High Tales of The Week

Bitcoiners lose their thoughts after Scott Bessent walks right into a Bitcoin bar

The Bitcoin neighborhood lit up on Thursday after US Treasury Secretary Scott Bessent made an unannounced look on the launch of Washington’s new Bitcoin-themed bar, Pubkey.

“Having the Secretary of the Treasury on the Pubkey DC launch looks as if a second I may simply look again on and say ‘wow, it was all so apparent,’” Bitcoin treasury firm Attempt’s chief funding officer Ben Werkman mentioned in an X publish on Thursday.

Steven Lubka, Nakamoto’s vice chairman of investor relations, known as it “the signal you might have been ready for.”

Many different distinguished Bitcoiners, together with Bitcoin analyst Fred Krueger, Gemini chief of employees Jeff Tiller, Bitcoin podcaster Natalie Brunell, and Bitcoin Coverage Institute co-founder David Zell, additionally seen Bessent’s look as a vastly optimistic signal for Bitcoin.

India’s authorities could think about stablecoin framework, diverging from RBI

The federal government of India could think about stablecoin laws in its Financial Survey 2025-2026, whereas the Reserve Financial institution of India (RBI) takes a “cautious” method to crypto and pushes for a central financial institution digital forex, revealing a divergence in coverage suggestions.

The federal government will “current its case” for stablecoins within the annual report revealed by India’s Ministry of Finance, which outlines key coverage suggestions and the state of the economic system, enterprise publication Moneycontrol reported, citing an official aware of the matter.

Nonetheless, the central financial institution continues to induce a “cautious” method to stablecoins, in response to RBI Governor Sanjay Malhotra, talking on the Delhi Faculty of Economics on Thursday.

Bitcoin hits ‘most bearish’ ranges: Is the bull cycle ending?

Bitcoin is coming into bearish territory as institutional demand dries up and key market indicators level to a downward section, in response to information from analytics platform CryptoQuant.

Bitcoin market circumstances have turned the “most bearish” inside the present bull cycle that began in January 2023, CryptoQuant mentioned in its newest crypto weekly report shared with Cointelegraph.

CryptoQuant’s Bull Rating Index has declined to excessive bearish ranges of 20/100, whereas the BTC worth has fallen far under the 365-day transferring common of $102,000 — a key technical degree and the ultimate bearish sign marking the beginning of the 2022 bear market.

The worth drop comes amid weakening institutional demand, together with diminished shopping for by Bitcoin treasury corporations similar to Michael Saylor’s Technique, together with restricted inflows into exchange-traded funds.

Warning: WhatsApp worm targets Brazilian crypto wallets, financial institution accounts

Brazilian crypto holders are urged to be looking out for a classy hacking marketing campaign that features a hijacking worm and banking trojan shared by way of WhatsApp messages.

In keeping with a brand new report from Trustwave’s cybersecurity analysis workforce SpiderLabs, the banking trojan, referred to as “Eternidade Stealer” is being pushed by way of social engineering on messaging software WhatsApp similar to “pretend authorities packages, supply notifications,” messages from pals and fraudulent funding teams.

“WhatsApp continues to be probably the most exploited communication channels in Brazil’s cybercrime ecosystem. Over the previous two years, menace actors have refined their techniques, utilizing the platform’s immense recognition to distribute banker trojans and information-stealing malware,” mentioned Spiderlabs researchers Nathaniel Morales, John Basmayor and Nikita Kazymirskyi.

Ex-Coinbase lawyer broadcasts run for New York Lawyer Normal, citing crypto coverage

Khurram Dara, a former coverage lawyer at cryptocurrency alternate Coinbase, formally launched his marketing campaign for New York State Lawyer Normal.

In a Friday discover, Dara cited his “regulatory and coverage expertise, significantly within the crypto and fintech area” amongst his causes to attempt to unseat Lawyer Normal Letitia James in 2026.

The previous Coinbase lawyer had been hinting since August at potential plans to run for workplace, claiming that James had engaged in “lawfare” in opposition to the crypto business in New York.

Till July, Dara was the regulatory and coverage principal at Bain Capital Crypto, the digital asset arm of the funding firm. In keeping with his LinkedIn profile, he labored as Coinbase’s coverage counsel from June 2022 to January 2023 and was beforehand employed on the crypto firms Fluidity and AirSwap.

