This week, Bitcoin Money (BCH) abruptly pressured its approach again into the middle of the market dialog after delivering the strongest efficiency amongst all main belongings. This transfer immediately pushed BCH nearer to Cardano’s place within the top-10 rating by CoinMarketCap, turning what was a relic of the crypto market into a possible top-10 contestant pushed by actual capital, not narratives.

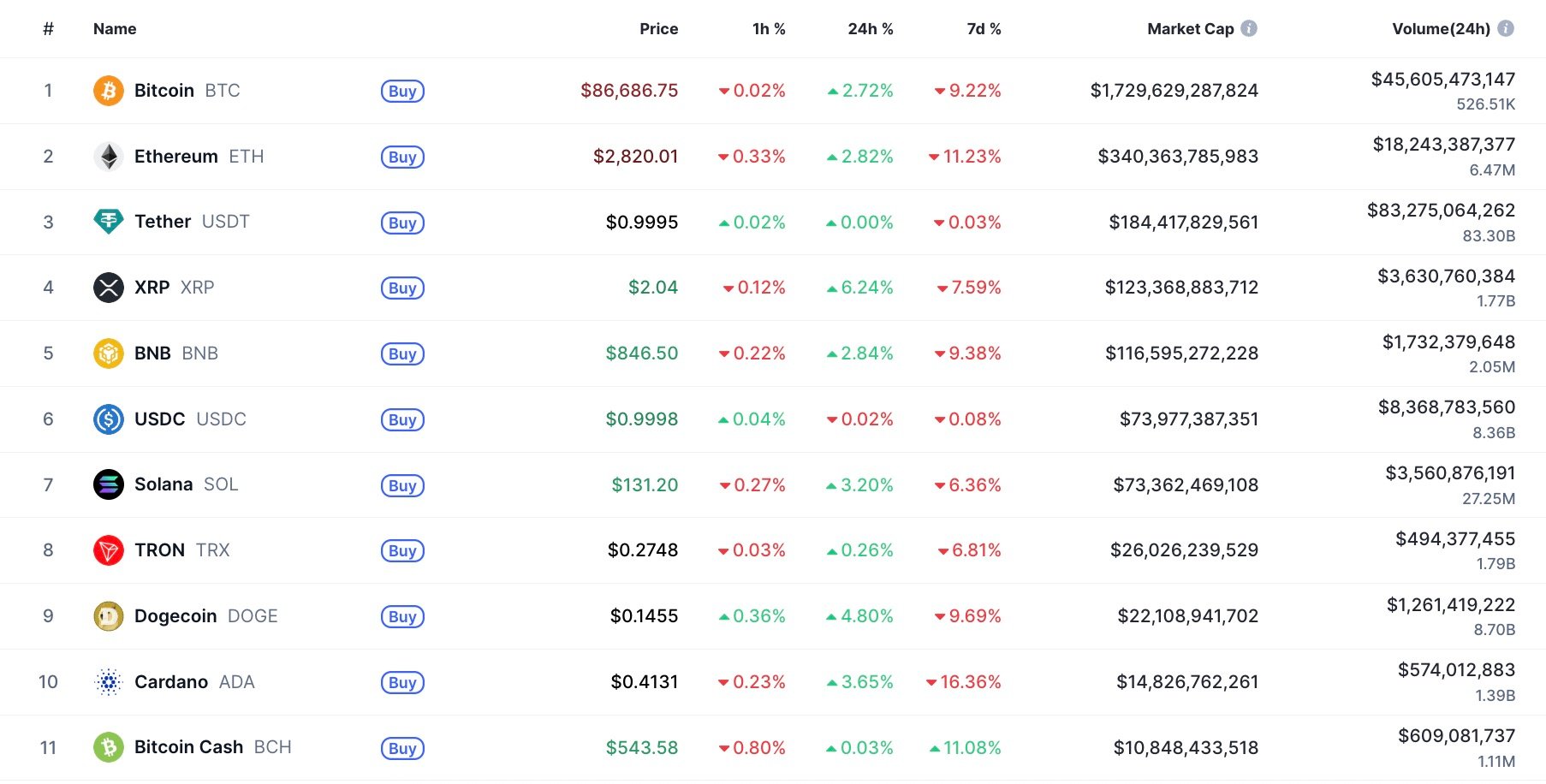

Over the previous seven days, BCH gained over 10%, whereas the remainder of the large-caps spent the week underneath strain. Simply take a look at the distinction: BTC fell 10.54%, ETH misplaced 13.13%, SOL is down 9.14%, DOGE misplaced 13.18%, and ZEC plunged by 19.75%.

Which means Bitcoin Money was not simply the most effective performer, however the one one with a optimistic weekly return. With BCH at $544 and a market cap of $10.8 billion, closing the gap on Cardano’s $14.7 billion, the as soon as unreachable hole has begun to shrink in actual time.

A significant driver behind this transfer is unusually tangible. MFI Worldwide Restricted introduced plans to accumulate $500 million value of Bitcoin Money as a part of its new “digital asset treasury” technique.

$500 million for Bitcoin Money

MFI is a small, Hong Kong-based fintech firm that operates buying and selling infrastructure in China and Southeast Asia. Irrespective of how credible the corporate is, the headline of somebody injecting half a billion into the asset everybody forgot about was sufficient to set off the bulls.

Mixed with the seen surge on the weekly chart, the place BCH skilled one among its greatest upward actions since mid-2024, the result’s a market through which Bitcoin Money is now not thought-about a legacy “dino coin,” however quite one of many few massive caps able to delivering weekly beneficial properties whereas the whole lot else traits downward.

Cardano is now the one defending its place quite than setting the tempo.