On this piece we’ll join every day and intraday alerts to grasp whether or not the present stress is simply one other leg in a broader downtrend or the early groundwork for a base.

Abstract

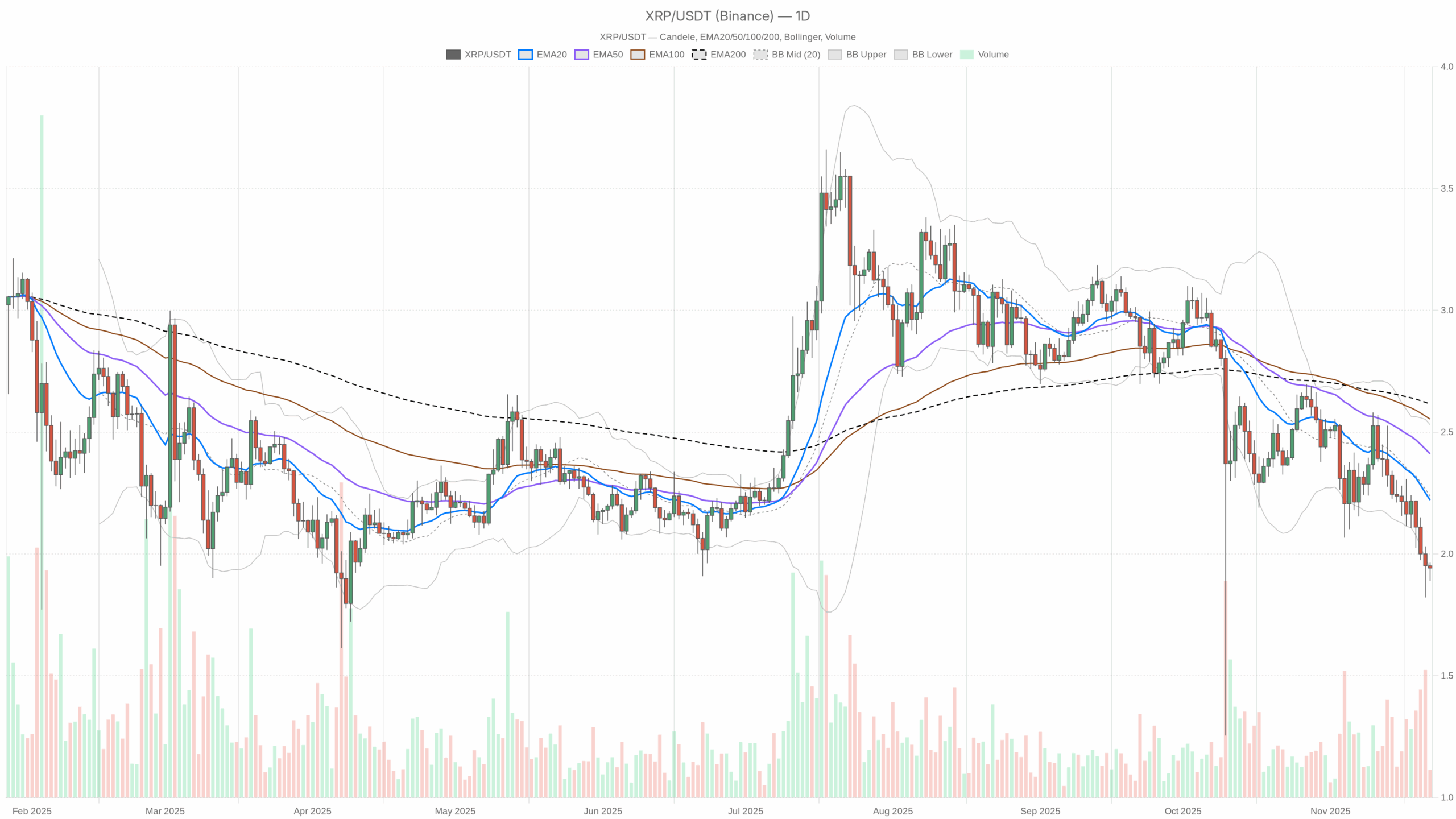

The every day chart factors to a transparent bearish market regime, with the value buying and selling beneath all main shifting averages. Momentum on the upper timeframe stays weak, as every day RSI hovers close to oversold territory and MACD remains to be destructive.

Nevertheless, intraday buildings on the hourly and 15minute charts have shifted towards neutrality, suggesting that quick promoting aggression has cooled. Volatility is contained, and common true vary readings present no disorderly capitulation. In the meantime, the broader crypto market is barely down on the day, and sentiment is dominated by excessive worry. Total, the surroundings favors cautious, tactical buying and selling fairly than aggressive trend-following.

Market Context and Course

The broader market backdrop will not be offering a lot help for threat property. Whole crypto capitalization sits round $2.98 trillion, edging decrease by a modest 0.14% during the last 24 hours. That gentle contraction in worth comes as Bitcoin dominance climbs to about 56.8%, underscoring a basic defensive rotation the place capital shelters within the largest coin fairly than flowing into secondary names. In such phases, underperformers usually wrestle to draw new bids.

