- Analysts argue centralized exchanges have gotten “common at all the pieces,” whereas small groups on Solana construct targeted on-chain instruments for buying and selling, transfers, and capital entry that might ultimately really feel smoother than CEXs.

- Vibhu suggests Solana itself might act as a long-term “alternate layer,” with banks and fintechs like SoFi funneling customers straight into SPL-USDC and wallets like Meridian or Solflare as an alternative of basic alternate dashboards.

- Rising Bitcoin outflows from exchanges and rising curiosity in self-custody help the shift towards on-chain methods, although some nonetheless imagine easy, acquainted alternate UIs will hold CEXs related for mainstream retail customers.

Solana information stirred up an entire new debate this week after contemporary feedback instructed that centralized crypto exchanges might slowly fade over the following decade. The concept isn’t brand-new, however the best way analysts framed it this time—mixing retail habits, Bitcoin liquidity shifts, and the rise of onchain instruments—set off a deeper dialog than common.

Exchanges Underneath Stress as Onchain Groups Construct Quicker, Less complicated Instruments

The dialog kicked off when analyst Vibhu argued that exchanges right now attempt to do all the pieces however don’t actually excel at any single piece. He described them as platforms that bundle each a part of the buying and selling stack—funding, swaps, interfaces, custody—however ship one thing simply “okay” throughout the board.

In the meantime, a lot smaller groups are constructing hyper-focused onchain instruments that concentrate on just one factor: buying and selling, capital motion, or simplified transfers.

As a result of these groups commit to at least one function as an alternative of ten, Vibhu says they transfer sooner, innovate faster, and produce cleaner consumer experiences. As soon as these instruments mature, he believes customers will naturally piece them collectively, getting a smoother stream than what exchanges present right now.

One chart he posted summarized the concept bluntly: exchanges are mainly stitched-together middlemen, and the following era doesn’t want them as a lot.

Nonetheless, one other analyst pushed again, arguing retail customers merely choose one thing acquainted. “Individuals like easy UIs,” he mentioned. Even when onchain instruments are technically higher, he believes exchanges will all the time function the place to begin for inexperienced persons and informal customers. And exchanges can nonetheless listing new onchain merchandise, retaining them helpful relatively than out of date.

Solana Positioned as a Lengthy-Time period “Change Layer”

Vibhu took it a step additional and pointed at Solana itself as a future exchange-like base layer.

Due to its velocity and near-zero charges, he mentioned Solana might ultimately exchange the necessity for a full centralized alternate. He defined {that a} consumer might transfer cash from Money App, Revolut, SoFi, and even Constancy straight into SPL-USDC. From there, customers can ship it into any Solana pockets and begin buying and selling or exploring DeFi with out ever touching a conventional alternate.

Apps like Meridian and Solflare already help the sort of direct stream, making the method really feel “extra regular” even for inexperienced persons.

He emphasised that banks nonetheless matter on this shift. Most individuals belief their checking account greater than any crypto platform. If a recognized financial institution—he used SoFi for example—lets individuals plug instantly into Solana markets, then the chain itself begins behaving just like the alternate layer.

That concept suggests a future the place exchanges aren’t central hubs. As a substitute, the chain turns into the “dwelling base,” and easy fiat bridges do the onboarding.

