- Cardano’s full governance decentralization and new cross-chain partnerships are reshaping long-term investor expectations.

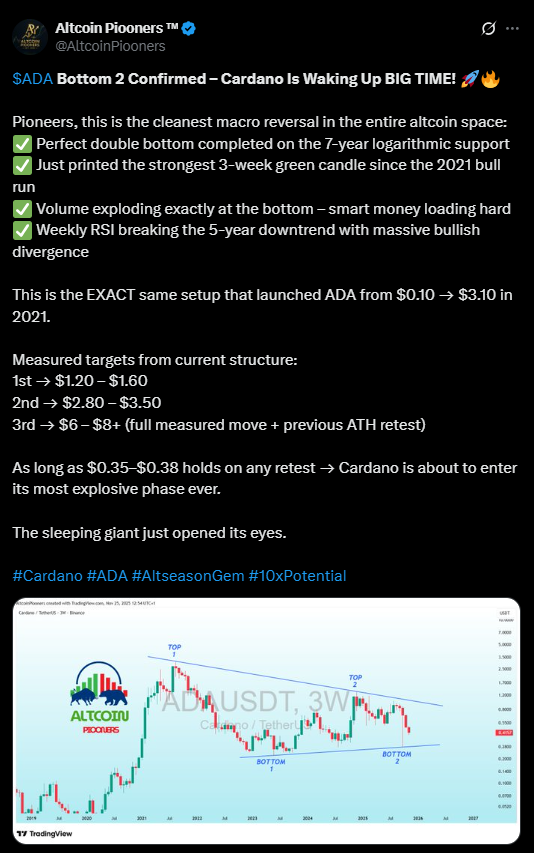

- Technical patterns present a falling wedge that might set off a significant breakout if key ranges are reclaimed.

- Lengthy-term projections stretch into multi-dollar territory, although conservative fashions nonetheless preserve ADA beneath $1.20 into 2026.

The third quarter of 2025 is beginning to really feel like a quiet reset for Cardano, even when the worth chart doesn’t present it but. After sliding sharply from the December 2024 peak of $1.32, the community lastly accomplished considered one of its most essential milestones: the Plomin laborious fork. Rolled out within the first quarter of the yr, this improve pushed Cardano into full community-driven governance, one thing that the challenge has been highlighting for years. It’s a structural shift that places ADA firmly within the class of third-generation blockchains aiming for full decentralization.

New Partnerships Develop ADA’s Utility

Past governance, Cardano’s ecosystem is widening sooner than anticipated. EMURGO finalized a significant partnership with Ctrl Pockets in early July, opening interoperability with greater than 2,300 blockchains. It’s a giant deal as a result of it provides ADA a clearer path into cross-chain exercise, a sector dominated by initiatives like Polkadot and Ethereum. Institutional curiosity is rising too. Grayscale allotted 20 p.c of considered one of its crypto funds to ADA, and Bloomberg Intelligence not too long ago raised the percentages of a spot ADA ETF approval. Nothing is assured there but, however the momentum issues. In the meantime, the gradual rollout of the Midnight privateness sidechain and new Bitcoin-linked DeFi instruments carry recent performance to a community that’s usually criticized for gradual improvement.

Technical Correction Setting Up a Potential Breakout

On the weekly chart, ADA has been forming a falling wedge since January 2025, a sample recognized for producing robust upside reversals. Value is now testing the $0.40 zone after dropping under the psychological $0.50 stage in November. Analysts see a stronger demand space between $0.27 and $0.30, and a retest later in 2025 might kind the bottom of a bigger breakout. If ADA manages to shut above $1.10 on the month-to-month chart, the technical projection factors towards a transfer towards $2.20 someday within the first half of 2026. AI fashions collected in October present ADA drifting between $0.65 and $1.50, with a median round $1.00. Quick-term sentiment continues to be bearish, however oversold weekly indicators and rising accumulation round $0.35 to $0.45 trace on the early phases of a bottoming course of.

Lengthy-Time period Path Via 2030 and Past

Looking to 2026–2030, long-term fashions paint a steadily bullish panorama. Value targets climb to $3.25 in 2026, $5 in 2027, and probably $10.25 by 2030. Hitting that will put ADA above a $360 billion market cap, pushing it into the highest three cryptocurrencies. This situation assumes vital institutional adoption, a wholesome international bull cycle, and main DeFi progress contained in the Cardano ecosystem. Extra excessive forecasts stretch into the $69 vary by 2040 and even $329 by 2050, however these numbers drift closely into speculative territory. By comparability, Changelly, CoinCodex, and Binance provide rather more conservative expectations, holding ADA between $0.79 and $1.18 via 2025–2030 as macro stress and competitors from different layer-1s stay severe elements.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.