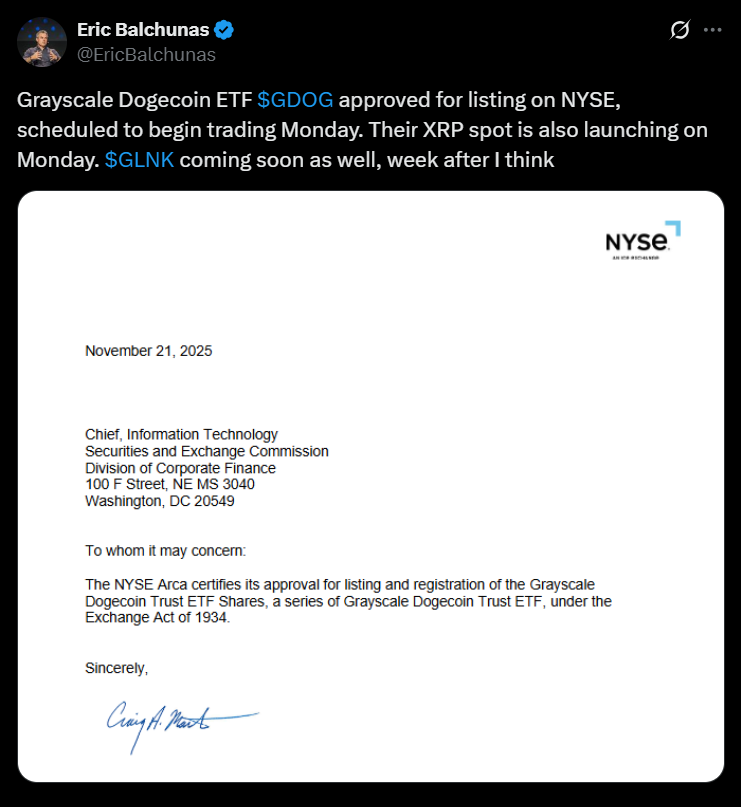

- Grayscale’s Dogecoin (GDOG) and XRP (GXRP) ETFs start buying and selling Monday on NYSE Arca.

- Each merchandise provide direct spot publicity after transitioning from personal placements.

- The launch joins a wave of altcoin ETFs pushed by rising institutional demand.

Grayscale is increasing its attain into the altcoin ETF enviornment as its Dogecoin and XRP merchandise formally go dwell on NYSE Arca this Monday, marking a significant milestone for U.S. buyers in search of direct, regulated publicity to each property. The newly listed Grayscale Dogecoin Belief ETF (GDOG) and Grayscale XRP Belief ETF (GXRP) will every maintain spot allocations of their underlying tokens, opening the door for conventional buyers to have interaction with two of the market’s most energetic cryptocurrencies with out navigating exchanges or self-custody.

A New Period for DOGE and XRP Entry

For Dogecoin, the transfer represents a big leap from meme coin origins to mainstream legitimacy. DOGE has persistently ranked among the many highest-volume traded digital property, and its ETF debut alerts that institutional curiosity has shifted decisively towards broader crypto diversification. XRP, in the meantime, enters the ETF panorama because the XRP Ledger approaches its fourteenth yr, having processed greater than 4 billion transactions since inception.

From Personal Placement to Public Markets

Each GDOG and GXRP have been beforehand accessible solely as personal placements, however the transition to NYSE Arca offers them far wider visibility and liquidity. Their launch expands Grayscale’s product lineup to greater than 40 choices, additional anchoring the agency as probably the most influential gamers in crypto funding merchandise. With renewed consideration on altcoin ETFs, demand for regulated publicity continues to construct throughout U.S. wealth channels.

A part of a Rising Altcoin ETF Wave

The timing of Grayscale’s rollout aligns with a broader surge in altcoin ETF exercise. Bitwise launched its XRP ETF earlier this week, whereas Franklin Templeton is making ready its personal Dogecoin product for launch subsequent week. Bitwise’s Solana ETF (BSOL) has already pulled in additional than $400 million in inflows this yr, underscoring the rising institutional urge for food for property past Bitcoin.

What This Means for Buyers

The introduction of GDOG and GXRP to public markets may reshape how each property commerce within the months forward, particularly as liquidity deepens and institutional allocators start assessing their long-term roles in diversified portfolios. Whereas market circumstances stay turbulent, the arrival of those ETFs alerts that conventional finance continues constructing bridges into the broader crypto ecosystem.

The submit Grayscale Brings DOGE and XRP ETFs to NYSE — Right here Is What Buyers Ought to Anticipate first appeared on BlockNews.