Winners and Losers

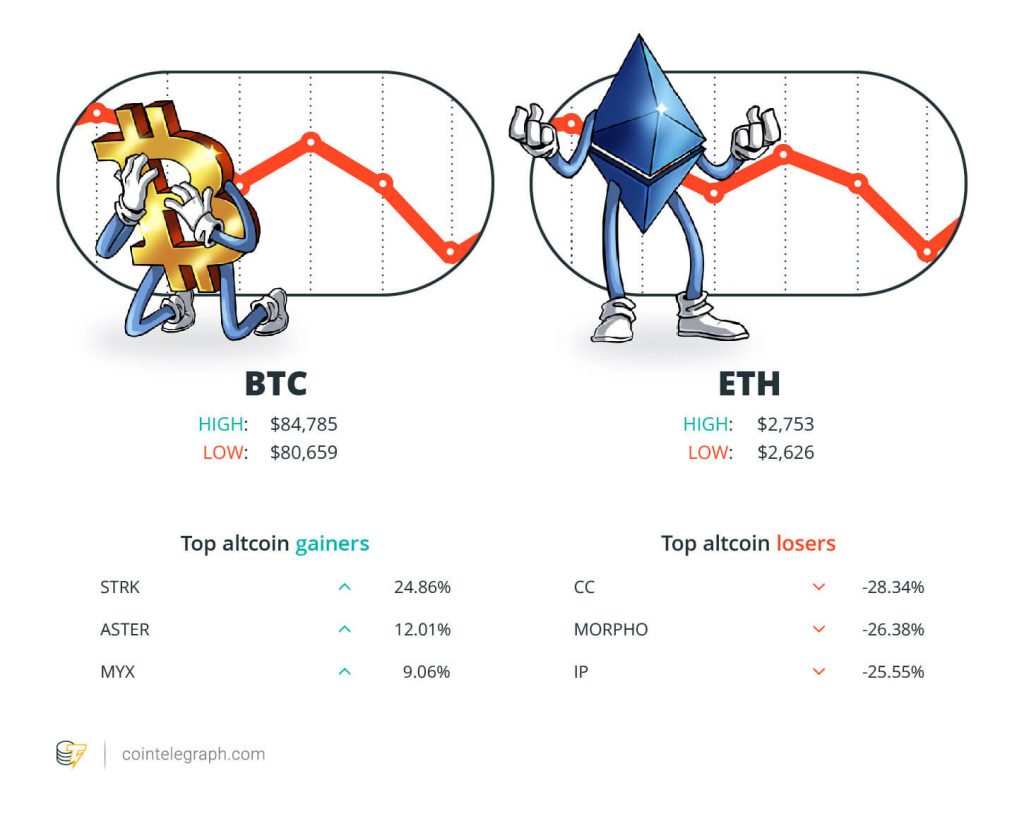

On the finish of the week, Bitcoin (BTC) is at $84,785, Ether (ETH) at $2,753 and XRP at $1.95. The whole market cap is at $2.90 trillion, in response to CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Starknet (STRK) at 24.86%, Aster (ASTER) at 12.01% and MYX Finance (MYX) at 9.06%.

The highest three altcoin losers of the week are Canton (CC) at 28.34%, Morpho (MORPHO) at 26.38% and Story (IP) at 25.55%. For more information on crypto costs, ensure that to learn Cointelegraph’s market evaluation.

High Prediction of The Week

Bitcoin gained’t hit $200K till Q3 2029: Veteran dealer Peter Brandt

Veteran dealer Peter Brandt mentioned he doesn’t see Bitcoin reaching $200,000 earlier than the tip of the yr as some crypto executives have predicted. In reality, he argues it could take almost 4 extra years to get there.

“The following bull market in Bitcoin ought to take us to $200,000 or so. That needs to be in round Q3 2029,” Brandt mentioned in an X publish on Thursday, whereas emphasizing that he’s a “long-term bull on Bitcoin.”

Learn additionally

Options

Crypto as a ‘public good’ within the twenty second century

Options

Powers On… High 5 crypto authorized and regulatory developments of 2021

Brandt’s forecast stands out for a number of causes. Many distinguished Bitcoin advocates, similar to BitMEX co-founder Arthur Hayes and BitMine chair Tom Lee, had anticipated at the very least $200,000 by the tip of this yr. Lee and Hayes even reiterated their confidence within the prediction as lately as October.

