Technique stays secure after the Bitcoin dip. Analysts say its S&P 500 inclusion prospects are nonetheless on monitor regardless of the correction.

Technique drew contemporary consideration after the current Bitcoin selloff. The drop raised doubts about corporations that maintain giant quantities of Bitcoin on their steadiness sheets.

Technique faces these questions typically, but analysts say the corporate nonetheless seems regular. Additionally they consider its S&P 500 bid stays on monitor.

Technique efficiency stands out regardless of the sharp correction

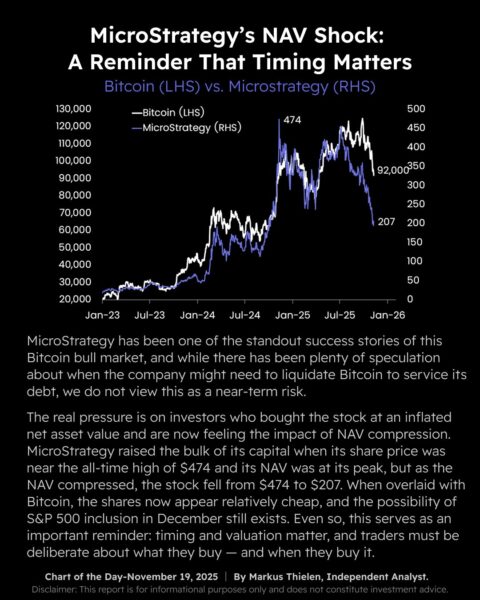

Technique noticed its share worth fall from a excessive of $474 to round $207. The drop adopted the broader crypto market slide and regardless of the transfer, Matrixport researchers stated the corporate nonetheless stands on agency floor.

They see no signal that Technique will face pressured promoting or main stress from the downturn.

Analysts at Matrixport stated the current strain sits primarily on shareholders who purchased the inventory at a premium. That premium light as soon as Bitcoin moved decrease. This prompted a steep compression in internet asset worth.

The corporate, nevertheless, didn’t present indicators of misery.

Crypto analysis group 10X Analysis reported a 70% probability that Technique will be a part of the S&P 500 earlier than the yr ends. Their evaluation helps Matrixport’s view that the correction didn’t weaken the corporate’s long-term outlook.

Technique inventory, and S&P 500 inclusion hopes

Technique now seems low-cost compared with Bitcoin’s worth development. Matrixport analysts stated the inventory trades at a degree that doesn’t replicate the corporate’s present steadiness sheet power.

Additionally they wrote that the S&P 500 inclusion stays potential in December.

S&P World Scores issued a B minus score for Technique.

The grade sits in speculative territory, but it surely marks the primary score of its form for a Bitcoin treasury firm. Analysts stated the score offers the market a brand new level of comparability when assessing comparable companies.

The score doesn’t have an effect on index inclusion by itself. The primary drivers will probably be market worth, liquidity, and itemizing guidelines. Technique nonetheless meets these standards. The December window stays open.

Smaller company crypto treasuries face tighter situations

Different companies didn’t maintain up as effectively. A number of smaller corporations with digital asset treasuries confronted extra intense strain.

Their mNAV ratios slipped under 1, which restricts their capability to boost funds by issuing new shares. For context, mNAV compares enterprise worth to the worth of crypto holdings. A ratio above 1 lets an organization elevate capital, and a ratio under 1 reduces that flexibility.

Treasury corporations that moved under this threshold embrace BitMine, Metaplanet, Sharplink Gaming, Upexi and DeFi Improvement Corp. Customary Chartered knowledge reveals that mNAV weak point began constructing months in the past and unfold throughout many companies.

Associated Studying: Is Technique Promoting Bitcoin? Saylor Denies The Rumors

Technique management maintains confidence throughout the downturn

Michael Saylor, the manager chairman of Technique, addressed considerations throughout a Fox Enterprise interview.

He stated the corporate was constructed to outlive main declines in Bitcoin’s worth. He added that Technique might deal with an 80 to 90% drawdown.

Saylor additionally pointed to the corporate’s newest buy. Technique acquired 8,178 Bitcoin price $835 million. This determine stands far above its current common of roughly 400 to 500 BTC purchased every month. The transfer reveals that the corporate has not slowed its accumulation.

These actions assist the view that Technique remains to be dedicated to its long-term plan. The corporate nonetheless holds the biggest company Bitcoin treasury on the planet and the current buy solely strengthens its place additional.