- LINK faucets two main help zones, forming a high-probability bounce setup.

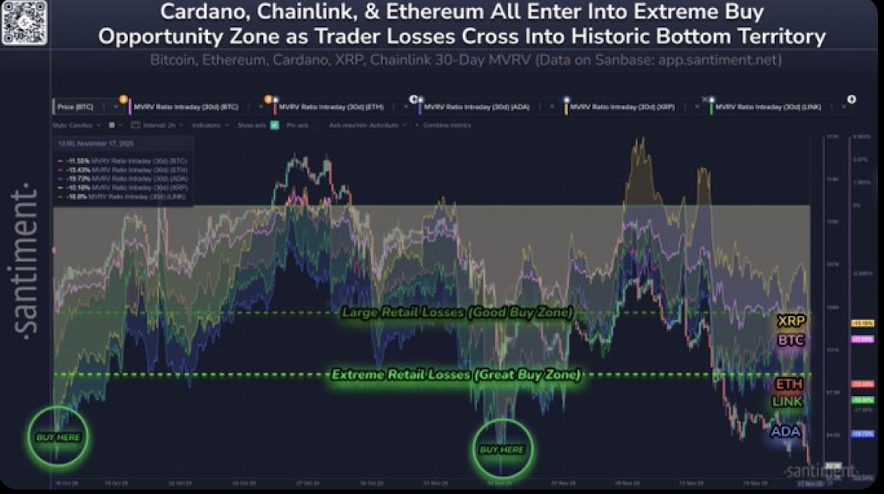

- On-chain MVRV exhibits Chainlink is in an “Excessive Purchase Zone,” hinting at undervaluation.

- A profitable breakout might goal $30+, whereas failure dangers a deeper help search.

The Chainlink ecosystem is beginning to give off that acquainted “one thing’s shifting” sort of power, with each technical patterns and on-chain metrics lining up in a means we don’t see fairly often. After weeks of heavy promoting strain, a number of indicators are hinting that LINK may lastly be scraping its backside. The newest worth motion tapped instantly right into a long-standing diagonal help stage — virtually completely — whereas additionally touchdown proper inside a key native demand zone. When two main helps converge like that, the chances of a bounce are likely to shoot up quick. LINK now sits at a make-or-break second; a clear rebound right here would affirm that the underlying development construction remains to be intact.

Falling Wedge Compression Alerts a Potential Breakout

Including to this setup, analysts level out that LINK has been grinding inside a falling wedge — a sample identified for compression, exhaustion, and ultimately explosive breakouts. If LINK manages to interrupt above the wedge’s resistance, upside targets stretch past $30, presumably marking the primary main shift in market management in months. However as at all times, affirmation is every little thing. A fake-out right here would drag the value proper again into the grind, so merchants are watching intently for a decisive transfer.

On-Chain Metrics Counsel LINK Is Deep in an “Excessive Purchase Zone”

Whereas charts paint the construction, on-chain information reveals how a lot ache merchants are literally sitting in — and Santiment’s 30-day MVRV ratio exhibits one thing large. LINK has entered what the platform classifies because the “Excessive Purchase Zone,” a area that traditionally solely seems round main market bottoms. Meaning most energetic merchants are holding losses so extreme that they resemble ranges seen in earlier accumulation phases. From a valuation standpoint, LINK seems essentially undervalued in comparison with the fee foundation of long-term holders. When these two issues align — undervaluation and technical help — aid rallies are likely to observe.

The Subsequent Resistance Will Determine The whole lot

What occurs subsequent relies upon totally on LINK’s potential to interrupt via the primary overhead resistance after this bounce try. If it pushes via cleanly, the chances dramatically enhance for a full structural reversal and a stronger long-term bullish development. In that case, LINK’s roadmap towards a lot greater ranges turns into much more reasonable.

But when the value fails to bounce convincingly and slips again beneath the demand zone, all the setup loses validity — forcing analysts to seek for the following main help earlier than any restoration can take form. For now, strain is heavy, help is robust, and sentiment is quietly shifting… which is commonly precisely how turning factors start.

The submit LINK Enters “Excessive Purchase Zone” as Promoting Stress Fades — Right here Is How a Reduction Rally May Rapidly Take Form first appeared on BlockNews.