Brandt’s projection additionally considerably contrasts with the bullish targets from crypto executives similar to Coinbase CEO Brian Armstrong and ARK Make investments’s Cathie Wooden, who each anticipate $1 million Bitcoin by 2030, only one quarter later than Brandt expects the value to be roughly 5 occasions decrease.

High FUD of The Week

Ex-prosecutor denies promising to not cost FTX government’s companion

Danielle Sassoon, one of many US attorneys behind the prosecution of former FTX CEO Sam “SBF” Bankman-Fried, took the stand in an evidentiary listening to involving a take care of one of many firm’s executives.

In a Thursday listening to within the US District Courtroom for the Southern District of New York, Sassoon testified in regards to the responsible plea of Ryan Salame, the previous co-CEO of FTX Digital Markets, which resulted in his sentencing to greater than seven years in jail.

In keeping with reporting from Internal Metropolis Press, Sassoon mentioned that her workforce would “in all probability not proceed to research [Salame’s] conduct” if he agreed to plead responsible. Additional investigation into the previous FTX government and his then-girlfriend, Michelle Bond, resulted within the latter going through marketing campaign finance costs.

Advocacy teams urge Trump to intervene within the Roman Storm retrial

Greater than 65 cryptocurrency and blockchain firms and advocacy teams have known as on US President Donald Trump to step in as federal prosecutors could also be getting ready to retry Twister Money co-founder and developer Roman Storm.

Learn additionally

Options

Rogue states dodge financial sanctions, however is crypto within the incorrect?

Options

The Turning into of Bitcoin: A Narrative Untainted by Illusions of Fact

In a letter to Trump dated Thursday and shared with Cointelegraph, advocacy organizations together with the Solana Coverage Institute, Blockchain Affiliation and DeFi Schooling Fund, amongst others, made a number of requests relating to crypto-related insurance policies.

The teams requested Trump to direct the IRS and US Treasury to make clear tax coverage on digital belongings, shield DeFi from regulators and encourage regulatory readability by means of monetary regulators just like the Securities and Change Fee and Commodity Futures Buying and selling Fee.

US gained’t begin Bitcoin reserve till different international locations do: Mike Alfred

The US authorities is unlikely to begin accumulating Bitcoin for its strategic reserve till different nations make the primary transfer, says crypto entrepreneur Mike Alfred.

Alfred mentioned in a podcast revealed on Tuesday that the US authorities will begin placing Bitcoin into its reserve created earlier this yr “when there may be sufficient strain externally.”

“As soon as the US authorities acknowledges that others are taking motion earlier than them, that’ll in all probability catalyze extra motion sooner or later,” he mentioned, including that the timeline for the US authorities’s motion is up within the air.

High Journal Tales of The Week

Ethereum’s Fusaka fork defined for dummies: What the hell is PeerDAS?

When you don’t know the distinction between PeerDAS and a precompile, Journal is right here to assist.

Bitcoin whale Metaplanet ‘underwater’ however eyeing extra BTC: Asia Categorical

Metaplanet will increase $135M to purchase extra Bitcoin whereas it’s on sale; round 61% of Singaporean retail traders now maintain crypto.

Musk’s ‘AI in area’ plan, merchandising machine calls in FBI over $2 price: AI Eye

One in 5 Base txs at the moment are generated by AI Brokers, and Anthropic workers preserve scamming their AI merchandising machine.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.

Learn additionally

Hodler’s Digest

An Ethereum blockchain improve, crypto regulatory battles, and Bitcoin worth dialogue: Hodler’s Digest, Aug. 1-7

Editorial Employees

8 min

August 7, 2021

The most effective (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — one week on Cointelegraph in a single hyperlink!

Learn extra

Hodler’s Digest

NY sues crypto corporations, FTX’s Nishad faces 75 years in jail, and Grayscale’s new BTC submitting: Hodler’s Digest, Oct. 15-21

Editorial Employees

7 min

October 21, 2023

Nishad Singh testifies in Sam Bankman-Fried’s trial; New York sues Gemini, Genesis and Digital Foreign money Group; and Grayscale recordsdata for brand spanking new spot Bitcoin ETF.

Learn extra