Abstract

The BTCUSDT pair is buying and selling round 86,566 {dollars}, nicely beneath its current shifting common cluster, confirming a dominant bearish regime on the each day chart. Momentum indicators present oversold or near-oversold circumstances, hinting that the aggressive leg of the selloff could also be dropping drive. Volatility stays elevated, but not chaotic, with the each day ATR above 4,400 {dollars}, framing huge however tradable ranges. Furthermore, sentiment throughout the broader crypto market is fragile, as highlighted by an Excessive Concern studying on the Concern & Greed Index. Even so, general crypto capitalization is marginally constructive on the day, suggesting selective dip-buying moderately than full-scale capitulation. Consequently, the market is oscillating between pressured liquidations from late bulls and cautious accumulation from longer-term members.

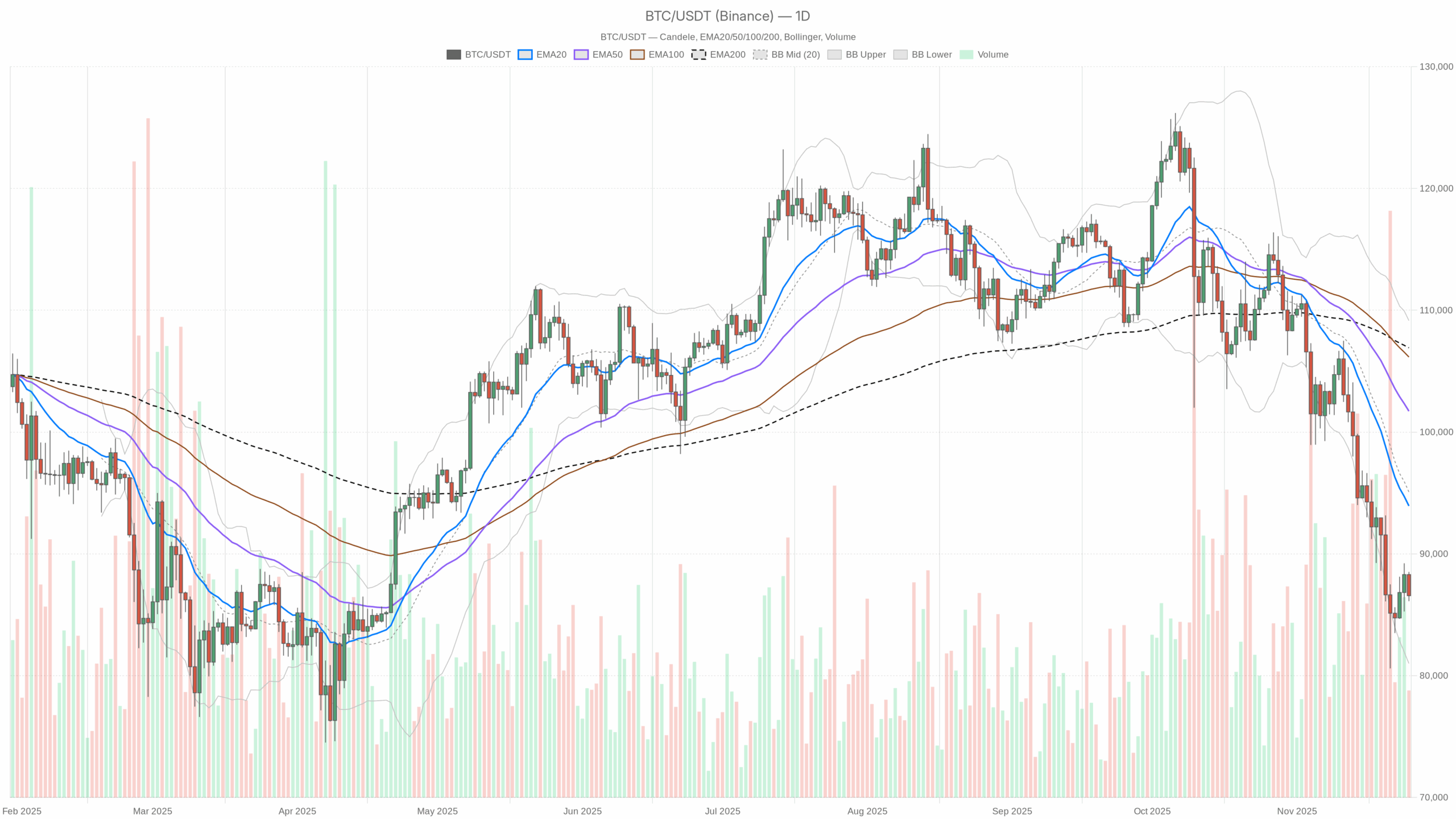

Bitcoin usd: Market Context and Path

On a macro degree, the asset trades inside a corrective downswing after an prolonged bull cycle, and the each day regime is explicitly flagged as bearish. With value close to 86,500 {dollars}, it’s sitting beneath the 20, 50 and 200-day exponential shifting averages, which all cluster between roughly 94,000 and 107,000 {dollars}. This means that medium and long-term members stay below water on current entries and that rallies are more likely to meet provide from trapped consumers.

