Be part of Our Telegram channel to remain updated on breaking information protection

Wall Road banking big JPMorgan Chase abruptly closed financial institution accounts belonging to Strike CEO Jack Mallers in September, triggering déjà vu over the crypto debanking period.

“J.P. Morgan Chase threw me out of the financial institution,” Mallers mentioned in a Nov. 23 put up on X. “Each time I requested them why, they mentioned the identical factor: ‘We aren’t allowed to let you know.”’

He added that his dad “has been a personal consumer there for 30+ years.”

JPMorgan Says It Recognized “Regarding Exercise”

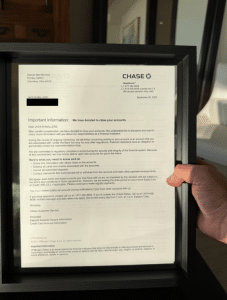

Mallers acquired a letter from the financial institution on Sept. 2 that mentioned ”through the course of ongoing monitoring we recognized regarding exercise in your account.”

It added that underneath the Financial institution Secrecy Act and different rules it has an obligation to periodically assessment its buyer relationships and mentioned it’s dedicated to ”regulatory compliance and making certain the safety and integrity of the monetary system.”

Letter Mallers acquired from JPMorgan Chase (Supply: X)

Mallers mentioned that he has since framed the letter and is now banking together with his personal Strike, which is primarily a digital funds app that makes use of the Bitcoin Lightning Community for quick, low-cost transactions.

Crypto Business ‘Debanking’ Unlikely Below Trump

The banking business has a historical past of proscribing entry to financial institution accounts for crypto companies, particularly within the US.

In the course of the Obama administration, the US Division of Justice (DoJ) launched an initiative known as Operation Chokepoint, which discouraged banks from doing enterprise with industries which might be deemed high-risk.

In the course of the more moderen Biden administration, the digital asset business confronted ongoing points with monetary establishments, who have been being pressured by federal banking regulators to disclaim companies to crypto firms and executives.

However US President Donald Trump has opted to embrace crypto, and is actively engaged on addressing the Operation Chokepoint initiatives from earlier administrations.

Following Mallers’ put up, Bo Hines, who beforehand headed Trump’s Council of Advisers on Digital Belongings and now serves as a strategic advisor for Tether, requested Chase if ”you guys know Operation Choke Level is over.”

Hey @Chase… you guys know Operation Choke Level is over, proper? Simply checking. https://t.co/W6yVnoCbXk

— Bo Hines (@BoHines) November 24, 2025

In August, Trump signed an govt order titled “Guaranteeing Honest Banking For All People.”

Its intention is to fight the apply of “politicized or illegal debanking,” and duties federal banking regulators with reviewing banks’ previous or present insurance policies and practices that will have required, inspired, or influenced “debanking.”

If any such insurance policies are discovered, remedial motion together with fines, consent decrees, or different disciplinary measures could be taken in opposition to the establishments concerned.

Trump and his household have mentioned that they have been “debanked” by monetary establishments for political causes. Eric Trump, one of many President’s sons, mentioned that “a few of the largest banks on the earth” canceled accounts for him and his members of the family on the finish of Trump’s first time period, which drove them to embrace crypto.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection