- SOL fell to its lowest degree since June 23, exhibiting robust bearish stress and weakening momentum.

- Futures OI sits close to $6.47B, and TVL dipped 4.7%, signaling stress even with excessive exercise.

- Reclaiming $130 is crucial—above it targets $134–$138, under it dangers a return to $123–$120.

Solana hasn’t appeared this shaky in months. After sliding to its lowest degree since June 23, the chart is flashing clear indicators of stress—heavy promoting stress, fading purchaser power, and indicators leaning deeper into bearish territory throughout a number of timeframes. Until sentiment flips quick, the chance of extra draw back retains rising.

In line with CoinGecko, SOL is buying and selling round $125.32, oddly up about 8% on the day, regardless that the broader image nonetheless feels weak. Worth bounced between $122.66 and $135.27, with spot quantity hitting a large $10.2 billion. Merchants aren’t backing off… they’re simply getting extra cautious.

Leverage builds up as futures exercise heats up

Coinglass knowledge exhibits Solana’s open curiosity sitting close to $6.47 billion, with $29.3 billion in futures buying and selling quantity previously 24 hours. That’s a crowded market—numerous leveraged positions, numerous folks betting each instructions. Heavy OI throughout a downtrend normally means volatility isn’t performed but.

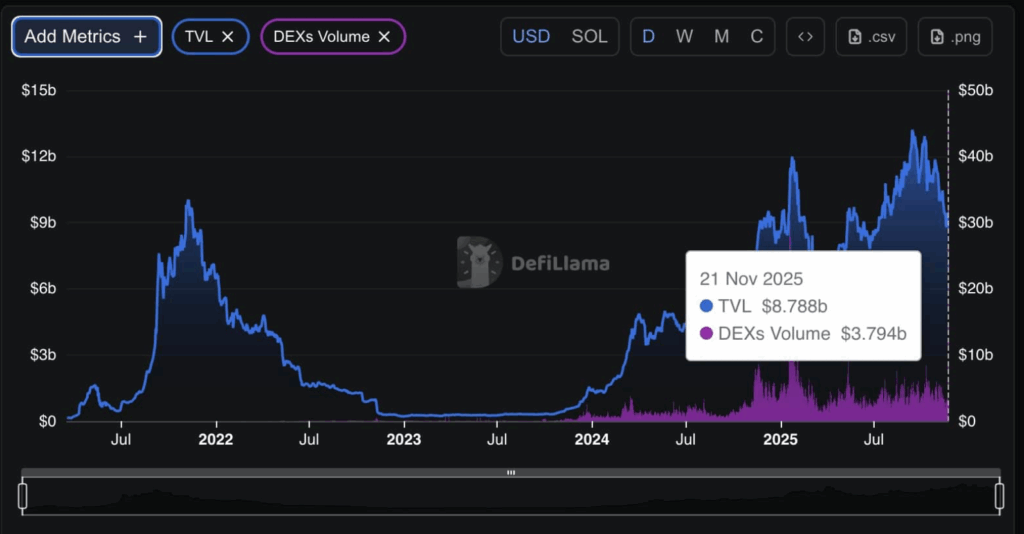

In the meantime, DeFi Llama stories Solana’s TVL at $8.78B, down 4.7% in a single day. DEXs nonetheless pushed about $3.32Bin 24-hour quantity, so exercise is wholesome… however the TVL dip hints at rotation, some profit-taking, and possibly nerves creeping in.

Put collectively: spot rebound + excessive derivatives move + regular DeFi utilization = energetic market.

However that TVL slip? That’s the small warning gentle blinking on the dashboard.

Solana Worth Prediction: What if SOL can’t reclaim $130?

SOL is sitting proper at a crucial level after a pointy intraday drop sliced by way of the mid-$120s. Analyst Crypto Tony’s 4-hour chart exhibits SOL attempting to recuperate, pushing again towards the $128–$130 area—now performing as contemporary resistance.

A transfer above $130 would shift short-term sentiment. However one other rejection? That retains the stress straight to the draw back.

Latest periods have carved out the traditional lower-high, lower-low stair-step sample, which is mainly the signature of bearish momentum. The break under $130 triggered a quick flush, wiping out hours of sideways chop in a single candle. Lengthy decrease wicks round $123 present patrons stepped in—however the bounce to date is tiny in comparison with the pace of the drop.

Crypto Tony summed it up completely:

“$130 reclaim is bullish. Rejection and drop is a brief place.”

Proper now, SOL is urgent in opposition to a former help that has flipped into resistance. If patrons handle a stable shut above $130, the door opens towards $134–$138. But when SOL fails once more, the downtrend stays totally in management—$123 turns into the following retest, and under that sits the $120 help zone.

A market nonetheless below stress

The repeated rejections, heavy leverage, shrinking TVL, and lower-high construction all paint the identical image: Solana’s market is harassed, and patrons want a clear reclaim above $130 to shift the tone. Till that occurs, each bounce dangers turning into one other quick setup for merchants.

If SOL can’t reclaim the extent quickly, count on extra chop… possibly even one other leg down.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.