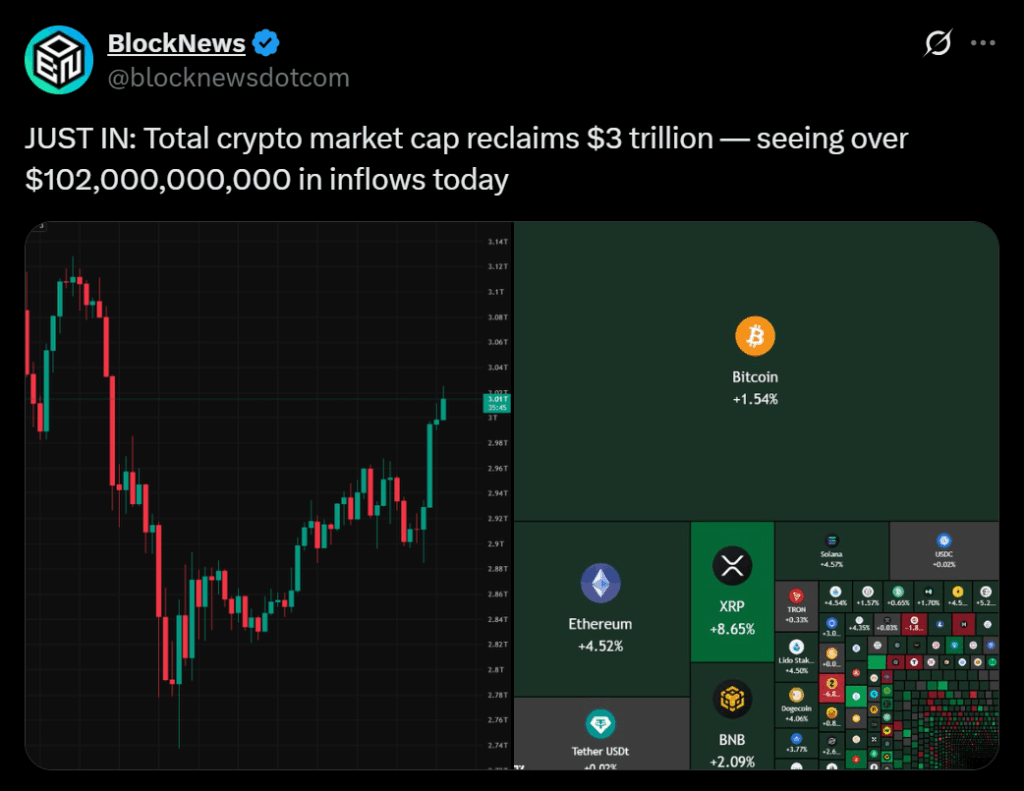

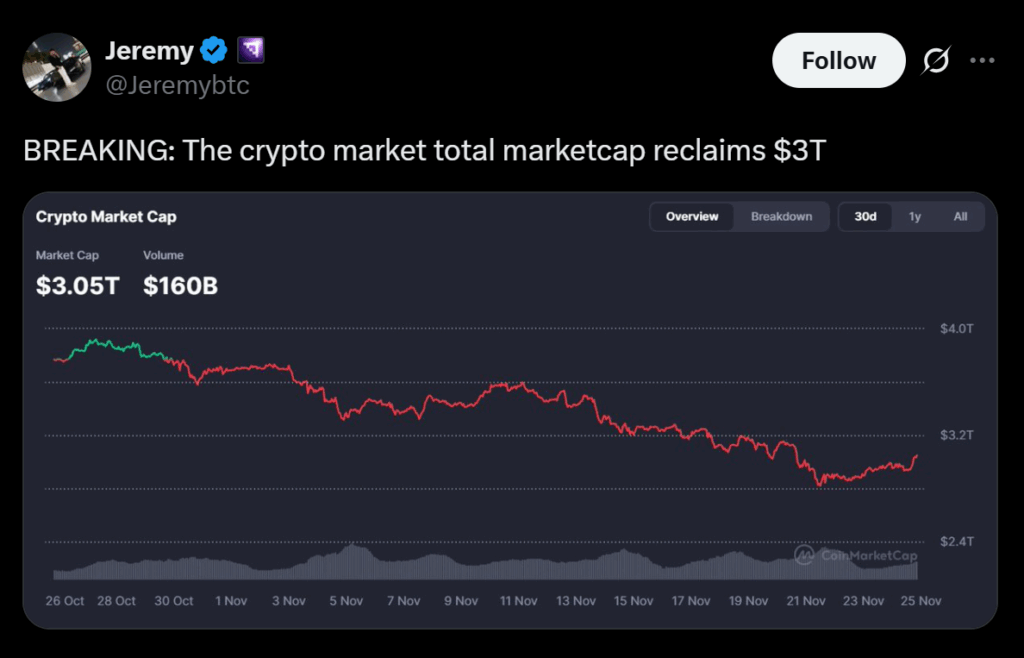

- Crypto market cap jumped again above $3T as $102B flowed in.

- BTC and ETH bounced as U.S. equities stabilized and ETF inflows returned.

- Sentiment remains to be in excessive concern, however recent capital triggered a pointy aid rally.

Crypto markets lastly caught a break at this time, with the entire market cap reclaiming the $3 trillion mark after greater than $102 billion poured again into the ecosystem in just some hours. The sudden shift got here after days of fear-driven promoting, giving merchants a much-needed reset as Bitcoin bounced towards the high-$88K vary and Ethereum lifted off its lows.

Macro Stability Helps Bitcoin Catch a Bid

An enormous a part of at this time’s bounce comes all the way down to conventional markets calming down. Analysts identified that Bitcoin has been shifting in lockstep with U.S. fairness indices, and after a shaky week, these indices lastly stabilized. That alone eased the stress that’s been weighing on BTC since early November.

Even when the broader progress cycle nonetheless seems to be fatigued, the discount in macro stress gave crypto sufficient house to rebound as an alternative of spiraling into one other leg decrease.

ETF Demand Flips Optimistic Once more

The actual spark, although, got here from renewed ETF inflows. U.S. spot Bitcoin ETFs introduced in additional than $238 million on Friday, reversing days of outflows. Ethereum ETFs additionally broke a brutal 10-day drought, pulling in $55 million.

That wave of institutional capital was sufficient to tilt sentiment away from despair and into cautious optimism. Concern stays excessive, however aggressive patrons clearly used the dip as a chance as an alternative of a warning signal.

Why the Market Cap Reclaim Issues

Reclaiming the $3 trillion line isn’t only a spherical quantity—it’s a psychological shift. It alerts that enormous gamers are nonetheless current, nonetheless accumulating, and nonetheless keen to purchase when liquidity dries up. At this time’s rally reveals that regardless of the current carnage, there’s actual demand ready slightly below the floor.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.