Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth rose over 1% previously 24 hours to commerce at $91,278 as of two:50 a.m. EST on buying and selling quantity that plunged 27% to $82.7 billion.

This uptick within the BTC worth comes as first-term Home member Brandon Gill, a Bitcoin permabull, bought as much as $150,000 in shares of BlackRock’s spot Bitcoin ETF (exchange-traded fund).

Gill has been an energetic purchaser of the biggest cryptocurrency by market capitalization, accumulating as much as $2.6 million price of the asset since his debut as a Home Consultant.

BREAKING: Rep. Brandon Gill, one in every of Trump’s closest allies within the Home, now studies roughly $300K in Bitcoin.

He’s collected as much as $2.6M in BTC since taking workplace.

The crypto wave has formally hit Capitol Hill. pic.twitter.com/voZM63MxAv— Cash Guru Digital (@Moneygurudigi) November 19, 2025

Cboe Futures Change To Present Buying and selling In Steady Futures For Bitcoin

In one other growth, Cboe World Markets Inc. introduced that it’ll introduce its new Cboe Bitcoin Steady Futures (PBT) and Cboe Ether Steady Futures (PET).

The merchandise are scheduled to start buying and selling on the Cboe Futures Change on Dec. 15, pending regulatory evaluate.

JUST IN: Cboe Futures Change to launch steady #Bitcoin futures contracts beginning December fifteenth 🚀 pic.twitter.com/BzKmZImxQE

— Bitcoin Archive (@BitcoinArchive) November 17, 2025

Cboe’s Steady Futures are designed to supply merchants long-term publicity to BTC and ETH.

The contracts can have a 10-year expiration at itemizing and a each day money adjustment, successfully creating perpetual-style publicity whereas eliminating the necessity to roll positions periodically.

