Abstract

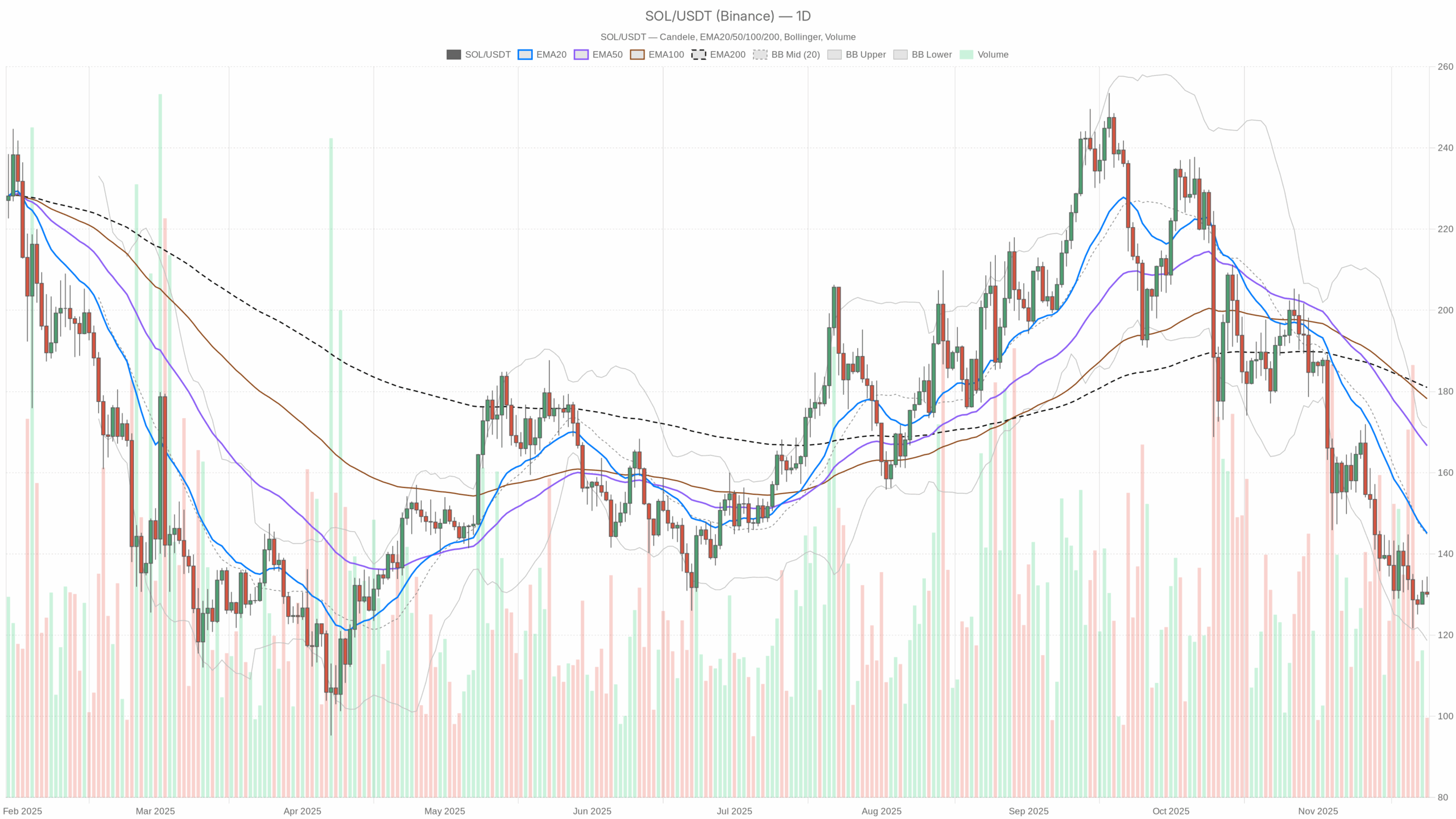

The day by day chart reveals a transparent bearish regime, with value round 130 USDT and buying and selling effectively beneath the 20, 50 and 200-day EMAs. Momentum is weak, because the day by day RSI hovers close to 33, near oversold however not but washed out. Nevertheless, the MACD histogram has virtually flatlined, suggesting draw back momentum is dropping power. Bollinger Bands are huge and value sits within the decrease half, pointing to elevated however decelerating volatility. Furthermore, the broader crypto market is modestly constructive on the day, which contrasts with the token’s underperformance. With the Worry & Greed Index at 19 (Excessive Worry), sentiment is clearly careworn, but that has traditionally paved the way in which for sharp mean-reversion rallies.

Solana crypto forecasting: Market Context and Route

The backdrop for this transfer issues. Whole crypto market capitalization stands close to 3.04 trillion {dollars}, up about 0.6% over the past 24 hours. Which means the broader market is grinding greater at the same time as this asset stays beneath strain, an indication of relative weak point versus the mixture crypto advanced. Bitcoin dominance sits just below 57%, confirming that liquidity and threat urge for food are nonetheless concentrated within the benchmark coin fairly than in altcoins.

