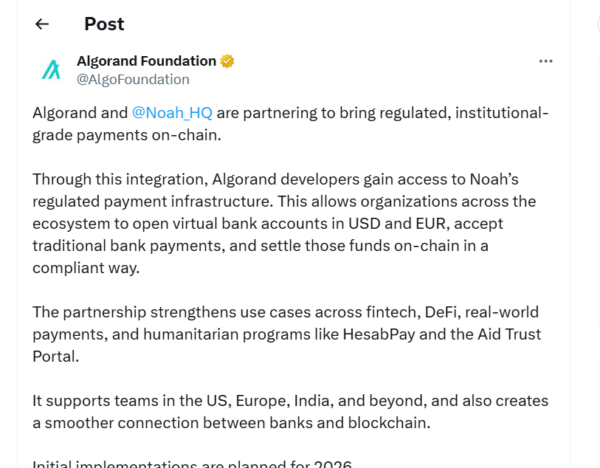

In a major transfer, Algorand and Noah are partnering to convey regulated, institutional funds onto the blockchain. This integration offers Algorand builders entry to Noah’s sturdy and controlled fee infrastructure. Consequently, the entire eco-system turns into extra interesting for builders.

This partnership is way more vital than many observers notice. Noah will not be a daily crypto challenge. It’s a regulated digital banking group. Particularly, Noah supplies precise digital financial institution accounts to companies worldwide.

Regulated Accounts Breakdown 5 Adoption Boundaries

This new infrastructure has allowed firms utilizing Algorand to open financial institution accounts straight. These accounts are utterly related with the blockchain community. This can be a pivotal change the place conventional finance is really built-in with Web3.

Associated Studying: Crypto Information: SG-FORGE Points First U.S. Blockchain Bond on Canton Community | Stay Bitcoin Information

Crucial benefit is that companies on Algorand can now settle for conventional financial institution funds of USD and EUR. Moreover, they’ll settle the acquired funds on-chain in a fully-compliant method. This permits the seamless motion of fiat cash and crypto property.

The combination eliminates 5 massive limitations to institutional adoption at a time. It negates the necessity for complicated, third-party processors of fee processors. As a substitute, compliance and enterprise onboarding are seamlessly constructed into the method.

This improvement locations Algorand the place it performs greatest. It crystallizes the identification of the community because the institutional-grade monetary layer. This infrastructure is significant for world commerce.

Algorand has current benefits within the enterprise sector. The community boasts excessive pace in addition to prompt finality. Moreover, it has a really sustainable consensus mechanism. This makes it appropriate for main authorities and enterprise use instances.

Algorand Strengthens Banking-to-Blockchain Connectivity

The partnership offers a powerful increase to the use instances for various sectors. It helps actual world funds, decentralized finance (DeFi), fintech platforms. The combination can even be helpful to humanitarian packages comparable to HesabPay and the Help Belief Portal.

The larger story is the direct move of USD and EUR settlements over the Algorand chain. Because of this real-world monetary worth is now transferring across the community. In the end, the collaboration has groups within the US, Europe, and India.

The partnership additionally supplies for a smoother and extra environment friendly connection between banks and blockchain programs. This can be a very important step because the future is rising as an inter-connecting of institutional networks.

Nevertheless, the total affect will take time to materialise. Preliminary implementations throughout the Algorand ecosystem are scheduled for 2026. This launch will additional cement the aggressive benefit of the community.

The collaboration helps create compliant real-world monetary merchandise. These merchandise embrace decrease prices and elevated regulatory confidence. Due to this fact, this transfer is a large leap for institutional on-chain banking.

In the end, this partnership brings Algorand nearer to being adopted in actuality on an institutional degree. As well as, it relates conventional banking to blockchain in a sensible method. It additionally permits for the graceful USD and EUR settlements on-chain. In consequence, builders could be extra highly effective of their instruments. In the end, the alliance helps with accelerated progress and expands the use instances for monetary functions in the true world.