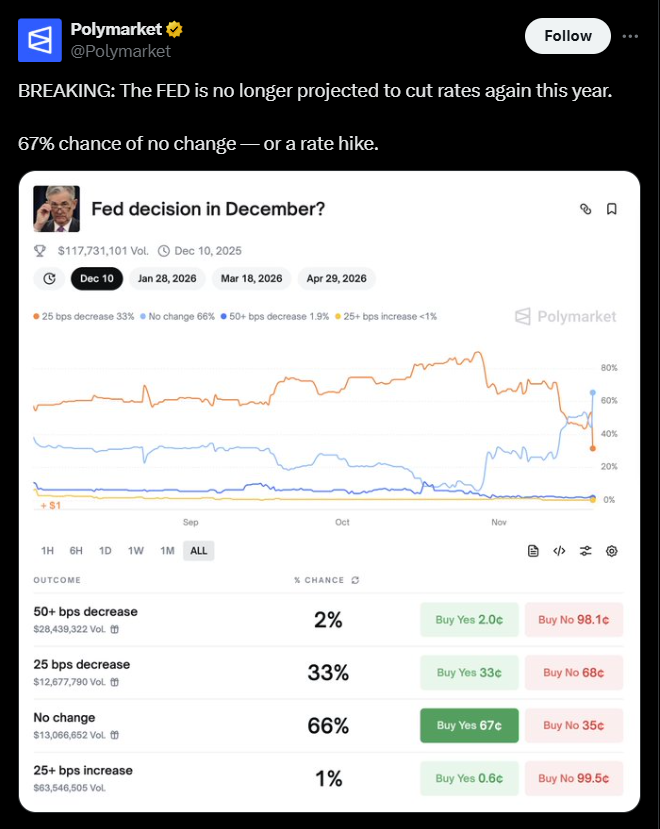

- Odds of a December charge reduce plunged from ~90% to ~30%.

- The shutdown delayed October and November jobs stories till Dec. 16.

- Merchants now overwhelmingly anticipate no transfer on the December assembly.

Expectations for a December Federal Reserve charge reduce have plunged after the Bureau of Labor Statistics confirmed it won’t launch October’s jobs report as a result of record-length authorities shutdown.

In line with Polymarket, the chance of a 25 bps reduce has collapsed from practically 90% three weeks in the past to only 32% right this moment, whereas “no change” odds have surged to 66%.

The lacking report was the ultimate set off. Merchants had been pricing aggressive easing heading into the tip of the yr, however the sudden lack of a crucial dataset compelled markets to dramatically recalibrate. As one high Polymarket participant summarized: “No information, no reduce.”

Shutdown Leaves Fed With No Visibility Forward of Resolution

As an alternative of releasing October information, the BLS confirmed it can merge the numbers with November’s report — now delayed till Dec. 16, six days after the Fed’s Dec. 9–10 assembly. Which means the Fed will make its ultimate coverage determination of the yr with out two months of employment information, one of many indicators it depends on most closely.

This unprecedented degree of uncertainty has pushed merchants into defensive positioning throughout equities, crypto, and macro markets. With no clear learn on jobs, the consensus has shifted towards the Fed holding charges regular till clearer indicators emerge.

How Markets Are Reacting

The recalibration in charge expectations comes at a time when volatility throughout threat property is already elevated. Crypto markets, particularly, felt the shock: Bitcoin dipped under key ranges as merchants adjusted for a probably longer interval of restrictive financial coverage.

The deeper challenge goes past the shutdown itself. With information releases compromised, the Fed should depend on incomplete data — and merchants at the moment are compelled to cost a wider vary of outcomes heading into December.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.