Furthermore, the Worry & Greed Index at 19 alerts Excessive Worry. Traditionally, such readings typically coincide with late phases of a selloff, when compelled sellers dominate. That mentioned, excessive concern can persist, so it’s higher seen as a contrarian tailwind fairly than a exact timing device. In distinction to the gloomy sentiment, Solana ecosystem exercise stays vibrant: Raydium, Orca, HumidiFi and different Solana-based DeFi venues are nonetheless producing substantial charge volumes. This mix of fearful costs and resilient utilization hints at an atmosphere the place medium-term accumulation might quietly be constructing, even when the short-term chart seems heavy.

Technical Outlook: studying the general setup

On the day by day timeframe, the token closes close to 130.06 USDT. The 20-day EMA round 145.08, the 50-day close to 166.65 and the 200-day at 181.01 are all clearly above spot and stacked bearishly (quick beneath lengthy). This configuration confirms a well-established draw back pattern the place rallies thus far have been offered fairly than purchased.

The day by day RSI at 32.91 paints an image of weak momentum however not but traditional capitulation. It implies that sellers stay in management, but every further leg decrease supplies diminishing incremental vitality. In the meantime, the MACD line at -13.57 is barely above its sign at -13.62, with a touch constructive histogram of 0.05. That tiny cross hints at momentum exhaustion fairly than contemporary aggressive promoting, in step with a maturing downtrend fairly than its early part.

Bollinger Bands on the day by day chart, centered close to 144.85 with the decrease band round 118.64 and the higher close to 171.07, are nonetheless comparatively huge. Worth is buying and selling nearer to the decrease band, which normally displays strain inside a volatility enlargement following a previous decline. Nevertheless, the truth that candles are not hugging the acute of the band suggests the transfer could also be shifting from acceleration to consolidation. The ATR at 10.86 confirms that greenback swings stay giant; but when ATR stops rising after a robust drop, it typically marks a transition towards a quieter, range-bound atmosphere.

Intraday Perspective and SOLUSDT token Momentum

On the 1-hour chart, the image is much less bearish. Worth round 129.97 USDT sits slightly below the 20-period EMA at 131.34, roughly in step with the 50-period at 130.7, and slightly below the 200-period at 134.91. This clustering of shifting averages, mixed with a impartial regime tag, suggests short-term consolidation after the earlier selloff. In consequence, intraday merchants are seeing a extra balanced tug-of-war between consumers and sellers.

The hourly RSI at 45.25 is impartial, implying that neither facet has a transparent edge over the very quick time period. In the meantime, the hourly MACD line (0.3) is beneath its sign (0.65) and the histogram is modestly unfavourable, pointing to a light draw back bias fairly than a robust push. On the 15-minute chart, RSI dips to about 39.5 and MACD is unfavourable, indicating that quick cash stays barely tilted to the promote facet. Nonetheless, each intraday regimes are labeled impartial, reinforcing the concept that the dominant pattern is on the day by day timeframe, whereas shorter horizons try to stabilize after the autumn.

Key Ranges and Market Reactions

Every day pivot ranges assist body the place the following battle might happen. The primary pivot level on the day by day chart sits round 131.26 USDT, simply above present costs. A sustained restoration above that zone would point out consumers slowly regaining management and may open the door towards the close by resistance space round 133.2. Conversely, failure to reclaim the pivot and a slip again by way of the 128 area, aligned with the primary day by day help, would verify that sellers nonetheless dominate reactions to each bounce.

Bollinger help close to 118.64 marks a essential draw back reference. A decisive break and day by day shut beneath that band would sign a contemporary draw back breakout with renewed volatility, probably triggering cease cascades. On the upside, the 20-day EMA close to 145 USDT is the primary actual structural hurdle; if value had been to reclaim and maintain above that shifting common, it could be the earliest signal that the present bearish regime is giving technique to a extra constructive part.

Future Situations and Funding Outlook

General, the bottom case stays a bearish however ageing downtrend on the day by day chart, set in opposition to a crypto market that’s nonetheless broadly resilient. Excessive concern, weakening draw back momentum on MACD, and impartial intraday buildings all argue for a rising likelihood of a reduction rally within the coming periods. Nevertheless, so long as value trades beneath the 20-day EMA and fails to ascertain greater highs above short-term resistance zones, any bounce ought to be handled as a counter-trend transfer inside a still-fragile construction.

For lively merchants, meaning specializing in response areas: maintaining a tally of how value behaves across the day by day pivot close to 131, the help band down towards 118, and the resistance cluster round 145. For longer-term contributors, the mix of utmost sentiment and strong underlying community exercise means that gradual accumulation with strict threat administration might supply a balanced method, acknowledging each the draw back threat of a deeper correction and the upside potential if the broader market rotation ultimately favors high-beta layer-1 belongings once more.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.