Sentiment indicators reinforce this cautious temper. The Concern & Greed Index stands at 11, labeled as Excessive Concern, highlighting that buyers stay extremely risk-averse. That mentioned, excessive worry may also precede medium-term turning factors when promoting turns into exhausted. For now, although, the macro context leans towards preservation of capital, and any rebound is prone to be challenged by a market nonetheless positioned defensively.

Technical Outlook: XRP studying the general setup

On the every day timeframe, the pair closes at 1.94, firmly beneath the 20day EMA at 2.22, the 50day EMA at 2.41, and the 200day EMA at 2.62. This configuration of descending shifting averages alerts a well-established downtrend with no confirmed reversal but. Each rally in the direction of these averages might encounter renewed provide as longer-term holders use energy to exit.

The every day RSI at 31.36 sits simply above the oversold threshold. This stage illustrates momentum exhaustion on the draw back however not a confirmed reversal. It implies that sellers have pressed the market laborious, but there may be nonetheless room for additional weak spot earlier than situations turn out to be excessive sufficient to pressure a pointy short-covering bounce.

Each day MACD stays destructive, with the road at -0.13 versus a sign at -0.10 and a small destructive histogram. This delicate configuration depicts waning however nonetheless bearish momentum: the impulse decrease is dropping depth, although the bears stay in management. Merchants looking forward to a sustainable shift would like to see the MACD line cross above the sign and the histogram flip decisively optimistic, neither of which has occurred but.

Bollinger Bands on the every day chart present the midline round 2.24, the higher band at 2.53, and the decrease band aligning virtually precisely with the present worth at 1.94. Buying and selling on the decrease band displays a draw back grind alongside the volatility boundary, sometimes related to persistent promoting fairly than a single panic occasion. It signifies that the asset is affordable relative to its latest vary, however not essentially {that a} reversal is imminent.

The every day ATR of 0.16 suggests a average volatility regime. Worth swings are significant however not excessive, hinting at managed stress fairly than a disorderly collapse. In apply, this encourages structured methods with clearly outlined threat fairly than anticipating dramatic intraday spikes.

Intraday Perspective and XRP crypto Momentum

In the meantime, intraday charts paint a extra balanced short-term image. On the hourly timeframe, the pair trades close to 1.94, barely above the 20hour EMA at 1.93 however beneath the 50hour and 200hour EMAs at 1.97 and a pair of.12.

This configuration displays a tactical pause inside a broader downtrend: short-term individuals are not aggressively promoting at market, but they haven’t flipped the construction into a real uptrend.

Hourly RSI round 50.68 confirms this neutrality, indicating that intraday momentum has reset with out favoring bulls or bears. MACD on this timeframe is sort of flat, with the road and sign each close to -0.01 and a negligible histogram, implying that short-term momentum is indecisive. Consequently, the following impulse transfer is prone to be guided by reactions round close by ranges fairly than by an entrenched intraday development.

On the 15minute chart, the shut matches the hourly stage at 1.94, whereas the 20and 50period EMAs converge round 1.93 and the 200period EMA sits larger at 1.96. This tight clustering exhibits very short-term consolidation beneath a still-heavy higher-timeframe backdrop. The 15minute RSI at 59.11 tilts barely bullish, and MACD edges marginally optimistic, hinting that scalpers are keen to probe the lengthy aspect, albeit with out sturdy affirmation from the bigger development.

Key Ranges and Market Reactions for XRP

Each day pivot evaluation highlights 1.93 as a central reference space, with an preliminary help area close to 1.90 and the primary resistance band round 1.97. Worth at present hovers simply above that central pivot, suggesting a delicate steadiness between dip-buyers and trend-following sellers.

A agency break beneath 1.90 would affirm that bears stay firmly in cost, probably opening the way in which to a continuation of the downtrend.

Conversely, a sustained push above 1.97, adopted by acceptance again towards the Bollinger midline close to 2.24, could be the primary significant signal that patrons are regaining some management. Nevertheless, every step larger will seemingly meet provide close to the descending EMAs at 2.22, 2.41, and a pair of.62, which construction a large overhead zone the place the major bearish narrative might reassert itself.

Future Eventualities and Funding Outlook for XRP

Total, essentially the most possible state of affairs within the quick to medium time period is a bearish bias with intermittent aid rallies.

Each day development and momentum stay negatively aligned, whereas intraday charts recommend that any bounce is extra prone to be corrective than the beginning of a full-fledged reversal. On this surroundings, tactically minded merchants might look to fade energy towards resistance zones, whereas longer-term individuals may desire to attend for clearer proof of development stabilization, reminiscent of a every day shut again above the 20day EMA and a extra constructive MACD profile.

Threat administration stays essential: volatility is average however persistent, and sentiment throughout the crypto market remains to be gripped by worry. Till the broader surroundings turns extra constructive and key technical ranges are reclaimed, publicity to this pair is greatest approached with endurance, disciplined place sizing, and an consciousness that the dominant development nonetheless factors downward.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding selections.