- A dormant whale bought 512K UNI after 4.5 years, locking in an $11.65M loss — clear capitulation habits.

- UNI has dropped from $10.2 to $6.4 as whales flipped from shopping for to heavy promoting.

- Optimistic trade netflows, bearish DMI alerts, and powerful promote momentum might drag UNI right down to $5.8 except bulls reclaim $7.6.

Uniswap’s greatest gamers have been appearing unusually recently — and never in a bullish means. One dormant whale, silent for 4.5 years, all of a sudden resurfaced and dumped 512,000 UNI, reserving a staggering $11.65 million loss. This whale initially purchased at peak euphoria, round $29.8, when the stash was value over $15 million. Now, with UNI beneath $7, the identical bag was value simply $3.64 million. Promoting at that type of loss isn’t rebalancing. It’s capitulation.

UNI’s value collapses after the “UNIification” pump

Simply ten days after Uniswap’s Unification proposal lit up the charts, pushing UNI to $10.2, issues turned ugly. Revenue-taking — from each whales and retail — triggered a pointy reversal. UNI tanked right into a downtrend, sinking to $6.4earlier than a tiny bounce to round $6.5. That’s a 9.14% drop in a single day, and the chart doesn’t look any friendlier throughout decrease timeframes.

As the value fell, whale habits shifted quick. Those that piled in earlier started dumping aggressively, amplifying the promote strain.

Whales flip from accumulation to panic promoting

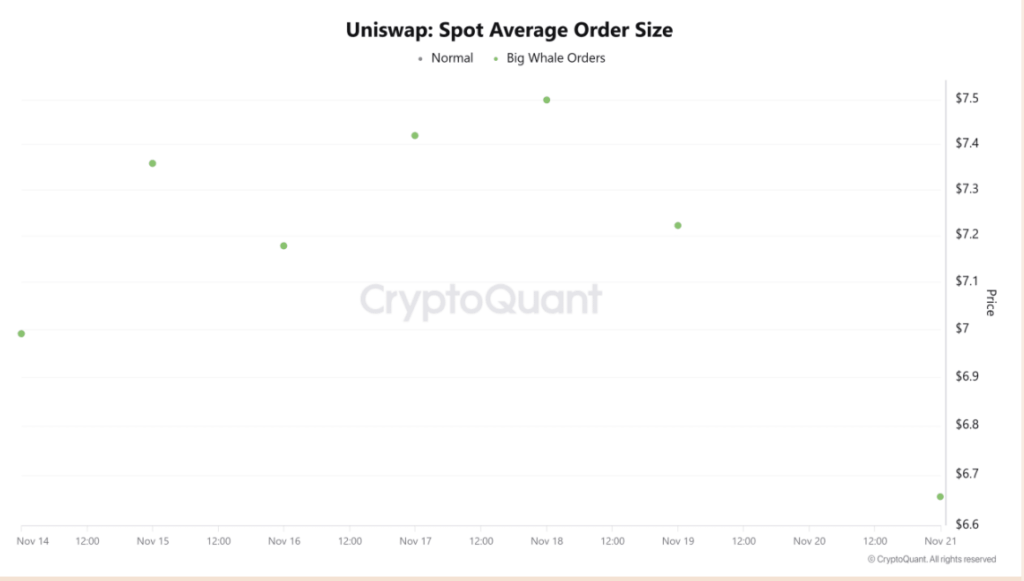

CryptoQuant’s Spot Common Order Dimension knowledge confirmed heavy whale shopping for on November 10 and 11, proper after the UNIification hype. However as soon as value peaked, sentiment flipped like a change.

- On November 11, one whale bought 1.71 million UNI value $15 million, all of which had been amassed between February and October.

- Regardless of months of holding, this whale nonetheless took a $1.4 million loss, in line with Lookonchain.

Promoting at a loss after a hype-driven spike? That’s basic fear-driven capitulation — the sort you normally see deeper in bear markets.

And the promoting hasn’t slowed. Over the previous three days, whales dumped 5.6 million UNI into the market.

Trade Netflow spikes as promoting strain intensifies

Uniswap has now seen three straight days of optimistic Trade Netflows — which means extra UNI is flowing onto exchanges than leaving. Tokens despatched to exchanges normally signify one factor: promoting intent.

UNI’s momentum indicators echo the identical story.

The Optimistic Directional Motion Index (DMI) simply made a bearish crossover — a technical affirmation that draw back momentum continues to be in management.

The Fibonacci Bollinger Bands present value clinging to the decrease area, with no significant signal of stabilization.

How low might UNI fall subsequent?

If the present pattern holds — whales promoting, momentum weakening, and netflows rising — UNI might simply slip towards $5.8, wiping out all features from the UNIification rally.

For bulls to invalidate this bearish setup, they have to reclaim the center band of the Fibonacci Bollinger Bands at $7.6. Solely then can UNI try a transfer towards the subsequent resistance at $8.4.

Till that reclaim occurs, each bounce dangers changing into one other quick alternative for merchants watching this breakdown unfold.

The submit Uniswap Whales Are Capitulating as UNI Crashes — Right here Is Why the Market Appears to be like Fragile and The place Worth May Go Subsequent first appeared on BlockNews.