Bitcoin continues to bleed, printing new native lows because the market fails to seek out sturdy assist. The broader construction has damaged down, and sellers stay in management after a collection of distribution strikes close to the highs. Regardless of oversold indicators creeping in, the shortage of a correct futures capitulation retains danger to the draw back open.

By Shayan

The Each day Chart

On the each day timeframe, BTC has formally damaged beneath the long-standing ascending channel that held worth motion for months. After the 50-day transferring common crossed beneath the 200-day transferring common, forming a loss of life cross, the worth accelerated downward.

Assist ranges round $100K and $86K have been simply breached, and BTC is now transferring towards the following demand zone close to $76K. The RSI can be sitting deep in oversold territory, however there has not been a pointy reversal candle or quantity spike that usually follows capitulation. Due to this fact, extra draw back might be anticipated within the quick time period.

The 4-Hour Chart

Zooming into the 4-hour chart, the pattern has been locked inside a clear descending channel. Nonetheless, BTC broke beneath the decrease boundary just lately, displaying sturdy momentum from the sellers. Minor makes an attempt to bounce have been weak and short-lived, leaving their marks as candle wicks solely.

Any retest of the $85K zone could now act as resistance, because it has been damaged to the draw back. With the RSI hovering close to 20 in oversold territory and displaying a number of failed restoration makes an attempt, short-term momentum stays clearly bearish except a deviation again into the channel with sturdy quantity materializes.

Sentiment Evaluation

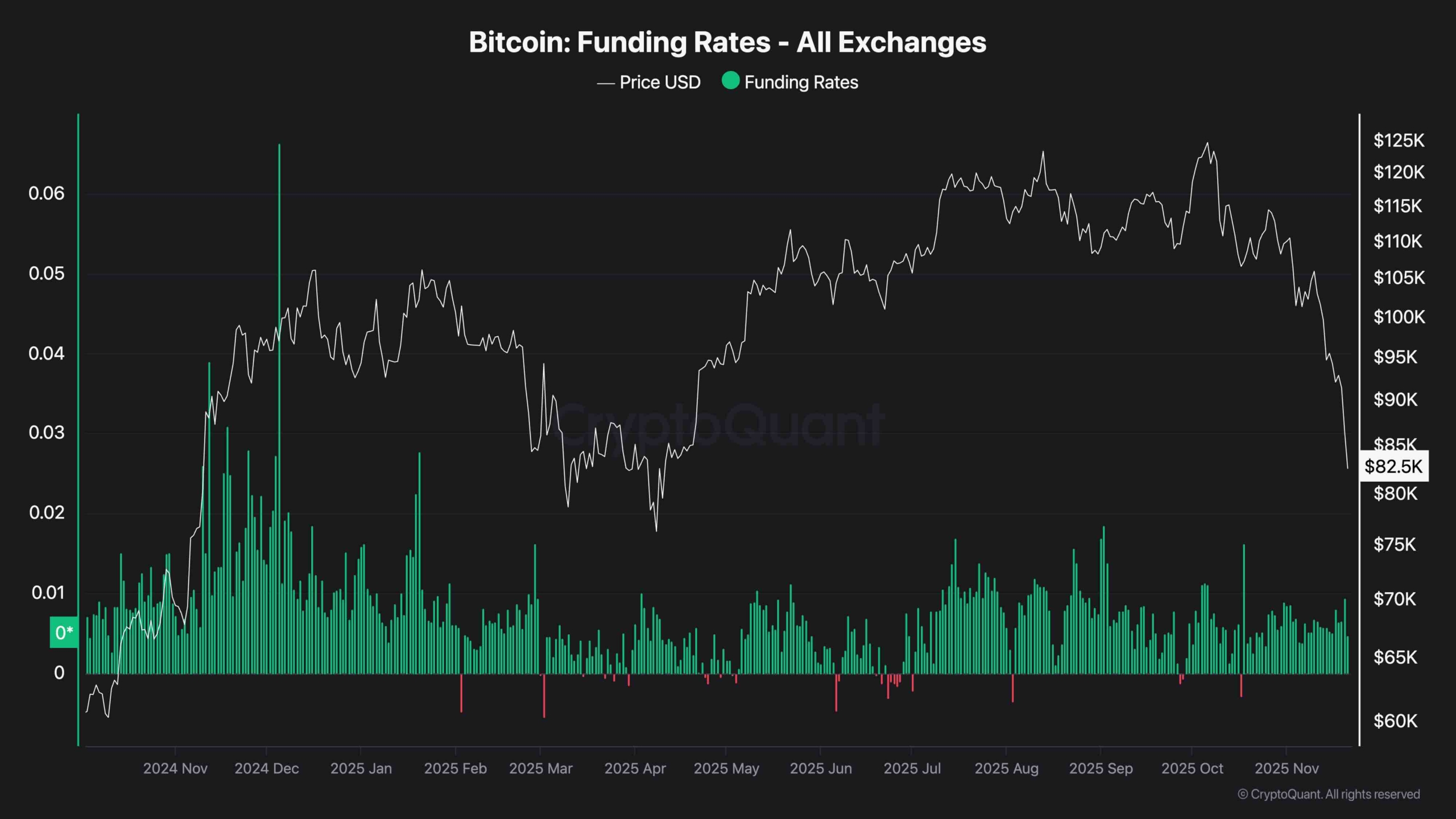

Funding Charges

Funding charges throughout exchanges are nonetheless hovering in optimistic territory, regardless of the aggressive drop in worth. This disconnect exhibits that many merchants are nonetheless holding lengthy positions, probably ready for a bounce.

It’s an necessary sign: the market has not gone by means of full liquidation or capitulation but. A real backside in Bitcoin is usually marked by destructive funding charges and a pointy spike in liquidations. Till that occurs, draw back strain might persist, and any aid rallies could be bought into.

The publish Bitcoin Value Evaluation: Will BTC’s Brutal Promote-Off Cease After Drop Beneath $81K? appeared first on CryptoPotato.