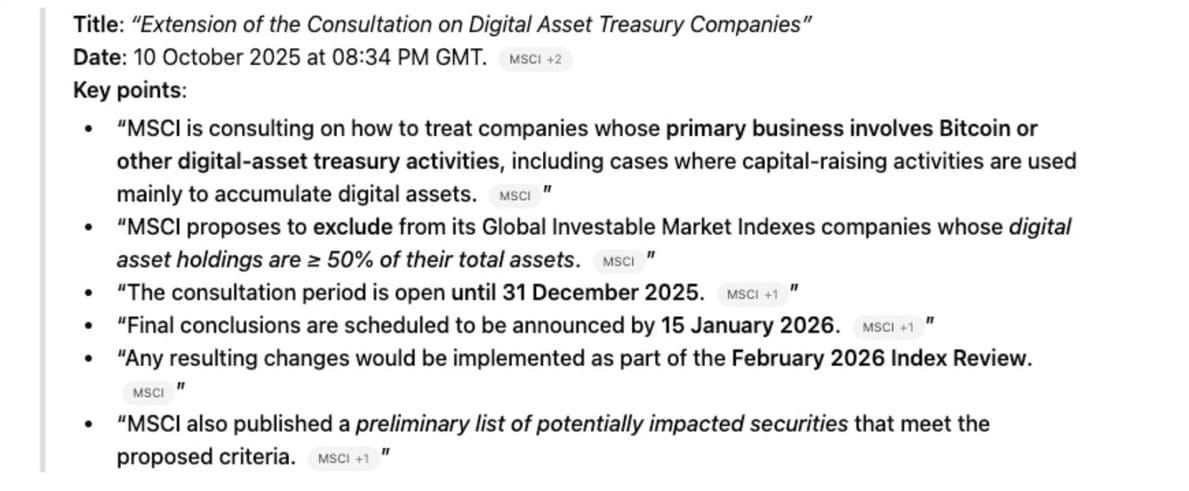

MSCI’s assessment of the best way to classify corporations with massive Bitcoin holdings has develop into central to ongoing discussions concerning the sharp market decline that started on October tenth, 2025.

The index supplier is assessing whether or not corporations whose digital-asset holdings make up nearly all of their belongings ought to proceed to qualify for inclusion in its fairness benchmarks.

The session opened on October tenth and runs by December thirty first, with conclusions anticipated January fifteenth, 2026, and doable implementation in February 2026.

The official MSCI doc states that the assessment applies to “corporations whose main enterprise mannequin entails Bitcoin or different digital asset actions, together with instances the place capital elevating actions are used primarily to build up digital belongings.”

The agency is contemplating excluding corporations whose digital-asset holdings characterize 50 % or extra of whole belongings from its International Investable Market Indexes.

Analysts Debate Whether or not the Session Triggered the Market Drop

Ran Neuner has linked the October tenth downturn on to the discharge of the MSCI session, arguing that the timing explains the sudden decline and lack of restoration.

WE FINALLY KNOW WHY THE MARKET CRASHED ON 10 OCTOBER AND WHY IT JUST CANT BOUNCE!

We by no means actually understood why the massive crypto crash began on October tenth and why we could not even get a single significant bounce!

In the present day the reply appear easy!

Let me break it down.

1. DAT’s… pic.twitter.com/vhrqdPvp8H

— Ran Neuner (@cryptomanran) November 21, 2025

He stated the announcement clarified “why the massive crypto crash began on October tenth” and claimed that Digital Asset Treasury corporations resembling Technique and others have been main patrons all through the cycle.

In line with his evaluation, reclassification might trigger these corporations to be faraway from passive indexes, resulting in pressured promoting by index-tracking funds.

Neuner stated that if the proposal is adopted, “corporations like MSTR will probably be robotically faraway from all indices,” which he believes might affect each institutional flows and total market construction.

He characterised the October tenth downturn as “not a coincidence” and stated the market might have instantly priced within the potential threat.

Technique Rejects the Fund Classification View

Technique founder and chairman Michael Saylor issued a public response emphasizing that his firm is an working enterprise, not a passive funding car.

Response to MSCI Index Matter

Technique shouldn’t be a fund, not a belief, and never a holding firm. We’re a publicly traded working firm with a $500 million software program enterprise and a novel treasury technique that makes use of Bitcoin as productive capital.

This yr alone, we’ve accomplished…

— Michael Saylor (@saylor) November 21, 2025

In his assertion, he wrote: “Technique shouldn’t be a fund, not a belief, and never a holding firm. We’re a publicly traded working firm with a $500 million software program enterprise and a novel treasury technique that makes use of Bitcoin as productive capital.”

Saylor additionally highlighted the corporate’s issuance of a number of digital credit score devices this yr, totaling greater than $7.7 billion in notional worth, and the launch of STRC, a Bitcoin-backed credit score product.

He contrasted Technique’s actions with passive buildings, stating: “Funds and trusts passively maintain belongings. Holding corporations sit on investments. We create, construction, concern, and function.”

He added that “index classification does not outline us,” and reiterated that the corporate’s long-term mission stays centered on constructing what he describes as a digital financial establishment.

Uncertainty Forward of MSCI’s January Choice

The session has develop into a key level of uncertainty for each fairness and digital asset markets as traders contemplate the implications for corporations whose stability sheets are closely weighted towards Bitcoin.

Some analysts warn that index exclusion might have an effect on liquidity and capital entry for digital-asset treasury corporations, whereas others argue that their operational buildings distinguish them from funding funds and justify continued index inclusion.

With MSCI’s determination scheduled for mid-January, market contributors anticipate ongoing volatility till the agency clarifies the way it intends to categorise corporations with substantial Bitcoin holdings.

Share this text