Furthermore, Bitcoin’s dominance stands at about 56.5% of whole crypto market worth, underscoring that regardless of the drawdown, capital remains to be gravitating towards the benchmark moderately than rotating decisively into altcoins. That mentioned, the whole crypto market cap is barely increased on the day, up roughly 0.35%, which strains up with information that some merchants see indicators of the selloff easing because the token steadies. In the meantime, the Concern & Greed Index at 20, labeled Excessive Concern, confirms that the prevailing temper is defensive. Traditionally, such sentiment clusters usually coincide with late levels of a down leg, however they will persist if macro threat aversion stays excessive.

Technical Outlook: studying the general setup

The each day exponential shifting averages paint a transparent image of a market below strain. Value at 86,566 {dollars} is beneath the 20-day EMA close to 93,938, the 50-day close to 101,718 and the 200-day round 106,920. This downward stacking of EMAs alerts pattern affirmation to the draw back and reveals that sellers have managed the tape for weeks. Any bounce towards the bottom of those averages would successfully be a check of overhead provide, moderately than an instantaneous pattern reversal.

The RSI at 30.38 on the each day chart is hovering simply above traditional oversold territory. This means momentum exhaustion on the draw back, the place the tempo of promoting has stretched value away from equilibrium. Whereas such readings can precede short-covering rallies, they don’t assure an instantaneous flooring; as an alternative, they spotlight that draw back threat and rebound potential have gotten extra balanced.

MACD provides nuance to this image. The each day MACD line sits round -5,675, beneath its sign line close to -5,177, and the histogram stays barely damaging at about -498. This configuration reveals that bearish momentum remains to be current however not accelerating. In different phrases, the indicator factors to a weakening draw back impulse, in step with information that the selloff could be easing moderately than freshly intensifying.

The Bollinger Bands on the each day timeframe have their midline round 95,076 {dollars}, with the higher band close to 109,151 and the decrease band near 81,002. Value now trades only some thousand {dollars} above the decrease band, implying that the current transfer has been a volatility growth to the draw back. When candles hug the decrease band after which begin to drift sideways, it usually foreshadows consolidation or a aid bounce, particularly when aligned with an RSI close to 30.

Day by day ATR at about 4,432 {dollars} confirms that realized volatility stays excessive. For merchants, this interprets into huge intraday swings, the place threat administration and place sizing grow to be essential. Excessive ATR in a falling market may mark late-stage capitulation, as pressured sellers drive outsized strikes earlier than circumstances normalize.

Intraday Perspective and BTCUSDT token Momentum

On the hourly chart, the image is much less one-sided than on the each day. Value round 86,588 {dollars} sits barely beneath the 20 and 50-hour EMAs close to 87,390 and 87,191, and likewise beneath the 200-hour EMA round 88,941. The regime right here is described as impartial moderately than bearish, suggesting short-term consolidation after the sharp decline. In the meantime, the hourly RSI at 39.78 displays mildly damaging however not excessive momentum, which regularly accompanies range-building phases.

MACD on H1 reveals the road at -122 versus a constructive sign line close to 52, producing a damaging histogram round -175. This configuration factors to lingering downward bias, but the magnitude is small relative to the each day readings, reinforcing the concept of intraday digestion moderately than contemporary breakdown. The hourly Bollinger Bands, with a midline close to 87,757 and a decrease band round 86,438, are beginning to comprise value inside a tighter hall, hinting at volatility compression after the sooner spike.

Zooming into the 15-minute chart, the token trades slightly below its brief EMAs as nicely, with a impartial regime and an RSI close to 35. This reveals that very short-term merchants are nonetheless leaning barely bearish, however there is no such thing as a signal of panic. Consequently, decrease timeframes seem like stabilizing, even because the broader each day construction stays clearly tilted to the draw back.

Key Ranges and Market Reactions

On the each day pivot framework, the central pivot sits close to 87,067 {dollars}, solely modestly above present spot. Holding beneath this reference retains the fast bias comfortable, whereas any sustained transfer again above it might sign that consumers are regaining some short-term management. The primary resistance space emerges round 88,019 {dollars}, the place earlier intraday rallies stalled. If value manages to push by way of this area on robust quantity, it may set off a short-covering breakout towards the decrease 90,000s, the place the 20-day EMA waits as a extra critical check.

On the draw back, the primary notable help from the each day pivot set lies close to 85,615 {dollars}. A clear break and each day shut below this band would warn that sellers stay firmly in cost and that the market might retest the decrease Bollinger Band close to 81,000 {dollars}. Nonetheless, if dips into that help are repeatedly purchased and candles begin to print increased lows, it might strengthen the case {that a} baselining course of is underway after the current slide.

Future Situations and Funding Outlook

Total, the primary state of affairs stays bearish on the each day timeframe, with value entrenched beneath all main shifting averages and momentum nonetheless damaging, albeit much less aggressive than earlier than. Quick-term charts, nevertheless, are hinting at stabilization, with impartial regimes and compressing volatility suggesting that an interim flooring could also be forming. Energetic merchants might search for affirmation by way of breaks above intraday resistance and enhancing RSI to play tactical bounces, all the time aware of the still-dominant downtrend.

Longer-term traders, against this, may interpret Excessive Concern readings and stretched technicals as an early accumulation sign, however persistence is important. Ready for the asset to reclaim a minimum of the 20-day EMA or to construct a transparent increased low on the each day chart would provide stronger proof that the worst of the correction is over. Till these alerts emerge, this market doubtless oscillates between swift draw back probes and sharp however fragile rebounds, demanding disciplined threat management from all members.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.