XRP is underneath heavy promoting strain as worry spreads throughout the crypto market, pushing sentiment into one among its most fragile levels of the cycle. What was as soon as a euphoric rally earlier this 12 months has steadily shifted into denial amongst long-term holders — and now anxiousness is starting to dominate. With XRP flirting dangerously with a drop beneath the $2 mark, buyers are watching intently, conscious that this stage carries main psychological and structural weight.

For now, XRP has managed to carry above $2, however the protection of this threshold is changing into more and more tough as liquidity thins and macro uncertainty intensifies. A break beneath this zone may set off a deeper reset, whereas a profitable rebound would reinforce it as a key long-term demand space.

This shift in sentiment can also be mirrored in on-chain metrics: long-term holders, beforehand sitting comfortably in revenue, at the moment are watching their unrealized positive aspects compress. Traditionally, transitions from euphoria to denial and into anxiousness have usually preceded main market inflection factors, making the present second particularly vital.

XRP NUPL Indicators Rising Market Anxiousness

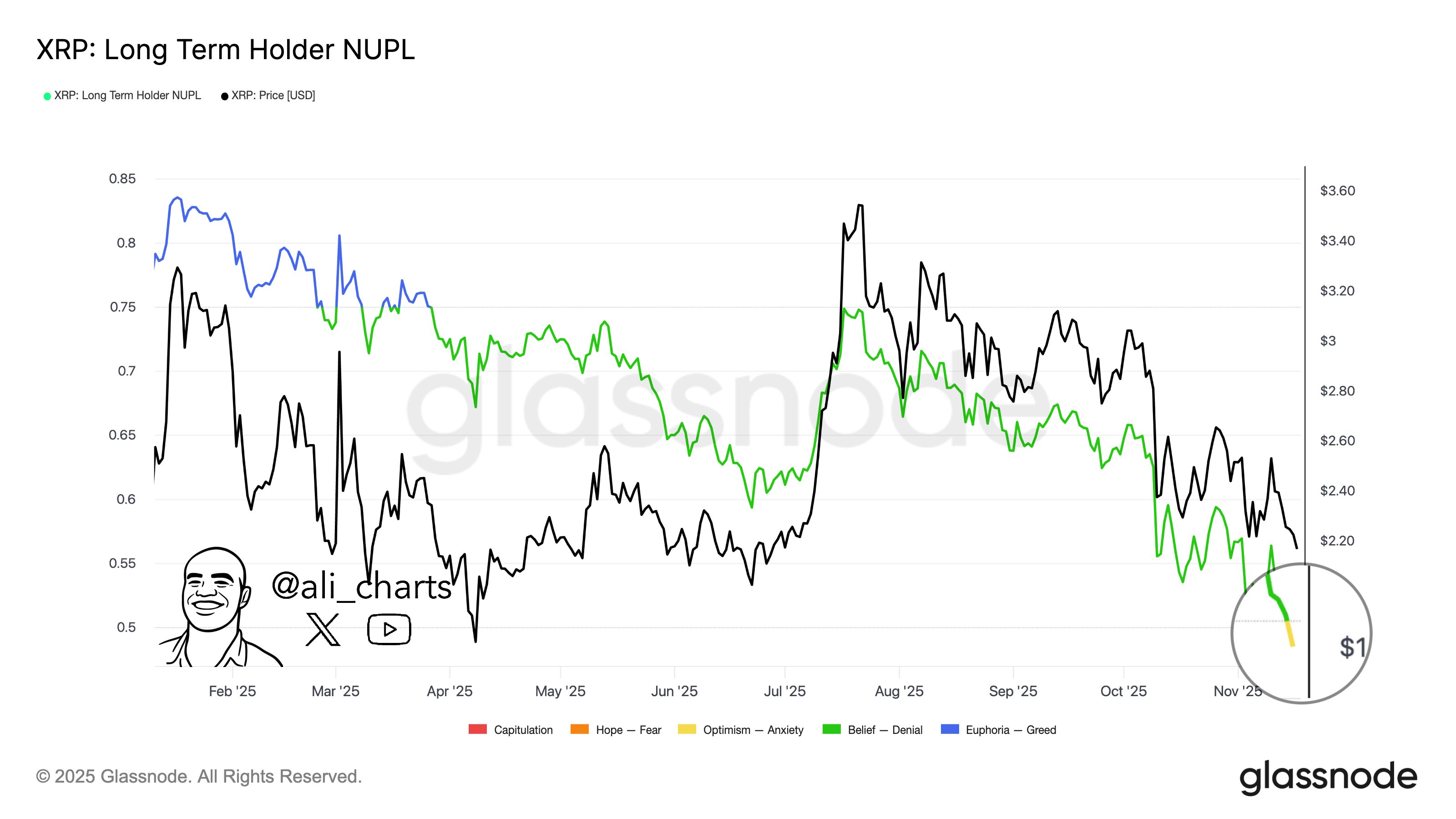

Analyst Ali Martinez shared new knowledge displaying that XRP’s Lengthy-Time period Holder Web Unrealized Revenue/Loss (NUPL) has now dropped beneath 0.5 — a stage that traditionally marks a transition from confidence to rising anxiousness amongst holders.

NUPL measures the distinction between the whole unrealized revenue and loss within the community, serving to determine the place buyers stand emotionally inside the market cycle. When NUPL is above 0.5, it sometimes displays optimism or perception, usually related to rising costs and robust conviction. However when it falls beneath 0.5, sentiment weakens, indicating that buyers are not comfortably in revenue.

XRP dipping beneath this threshold means a good portion of the market is dropping confidence as unrealized positive aspects shrink. Buyers who had been beforehand sitting on sizable earnings at the moment are seeing these margins erode, pushing them right into a extra defensive psychological state. Traditionally, this indicators that the market is shifting towards anxiousness — a stage the place many holders start doubting whether or not upside momentum will return.

This decline in NUPL aligns with XRP’s present worth conduct close to the $2 help stage, emphasizing how fragile the market has change into. Whereas anxiousness can gasoline panic promoting, it has additionally marked the start of long-term accumulation phases in previous cycles. The subsequent transfer for XRP could depend upon whether or not worry intensifies — or whether or not sturdy palms step in to soak up provide.

Testing Vital Assist as Promoting Strain Deepens

XRP continues to commerce underneath heavy promoting strain, with the chart displaying a transparent collection of decrease highs and protracted failures to reclaim key shifting averages. The value is now hovering close to $2.14, testing an important help zone that has repeatedly acted as a psychological and structural stage for consumers all year long. Every try to interrupt above the 50-day and 200-day shifting averages has been met with rejection, signaling that momentum stays firmly on the facet of the sellers.

Quantity has regularly elevated throughout current downswings, suggesting that the sell-offs are pushed extra by capitulation than easy profit-taking. The sharp decline towards $1.20 in October nonetheless stands out as an indication of utmost volatility and liquidity stress, and though XRP shortly recovered from that anomaly, it highlighted how fragile the market construction had change into. Since then, worth has failed to determine a sustained uptrend, as an alternative forming a tighter and extra compressed consolidation beneath the foremost shifting averages.

If the $2 help stage breaks decisively, XRP may revisit deeper liquidity pockets round $1.75–$1.90, the place consumers beforehand stepped in throughout September. Nevertheless, holding above $2 would hold the potential for a restoration alive, particularly if market sentiment stabilizes.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.