- Tether invested in Parfin to develop USDT’s institutional settlement and stablecoin infrastructure throughout Latin America.

- Inflation and banking instability in nations like Argentina and Brazil are driving large regional demand for stablecoins.

- LATAM has grow to be a significant world crypto hub, with practically $1.5 trillion in transaction quantity and rising reliance on USDT.

Tether is stepping deeper into Latin America, putting a recent funding behind Parfin because the area’s urge for food for institutional crypto rails retains heating up. The transfer is supposed to hurry up onchain settlement, one thing numerous main gamers throughout LATAM are already leaning towards as conventional methods hit their limits. It’s an indication that stablecoins, particularly USDT, have gotten greater than only a buying and selling device; they’re turning into precise monetary plumbing for companies that transfer critical worth. And actually, the timing feels nearly too excellent given how shortly LATAM is adopting digital finance.

Increasing Onchain Settlement And Institutional Infrastructure

Parfin, which operates out of London and Rio de Janeiro, has been constructing the type of spine establishments must deal with custody, tokenization and settlement since 2019. Tether’s new funding, regardless that they didn’t share the quantity, goals to push USDT into that movement as a major settlement asset. They see USDt as a rail for high-value operations like cross-border funds, tokenized real-world belongings, and credit score markets tied to business receivables. Parfin lately grabbed official registration in Argentina as a digital asset service supplier, simply including extra gas to the hassle. It’s additionally been working in Brazil since 2020, giving it a powerful regional place to scale these instruments shortly.

Tether Sees Latin America As A Main Pressure For Blockchain Development

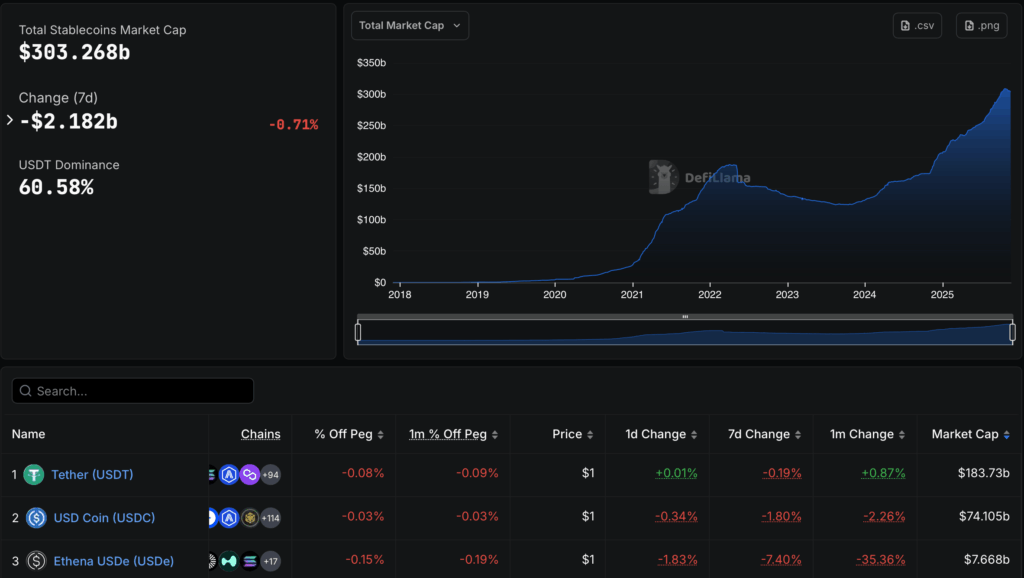

Paolo Ardoino, Tether’s CEO, stated the transfer displays the corporate’s perception that Latin America is turning into one of many world’s prime blockchain innovation zones. And he may not be mistaken; USDT already dominates the stablecoin market with round a $183.73 billion market cap, based on DefiLlama. Your complete stablecoin market is sitting close to $303.2 billion, so Tether principally owns the biggest slice. This Parfin deal additionally comes simply days after a separate funding into Ledn, a Bitcoin-backed lending platform, displaying Tether is doubling down throughout a number of fronts to strengthen its ecosystem. The broader technique appears fairly clear: construct out stablecoin rails wherever adoption and structural demand are already exploding.

Latin America’s Crypto Increase Reveals No Indicators Of Slowing Down

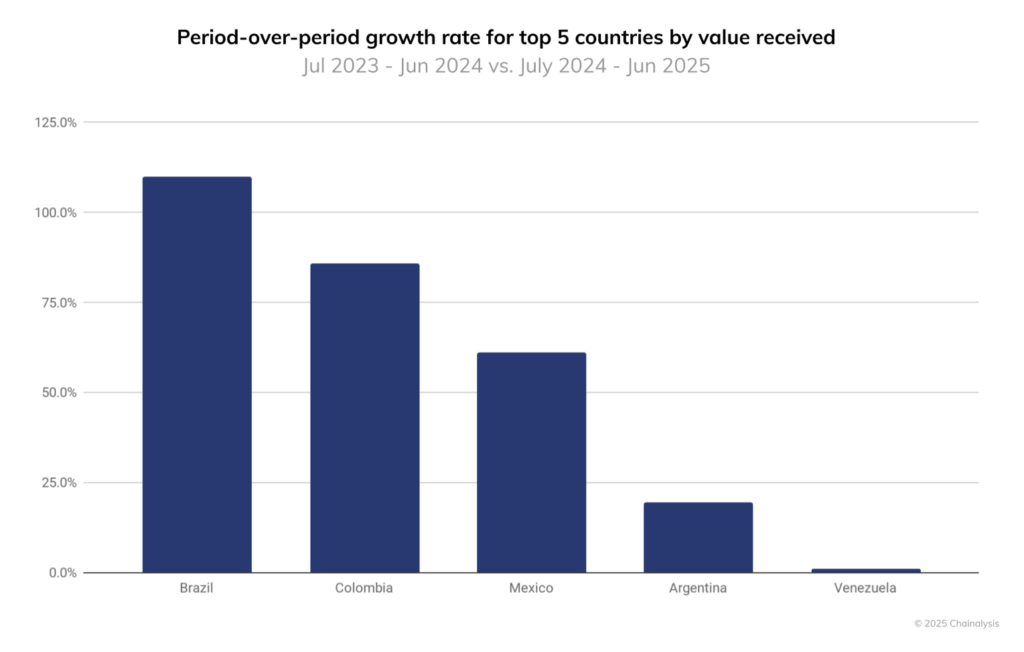

Chainalysis reported in October that LATAM dealt with practically $1.5 trillion in crypto transactions from mid-2022 to mid-2025, making it one of many largest hotspots globally. Brazil alone pulled in round $318.8 billion, nearly a 3rd of the area’s exercise, whereas Argentina adopted with $93.9 billion. A number of this surge comes from inflation stress—particularly in Argentina, the place forex points have pushed folks towards something extra steady than the peso.

Stablecoins have grow to be a type of digital protected zone; Bitso even stated USDT and USDC made up 39% of all crypto purchases on its platform in 2024. Past safety from inflation, stablecoins are getting used for on a regular basis funds, financial savings, and cross-border transfers with out SWIFT’s heavy charges. As Bybit’s LATAM chief put it, crypto isn’t simply rising—it’s actually altering lives within the area, reshaping how folks transfer and retailer cash.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.