- LINK reserves climbed to $11M, with regular accumulation exhibiting no main outflows for months.

- Chainlink stays a core infrastructure layer throughout DeFi, enterprise techniques, and multichain environments.

- Rising reserves and rising ecosystem reliance could sign long-term confidence regardless of short-term worth stagnation.

Chainlink has been quietly stacking reserves this month, with the LINK reserve climbing to about $11 million—one thing that caught the attention of analysts who’ve been monitoring the challenge’s underlying exercise. LINK traded close to $13.42 earlier within the day earlier than slipping to round $12.94 as Bitcoin out of the blue plunged underneath the $90,000 mark. The transfer pushed LINK about 6.65% decrease in 24 hours, giving it a market cap near $9.01 billion. Buying and selling quantity jumped sharply to $739.32 million, up practically 28% from the day prior to this, which normally suggests merchants are reacting to extra than simply worth noise.

With 696.84 million LINK circulating out of its one billion max provide, the token’s actions this week match into a bigger dialog about Chainlink’s place within the broader crypto stack. Many analysts identified that Chainlink has turn out to be a spine for numerous on-chain techniques—virtually each main app appears to depend on it earlier than going dwell. That’s as a result of it handles worth feeds, cross-chain messaging, non-public computation, compliance instruments, and hyperlinks to conventional monetary techniques. Numerous the worth DeFi secures flows by means of Chainlink’s rails. Regardless of that, LINK itself stored buying and selling in a slim zone, exhibiting no main push in both route.

Rising LINK reserves trace at long-term confidence

One of many extra fascinating updates got here from a Chainlink dashboard exhibiting the reserve has now reached $11 million. The reserve presently holds about 803,388 LINK at a mean value foundation of $20.06. The chart revealed regular accumulation from early August to early November—no sharp drops, no sudden liquidations, only a sluggish, constant construct.

Individuals have a tendency to concentrate when reserves develop like this as a result of it provides a reasonably clear view of how assets contained in the ecosystem are shifting. A rising reserve suggests new inflows and, probably, a quiet type of long-term confidence. Some merchants argued that if this pattern continues, it might affect expectations over time—even when it doesn’t assure any short-term worth motion. Others merely famous that the regular rise provides one other piece to the puzzle: an image of accelerating exercise across the community.

Chainlink’s position expands because the multichain world will get noisy

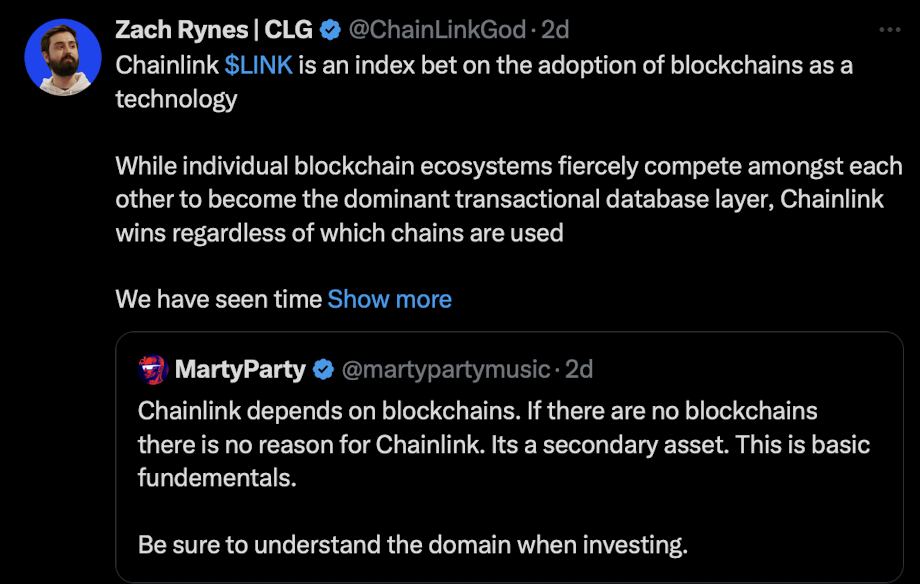

One other layer of the dialogue revolved round how Chainlink matches right into a multichain surroundings that grows extra chaotic by the month. Supporters burdened that Chainlink isn’t tied to only one digital machine—it really works throughout EVM chains, SVM chains, MoveVM chains, and the listing retains increasing. That versatility is why folks name it blockchain agnostic. It’s constructed to attach ecosystems that usually don’t speak to one another.

As new blockchains launch, every brings its personal remoted surroundings that wants safe knowledge feeds, cross-chain motion, and infrastructure that truly works in complicated environments. Business voices have been calling Chainlink a type of “international orchestration layer,” capable of join each on-chain and off-chain techniques by means of constant requirements.

A much bigger image that ties all the pieces collectively

Observers linked these broad capabilities—worth feeds, cross-chain instruments, enterprise integrations, DeFi safety—to the rising reserve numbers. The concept is easy: if Chainlink continues to take a seat on the heart of extra blockchain techniques, extra monetary establishments, and extra cross-network infrastructure, then elevated accumulation inside its reserves isn’t stunning. It’s a part of an extended story forming quietly within the background, whilst LINK’s worth seems to be indecisive within the brief time period.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.