- TAO drops close to 60% from ATH however lands on its multi-month assist at $300.

- Liquidity clusters present a probable bounce zone at $291–$302 with invalidation at $275.

- Upside targets stay $383 and $471 if bulls defend the vary lows.

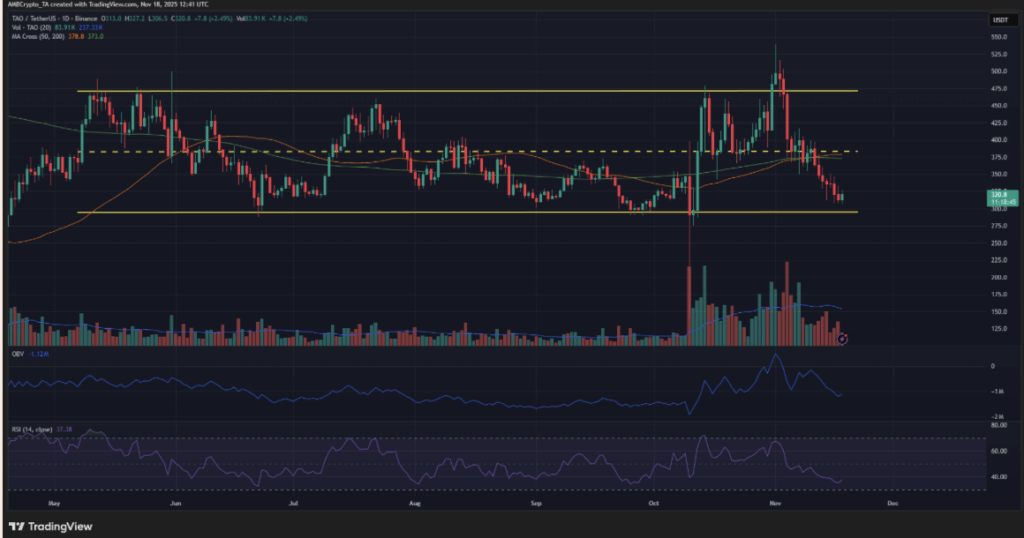

Bittensor has been bleeding out fairly aggressively, with TAO falling one other 14.8% this week — barely worse than Bitcoin’s personal drop. The volatility round this undertaking has been wild; since June, TAO has been bouncing inside a variety between $294 and $470. Early November even noticed a breakout towards $539… just for the worth to break down 41% in simply three weeks. The drawdown from the all-time excessive has now pushed near 60%, once more, placing TAO proper again on the identical multi-month assist space round $300. It’s a psychological stage, a technical stage, and truthfully one of many solely locations bulls have constantly defended all 12 months.

Developer Exercise Has Slowed — A Crimson Flag for Lengthy-Time period Buyers

One other factor weighing on sentiment is developer exercise. Bittensor’s core dev rely dropped sharply in July and August and hasn’t picked up since. For long-term holders, that’s uncomfortable — worth can all the time get better, however shrinking growth momentum is tougher to clarify away. Mix that with the most recent crash, and it’s not shocking many buyers are nervous. Nonetheless, short-term merchants aren’t wanting on the fundamentals proper now; they’re watching the chart.

TAO Sits Immediately in a Demand Zone Merchants Have Protected Since June

From a technical standpoint, TAO is now sitting in what some would name a “low-risk, high-reward” area. The $300 zone has been defended for months, and worth has slid again into it whereas buying and selling quantity retains falling. Declining quantity on a retrace normally means sellers are pushing, sure, however with out conviction. It units the stage for bulls and bears to discover a momentary stability — and sometimes that’s the place reversals start. A couple of days of sideways motion right here could possibly be all it takes for patrons to aim a brand new leg upward. After all, demand really has to point out up, and a Bitcoin bounce would in all probability assist spark that shift throughout altcoins.

Liquidation Heatmap Reveals The place the Bounce May Set off

CoinGlass knowledge exhibits a thick liquidity pocket between $291 and $302 — principally the precise vary TAO is testing proper now. Importantly, there’s barely any liquidity increase beneath the vary. That indicators one thing easy: the worth is much less prone to violently wick far beneath this assist earlier than a bounce try. For merchants, that defines clear invalidation. A bullish swing setup turns into invalid round $275. The actual demand zone sits between $288 and $302, and if TAO holds that area, the logical upside targets are $383 (mid-range resistance) and $471 (vary excessive). Whether or not the bounce materializes relies upon totally on patrons stepping in — however TAO has held this zone earlier than, and the market is watching to see if it might do it once more.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.