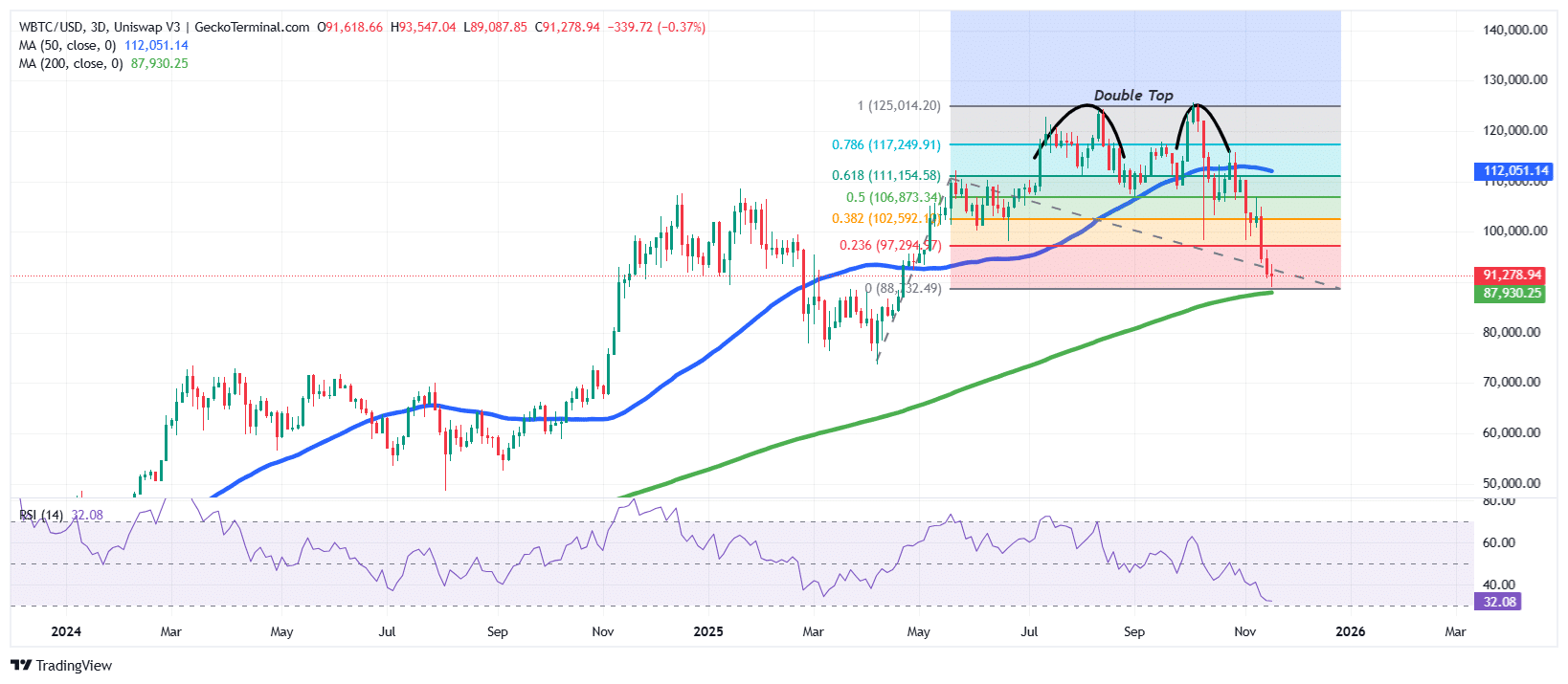

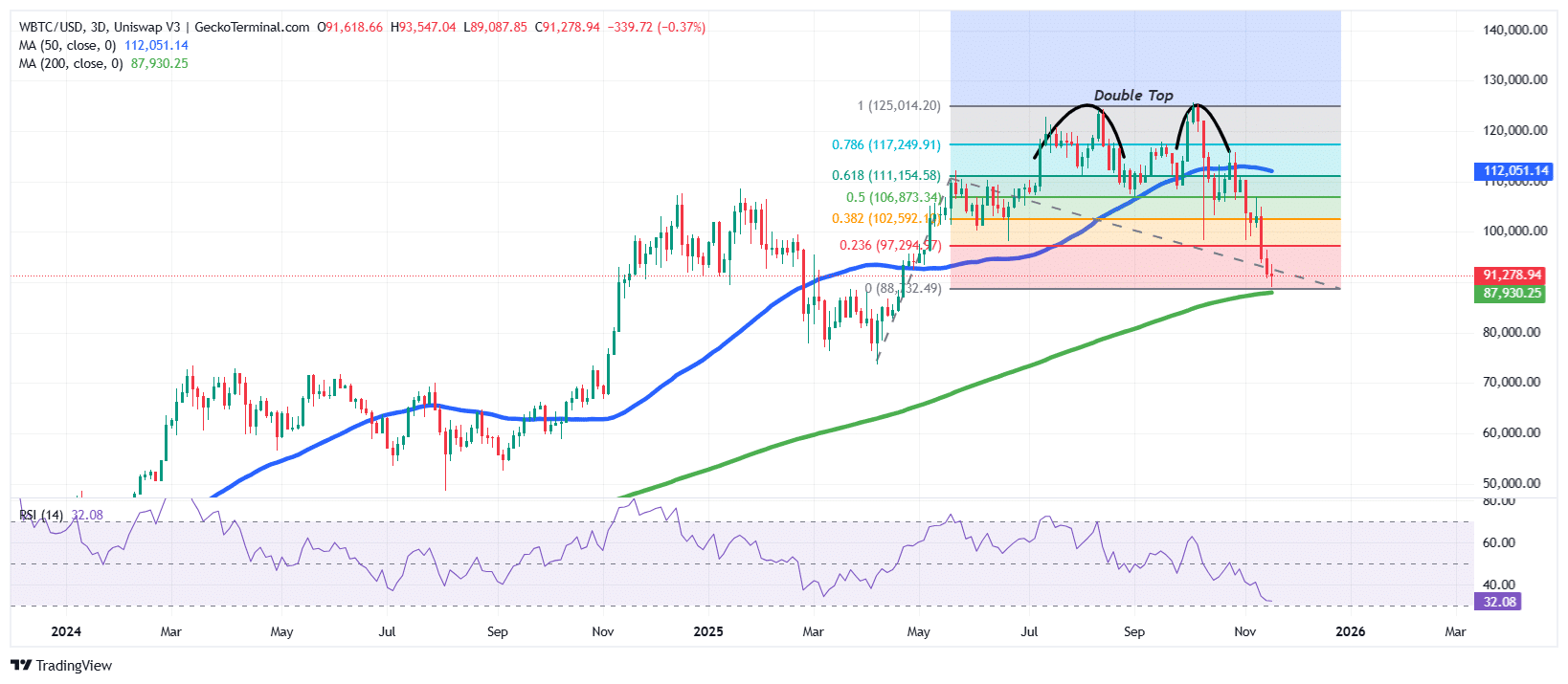

Bitcoin Value Slips Towards 200 SMA As Double-High Breakdown Intensifies

After rallying strongly from the $88,000 area earlier within the yr, the BTC worth met heavy resistance close to the $126,000 zone. This space triggered repeated rejections, resulting in the formation of a transparent double-top sample, which signaled exhaustion within the bullish pattern.

From July by way of early September, the Bitcoin worth consolidated beneath that ceiling, and has struggled to realize upward momentum.

Ultimately, sellers took management, pushing the value of BTC beneath the neckline of the double-top construction. This breakdown marked the start of a sustained bearish part.

Furthermore, the bearish stance is supported by a number of failed restoration makes an attempt across the 50 Easy Shifting Common (SMA) on the 3-day chart.

Because the downtrend continued, BTC moved decisively beneath the mid-range Fibonacci ranges, shedding the 0.382 and 0.5 retracements, which added to the bearish narrative.

Bearish strain intensified not too long ago as the value of BTC dropped to the important 0.236 Fibonacci help close to $97,000 and continued decrease towards the long-term 200 SMA round $87,900.

Buying and selling beneath the 50 SMA and transferring towards the 200 SMA cements the weak pattern, as bulls battle to defend traditionally robust zones.

Moreover, the Relative Power Index (RSI) on the 3-day timeframe has slid to 32, approaching oversold circumstances. Whereas not but beneath the traditional 30 degree, the momentum is clearly bearish, supporting the general robust promoting dominance.

BTC Value Prediction

Primarily based on the present BTC/USD chart evaluation, bearish sentiment stays dominant because the BTC worth trades nicely beneath the 50 SMA and approaches the long-term 200 SMA. The confirmed double-top breakdown helps the broader downward momentum, whereas the RSI close to oversold territory means that promoting strain is intense however could also be nearing exhaustion.

If the downtrend continues uninterrupted, the subsequent help and cushion towards bearish strain aligns with the $87,930 area, on the 200 SMA. A breakdown beneath this zone might expose a deeper correction for the value of Bitcoin towards $84,000.

Nevertheless, oversold circumstances could gas a short-term reduction bounce. In such a situation, preliminary resistance lies across the $97,000–$100,000 vary, corresponding with the 0.236 Fib degree and native horizontal resistance.

Ali Martinez helps that bullish outlook, as his evaluation exhibits that the value of BTC might bounce to $99,000.

Bitcoin $BTC might bounce to $99,000! pic.twitter.com/CgBNG5DDUa

— Ali (@ali_charts) November 19, 2025

A stronger pattern reversal would require reclaiming the 50 SMA ($112,051), which might sign weakening bearish momentum and open the door for a broader restoration.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection