- Injective now helps Chainlink Knowledge Streams, bringing sub-second market information to its mainnet.

- Builders achieve sooner time-to-market, customizable information feeds, and stronger monetary tooling.

- Helix Markets is the primary dApp to undertake the combination, signaling a broader shift towards high-performance DeFi on Injective.

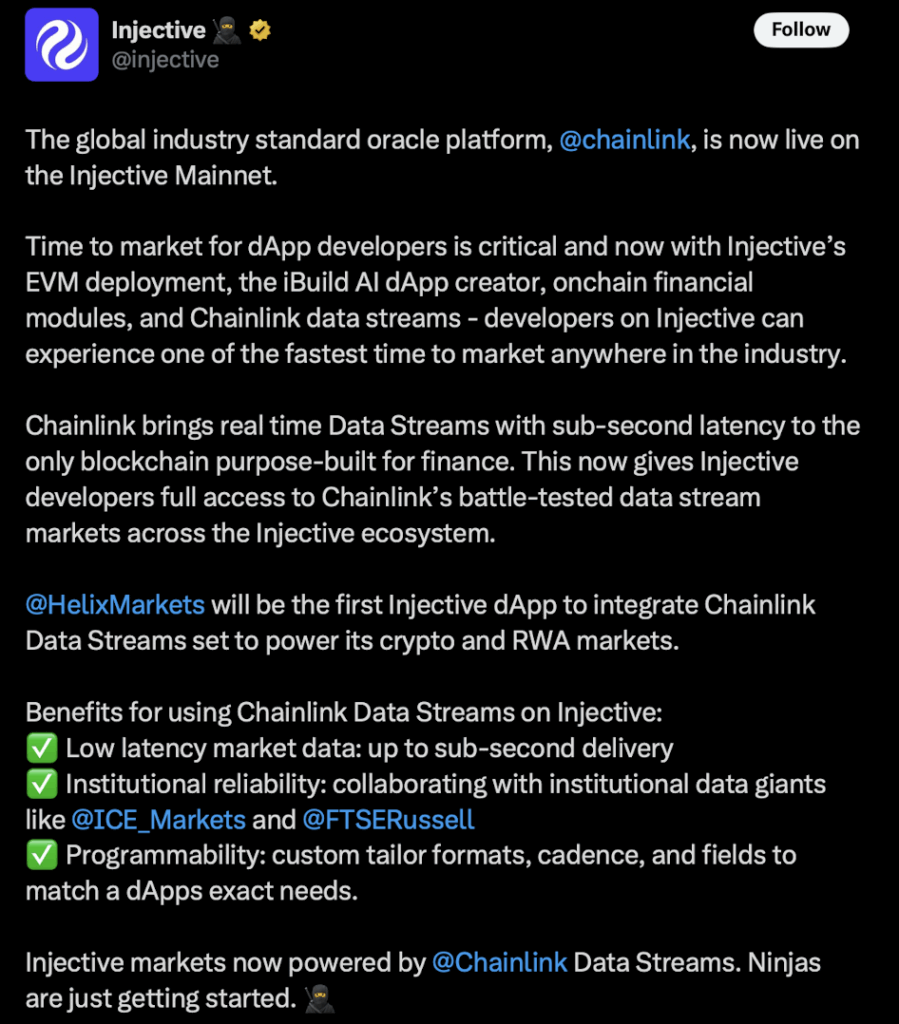

Injective, the finance-focused blockchain constructed for pace and precision, simply flipped an enormous change on its mainnet: full integration of Chainlink’s Knowledge Streams. For a platform obsessive about quick, dependable monetary tooling, this can be a milestone that’s been a very long time coming. And actually, it adjustments quite a bit.

Injective has all the time positioned itself because the chain the place DeFi apps can launch rapidly and run with out hiccups. Now, with Chainlink’s low-latency feeds plugged instantly into the community—plus Injective’s personal EVM assist—builders get a smoother, sooner path from thought to stay market. In an trade the place time-to-market usually decides who wins and who will get forgotten, this can be a severe improve.

Sooner information, tighter execution, and instruments that really feel like TradFi on-chain

For dApp builders, pace isn’t a luxurious. It’s survival. And this integration offers them entry to one of many quickest information infrastructures in all of Web3. Chainlink’s Knowledge Streams push real-time market information with sub-second updates, which suggests price-sensitive functions—like high-frequency buying and selling bots, derivatives platforms, and instantaneous settlement programs—get the type of accuracy that used to solely exist in conventional finance.

Builders may also customise their information streams—format, cadence, granularity, additional metadata—mainly fine-tuning the feed to match precisely what their dApp wants. In monetary markets, these tiny particulars usually decide whether or not a product succeeds or falls flat. With Injective + Chainlink, these particulars develop into simpler to manage.

Helix Markets turns into the primary dApp to plug into Chainlink Streams on Injective

Helix Markets, one among Injective’s flagship DeFi functions, is already tapping into Chainlink Knowledge Streams—and the mix is fairly highly effective. Helix can now entry high-throughput, real-time, institution-grade information for each crypto belongings and conventional markets. Meaning merchants get extra correct data, tighter execution, and fewer lag throughout risky moments.

This sort of improve doesn’t simply assist Helix—it exhibits what’s doable for each future finance-oriented dApp that chooses Injective as its residence. With Chainlink’s infrastructure doing the heavy lifting behind the scenes, builders can deal with enhancing merchandise as a substitute of wrestling with unreliable information inputs.

A stronger, sooner, extra aggressive Injective ecosystem

The combination of Chainlink Knowledge Streams is already making Injective extra enticing to builders—particularly these in high-performance sectors like derivatives, structured merchandise, buying and selling protocols, and artificial asset markets. As extra apps combine Chainlink tech, Injective’s popularity as a DeFi-optimized blockchain will get stronger, whereas the general ecosystem turns into extra fluid, extra environment friendly, and extra vibrant.

And searching ahead? It’s onerous to not see the potential. Actual-time, dependable information is the spine of any monetary system, and Injective now has direct entry to among the finest infrastructure out there in Web3. For builders constructing the subsequent wave of DeFi innovation, Injective is shaping as much as be one of many sharpest instruments within the field.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.