- A Hyperliquid whale’s earnings collapsed from $100M to $38.4M in ten days.

- ETH lengthy at $3,200 and XRP lengthy at $2.30 are each deeply underwater.

- Greater than $61M in revenue vanished as each property fell over 18% in the identical interval.

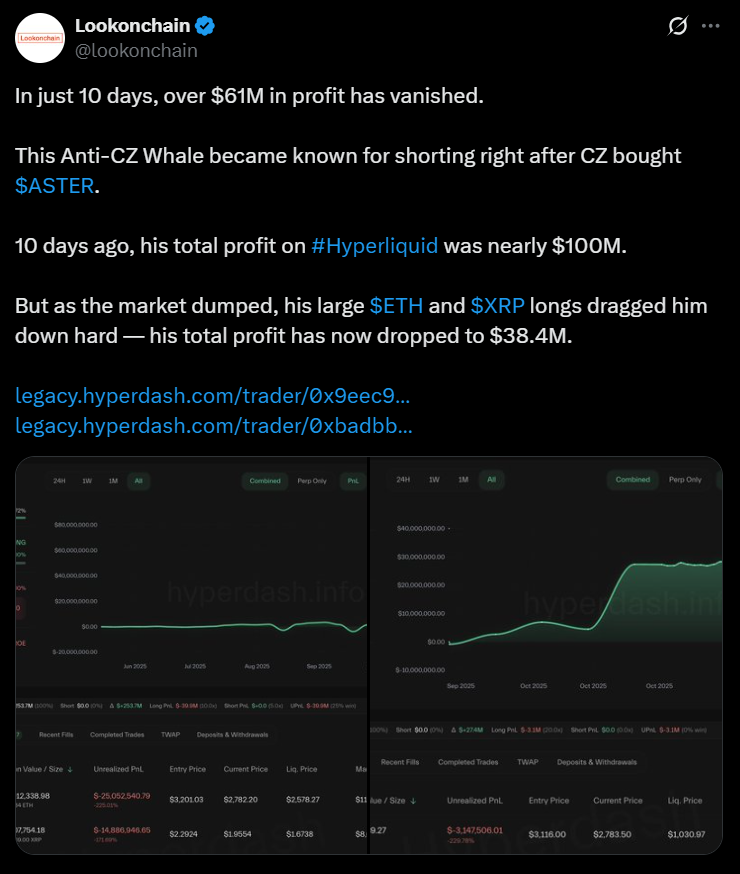

A serious whale on Hyperliquid simply watched earnings plunge from practically $100 million to $38.4 million in solely ten days, based on new knowledge flagged by on-chain tracker Lookonchain. The sharp drawdown displays the brutal selloff gripping the crypto market, with each Ethereum and XRP posting heavy losses that hit leveraged lengthy positions exhausting.

ETH Lengthy Turns Deep Purple

Ethereum’s decline from $3,400 to round $2,800 has been the most important drag on the dealer’s portfolio. The whale opened an extended at $3,200, and with ETH now properly under that stage, unrealized positive aspects evaporated rapidly. The transfer represents an prolonged 18% slide over ten days, mirroring broader risk-off sentiment.

XRP Lengthy Suffers Related Destiny

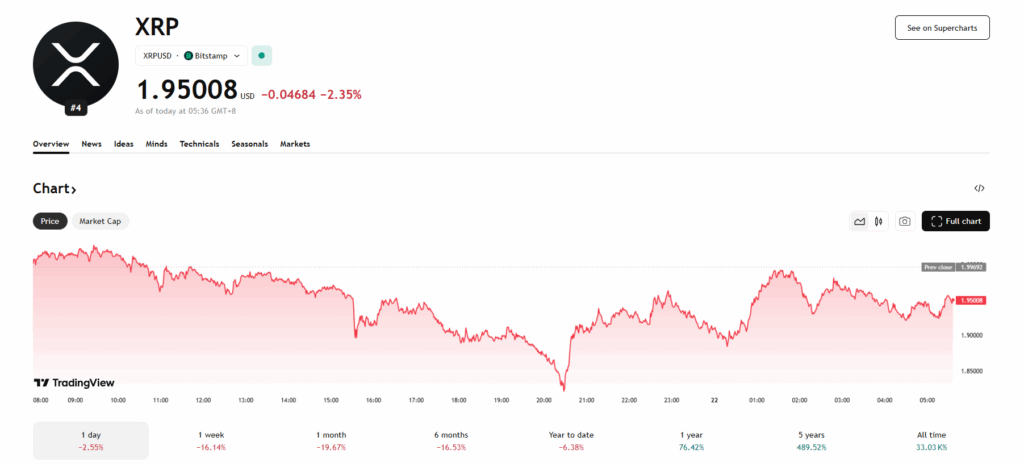

XRP additionally dropped sharply, falling from $2.50 all the way down to $1.96 on the time of writing. The dealer entered lengthy at $2.30, leaving that place underwater as properly. XRP’s double-digit correction contributed closely to the revenue wipeout, with the asset dropping greater than 18% over the identical interval.

Excessive Leverage Meets Market Reversal

The whale stays worthwhile total, sitting on $38.4 million, however the pace and scale of the drawdown underscore the dangers tied to outsized directional bets on Hyperliquid. Because the cryptocurrency market unwinds months of positive aspects, leveraged lengthy merchants have been among the many hardest hit, with sudden worth swings accelerating unrealized losses.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.