The founding father of Capriole Investments says he “can’t be bearish” on Bitcoin, pointing to key indicators that stay inside inexperienced territories.

Bitcoin Heater & NVT Are Each Inside Bullish Zones

In a brand new put up on X, Capriole Investments founder Charles Edwards has shared a few indicators associated to Bitcoin that might paint an image totally different than what the gang is pondering proper now.

Associated Studying

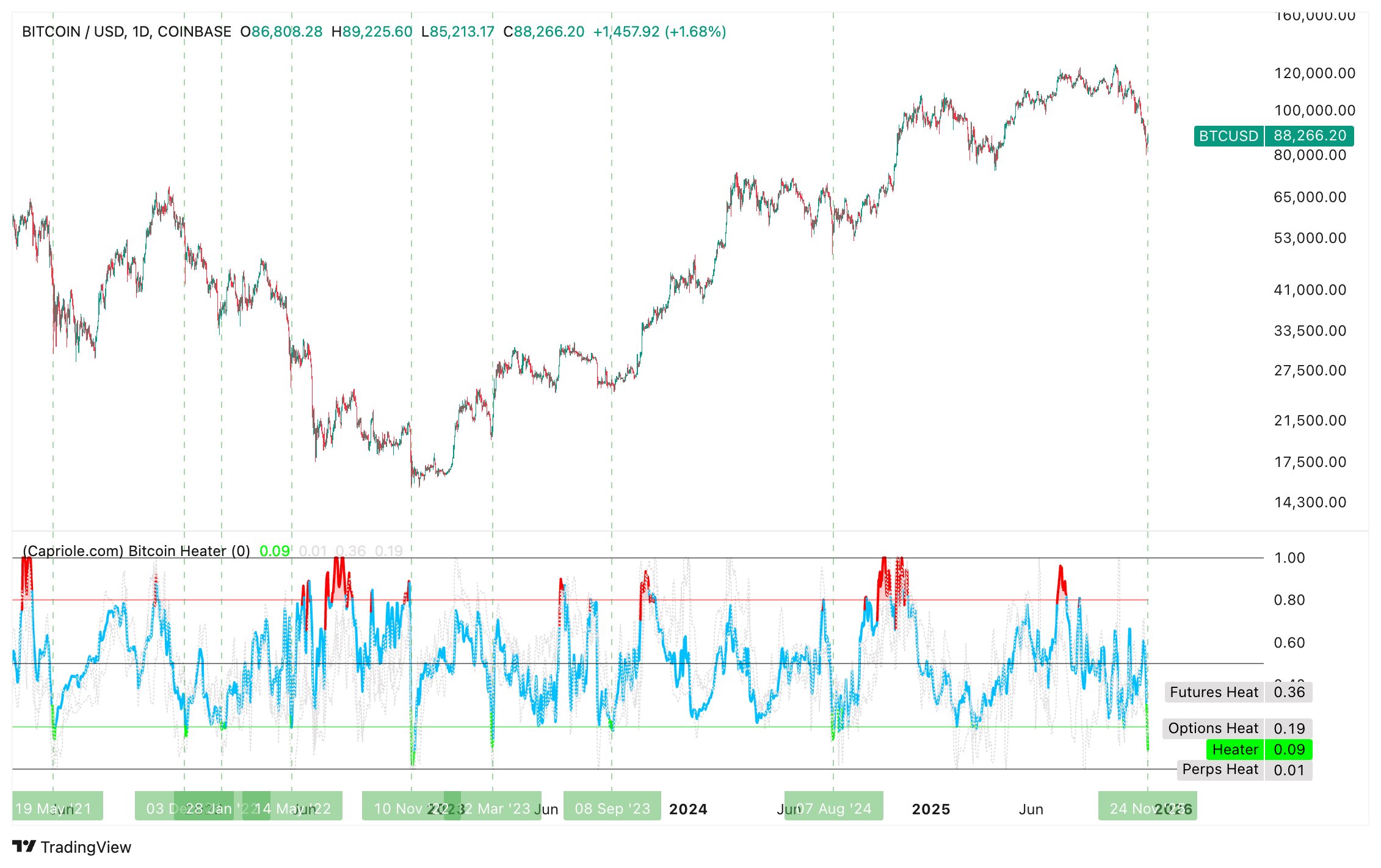

The primary indicator is Capriole’s “Heater,” gauging the scenario associated to the derivatives market. The metric tracks the information related to your complete sector, together with perpetual swaps, futures, and choices markets.

When this indicator has a excessive worth, it’s an indication that buyers are utilizing excessive leverage and have an excessive stage of bullish positioning throughout the assorted derivatives markets.

Now, right here is the chart for the metric shared by Edwards that reveals the pattern in its worth over the previous few years:

As is seen within the above graph, the Heater has witnessed a plunge lately because the Bitcoin value has crashed, indicating a cooldown in sentiment on the totally different derivatives markets.

The metric is now contained in the inexperienced zone, which has traditionally facilitated a minimum of native backside formations for the cryptocurrency. The identical sign additionally emerged alongside the bear market backside again in November 2022.

The opposite indicator that’s bullish on Bitcoin proper now’s the Dynamic Vary NVT. The Community Worth to Transactions (NVT) Ratio is a well-liked BTC metric that’s used for measuring whether or not the asset’s worth (that’s, the market cap) is truthful in comparison with the community’s capability to transact cash (the transaction quantity).

When this metric has a excessive worth, it implies that the market cap is excessive relative to the transaction quantity. Such a pattern may very well be an indication {that a} correction could also be due for the coin.

However, a low worth on the metric can counsel the cryptocurrency’s worth might not be inflated relative to its quantity, and thus, may doubtlessly have room to develop.

Capriole’s Dynamic Vary NVT defines decrease and higher bands for the metric, past which the asset could also be thought of underbought and overbought, respectively. Because the metric’s identify suggests, these bands are dynamic, which means that they alter with time and replicate the latest Bitcoin surroundings.

From the above chart, it’s obvious that the Bitcoin NVT Ratio has declined under its decrease band lately, implying the coin could also be undervalued. The final time this sign appeared was through the bearish interval earlier within the 12 months.

Associated Studying

“We’ve got some large headwinds to resolve (like institutional promoting), however I can’t be bearish with Heater within the deep inexperienced zone at present + basic worth throughout the board,” stated Edwards. The analyst suspects BTC would possibly climb larger for a minimum of the approaching week.

BTC Value

On the time of writing, Bitcoin is floating round $87,000, down over 7% within the final seven days.

Featured picture from Dall-E, Capriole.com, chart from TradingView.com