On-chain knowledge reveals the Bitcoin Market Worth to Realized Worth (MVRV) Z-Rating has declined to the bottom ranges because the value was at $35,000.

Bitcoin MVRV Z-Rating Has Plummeted Lately

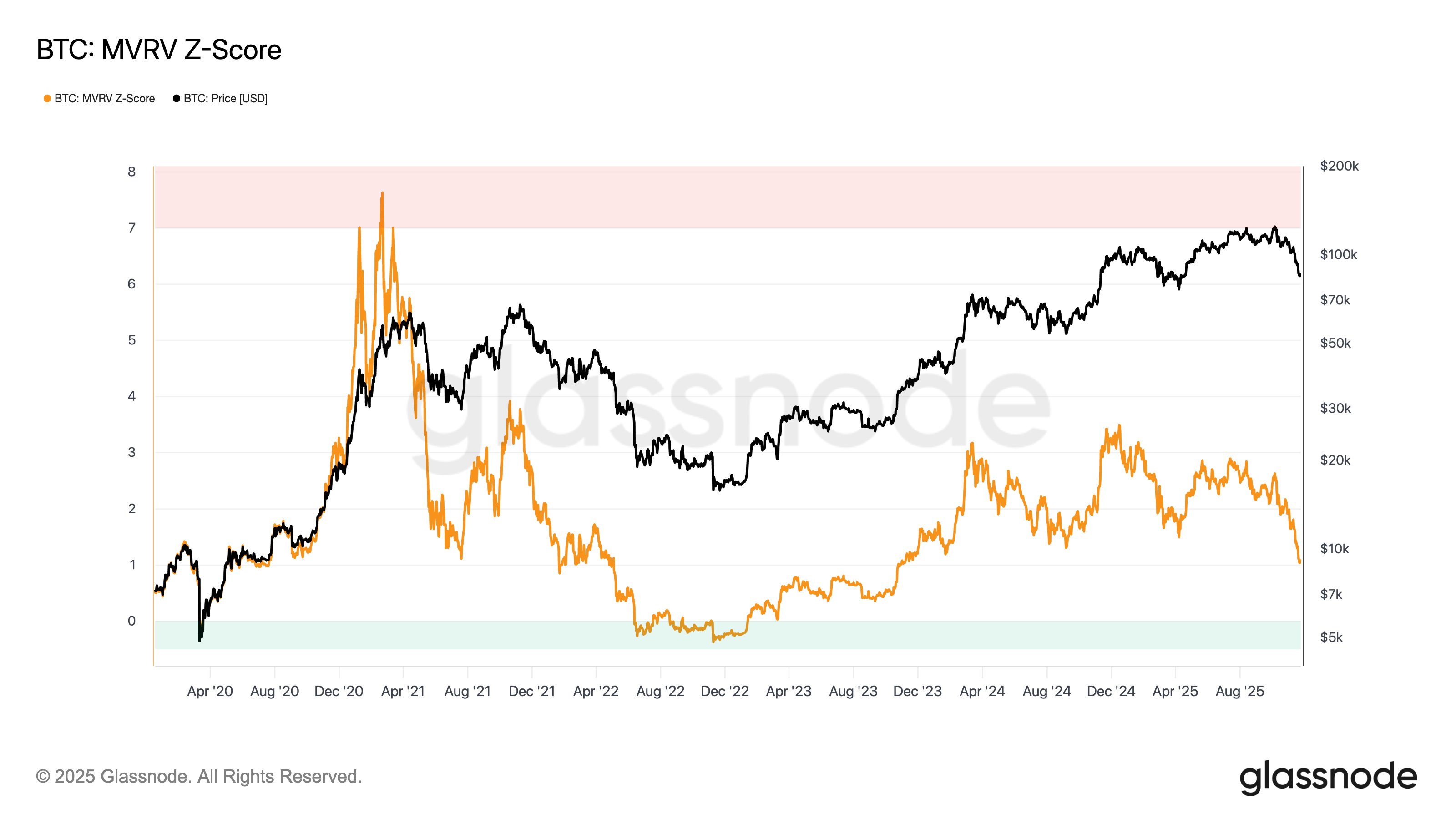

In a brand new put up on X, Glassnode analyst Chris Beamish has mentioned in regards to the newest pattern within the Bitcoin MVRV Z-Rating. This on-chain indicator calculates the distinction between the market cap of BTC and its Realized Cap, and takes its ratio with the usual deviation of the market cap.

The Realized Cap right here refers to a capitalization mannequin for the asset that calculates its whole worth by assuming the ‘actual’ worth of every coin in circulation is the same as the worth at which it was final transacted on the blockchain.

In brief, what this metric represents is the quantity of capital that the traders as an entire have put into the cryptocurrency. In distinction, the market cap is the worth that they’re carrying within the current.

Because the Bitcoin MVRV Z-score compares the market cap with the Realized Cap, it primarily tells us whether or not the general community is in a state of revenue or loss.

Now, right here is the chart shared by Beamish that reveals the pattern within the Bitcoin MVRV Z-Rating over the previous couple of years:

The worth of the metric seems to have been heading down in latest weeks | Supply: @ChrisBeamish_ on X

As is seen within the above graph, the Bitcoin MVRV Z-Rating has gone via a decline just lately. This drop in investor profitability is a results of the bearish trajectory that the cryptocurrency’s value has adopted.

The metric remains to be a notable distance above the zero mark, which suggests the market cap continues to be higher than the Realized Cap. In different phrases, the traders are nonetheless in a state of internet unrealized revenue.

The diploma of the holder acquire, nonetheless, is low when in comparison with the profitability stage of the final couple of years. In reality, the present MVRV Z-Rating is at an identical stage to when Bitcoin was buying and selling across the $35,000 stage.

Traditionally, a cooldown in investor profitability has facilitated backside formations for the cryptocurrency. Normally, nonetheless, main bearish phases have solely reached their lows when the community has outright gone underwater.

At the moment, Bitcoin nonetheless has some methods to go earlier than this could occur. Although, it’s doable that the present stage is sufficient for the asset to succeed in a backside, because it has already executed a number of occasions over this cycle.

Similar to how a low worth on the MVRV Z-Rating can result in a backside, a excessive one can lead to a prime as a substitute as profit-taking explodes. From the chart, it’s obvious that the metric reached an excessive stage through the bull run within the first half of 2021.

Thus far within the present cycle, no peak within the indicator has been of an identical scale; the tops this time round have fashioned at a comparable profitability stage to the second-half 2021 bull run.

BTC Value

Bitcoin has rebounded since its low under $81,000 on Friday as its value has now climbed again to $88,600.

The pattern within the value of the coin over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.