- HYPE types a brand new low regardless of sturdy fundamentals and income progress.

- Main help lies at $28–$30, with deeper help at $21–$23.

- An actual pattern reversal requires a break and reclaim of $45 — till then, the downtrend stays in management.

The crypto market took one other hit this week, and Hyperliquid wasn’t spared. HYPE shaped a recent low — once more — leaving merchants questioning how a lot deeper this slide can go. Are traders scared? Nonetheless assured? What does liquidity say about the actual state of this market? Too many questions, actually, however the solutions normally cover within the charts lengthy earlier than they present up in sentiment.

What’s unusual is that fundamentals haven’t collapsed in any respect. Utilization is powerful, each day income retains flowing, and Hyperliquid Methods goals to lift a large $1B for HYPE purchases. On paper, that’s the type of gasoline bulls love. So… why is the worth nonetheless rolling downhill?

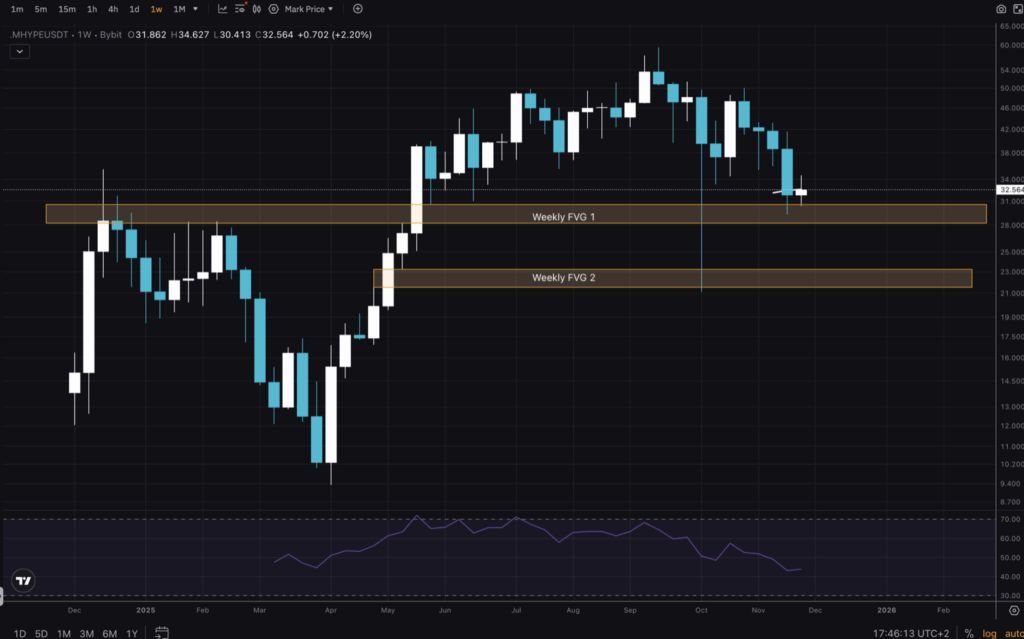

Weekly chart: Assist ranges get examined as RSI drifts decrease

Wanting on the 1W chart, we are able to spot two main Weekly FVGs. The higher one — between $28 and $30 — is being examined and stuffed proper now, making it the primary actual help zone. The second sits round $21–$23 and will change into an even bigger deal if issues maintain slipping. There aren’t many shifting averages to lean on at this timeframe, however RSI continues drifting downward and now sits across the center of its vary, not oversold however positively leaning mushy.

Every day chart: Downtrend clearly outlined, MAs misplaced, momentum weak

Zooming into the 1D chart, the downtrend turns into painfully clear. Value broke under the earlier low, making a market construction break. A decrease excessive shaped quickly after as HYPE bought rejected from a bearish orderblock — not precisely an awesome signal. The continued drop pushed the worth under all main shifting averages (sure… all of them), and that alone confirms the bearish construction.

Now merchants are asking whether or not we get a traditional bounce again into the underside of these MAs to type one other decrease excessive. RSI right here is caught on the backside of its vary, displaying momentum is exhausted however not but flipping.

4H chart: A possible commerce setup types regardless of the chaos

Shifting into the low timeframes — the 4H chart — issues get a bit extra fascinating. A transparent vary is forming, with seen ranges that merchants can use. The earlier low (marked in yellow) would possibly act as resistance, however value might break above it briefly simply to check the bearish orderblock overhead.

For aggressive merchants, a protracted entry at present ranges with a cease under the decrease low and a take-profit close to the purple zone affords roughly a 1:3 risk-to-reward. RSI is low right here as nicely, giving room for a potential squeeze upward.

What bulls want for an actual pattern reversal

To flip this chart bullish once more, consumers have plenty of work forward. They would wish to interrupt above $45 and reclaim it as help — not a small process given current value conduct. Till that occurs, this stays a downhill experience with occasional bounces. Keep cautious, keep affected person, and please… maintain stops in place. Right here is the place self-discipline issues greater than hope.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.