- Ethereum is consolidating round $2,717, displaying stability regardless of latest volatility.

- A whale purchased 114,684 ETH in 48 hours, elevating holdings to roughly $1.34B—an indication of long-term confidence.

- ETH should break $2,800 quickly to intention for $3,000; failure may ship worth again towards $2,500.

Ethereum has slipped into a type of quiet consolidation phases the place the worth doesn’t transfer a lot, however the market feels prefer it’s holding its breath. ETH is buying and selling round $2,717, barely shifting within the final 24 hours, which regularly occurs proper earlier than momentum flips by hook or by crook. It’s not bullish but—removed from it—however the stability itself is fascinating given all the things occurring behind the scenes.

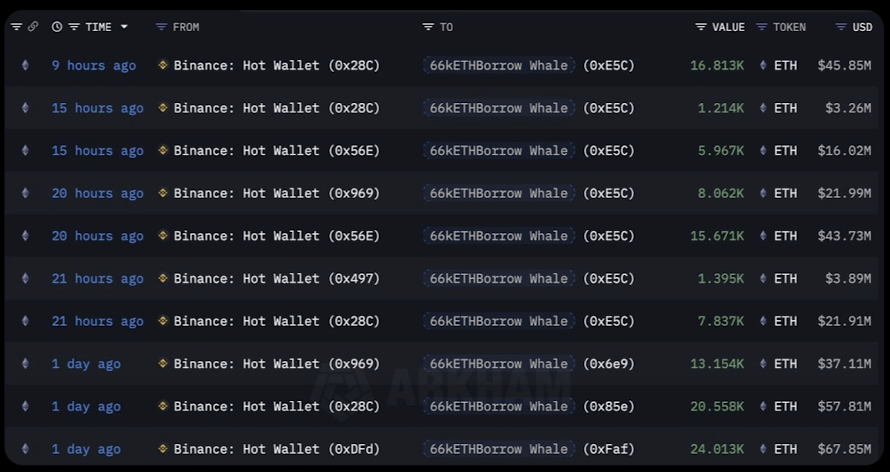

Crypto analyst ToraX highlighted a very huge transfer: a whale scooped up 114,684 ETH in simply 48 hours. That’s roughly $314 million added to their bag, bringing their whole holdings to 489,696 ETH, now valued round $1.34 billion. You don’t spend that sort of cash until you’re pondering long-term. With Ethereum 2.0 upgrades rolling out and DeFi nonetheless anchored to ETH, this type of accumulation feels extra like positioning than hypothesis.

Market stays regular regardless of giant strikes

What’s fascinating is how the worth barely reacted. Even with such an enormous purchase, ETH didn’t spike—it stayed calm. That often alerts cautious optimism: individuals aren’t panicking, however they’re not dashing in both. It may also trace that institutional-style shopping for is occurring quietly, in a means that avoids triggering large volatility.

Whether or not different giant gamers observe stays to be seen, however when a whale accumulates this aggressively into weak point, it tends to catch consideration quick.

Ethereum technicals nonetheless lean bearish

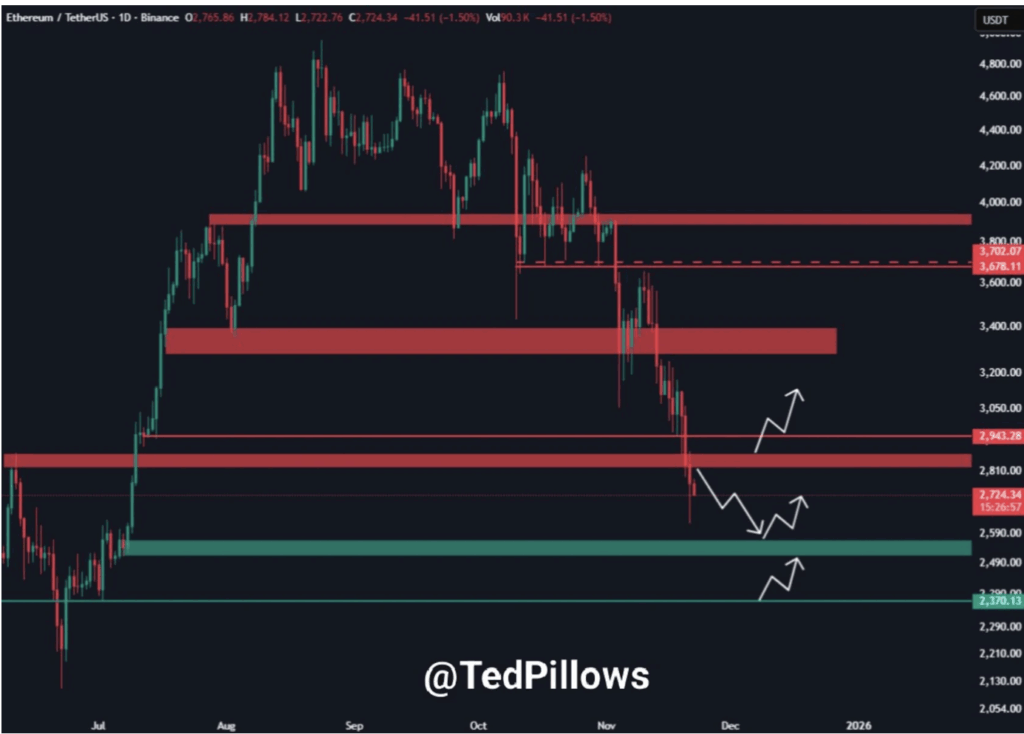

Zooming out to the weekly chart, ETH’s general development nonetheless seems… properly, heavy. The value has fallen far under the 50-week and 100-week shifting averages, although it’s nonetheless holding above the 200-week MA, which is appearing as long-term help. Contemplating ETH got here from a excessive of $3,981, the decline remains to be dominant, and the broader downtrend hasn’t structurally reversed but.

The RSI at 38.65 exhibits bearish momentum however not oversold circumstances — which means a reversal is feasible if sentiment flips. In the meantime, MACD stays bearish, with a deeply detrimental studying at -210.00123. The rising histogram bars reinforce ongoing promoting stress, although this typically seems proper earlier than a development cools off.

Can ETH lastly break $2,800—or is a drop towards $2,500 subsequent?

Yesterday, ETH almost touched $2,600, however resistance kicked in exhausting. Now, all eyes are on the $2,800 resistance degree. A clear break above that zone would shift short-term sentiment and probably open the door towards $3,000—a degree the market hasn’t examined shortly.

However right here’s the opposite aspect of that coin:

If ETH fails to reclaim $2,800, momentum may slide again and push the worth under $2,500, signaling one other leg down. Merchants shall be watching intently to see whether or not help or resistance asserts itself within the subsequent few classes.

This subsequent transfer—up or down—will seemingly outline Ethereum’s short-term trajectory.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.