Bitcoin Outflows Add One other Layer to the Debate

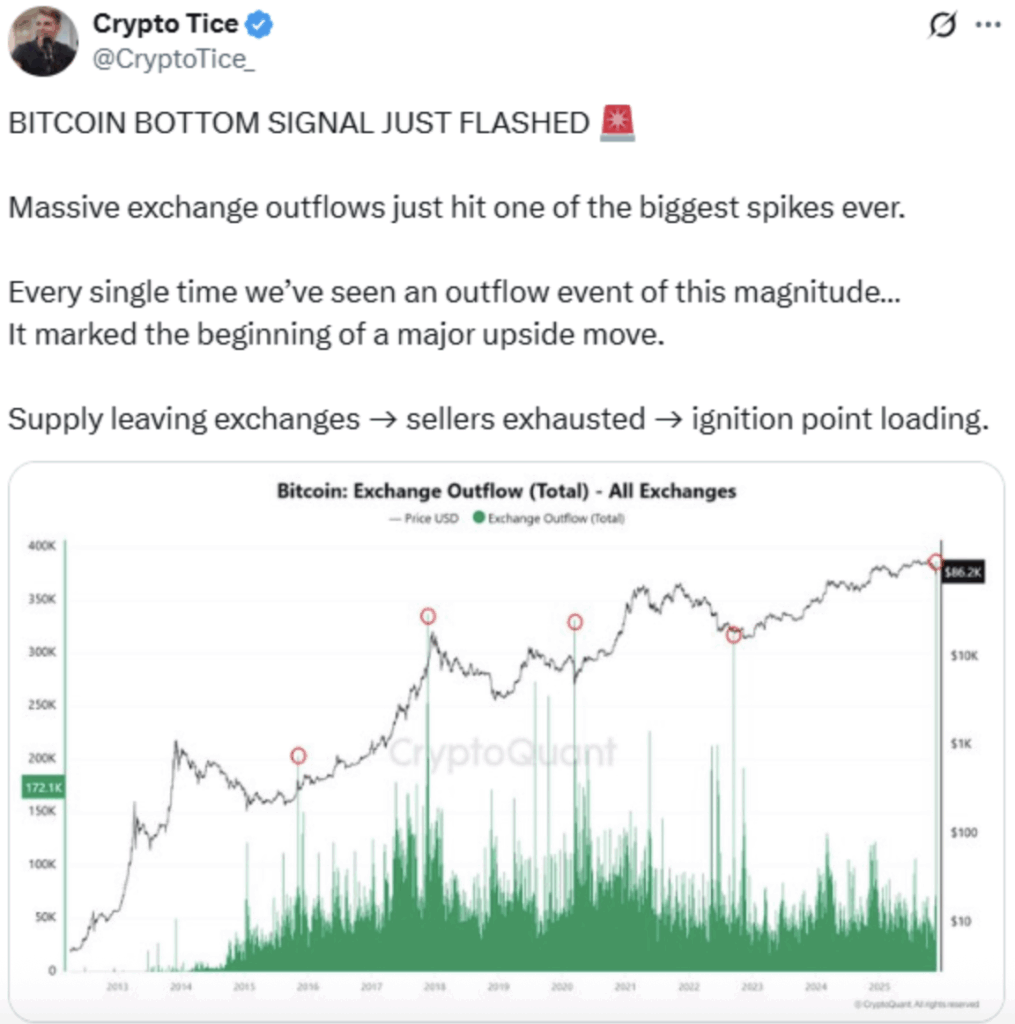

Solana information additionally related to a different large development available in the market: heavy Bitcoin outflows from exchanges. Analyst Crypto Tice highlighted a chart displaying massive BTC leaving buying and selling platforms. Traditionally, related outflows appeared close to bottoms or early uptrends.

The logic is easy: cash that depart exchanges are often not on the market. Much less provide = much less promoting strain.

And if massive holders hold migrating towards self-custody and onchain instruments, it reinforces the argument that alternate dependence is shrinking, not rising.

Some imagine that is precisely why ecosystems like Solana will thrive—quick blockchains that really feel like “internet-native exchanges.”

Others argue that regardless of how sturdy onchain instruments turn out to be, most customers will nonetheless return to centralized platforms as a result of they’re acquainted, regulated, and don’t require individuals to handle their very own keys.

Both means, the following decade is clearly shaping as much as be a tug-of-war between onchain autonomy and conventional comfort. And proper now, Solana sits proper in the midst of that dialog.

The publish Solana On-Chain vs Centralized Exchanges — Right here Is Why the Subsequent 10 Years May Look Very Totally different first appeared on BlockNews.