- DOGE reveals a repeating long-term cycle with increasing volatility and renewed shopping for curiosity.

- Breaking above $0.16 may goal $0.182, whereas failure dangers a retest of $0.135.

- Lengthy-term bullish targets reopen provided that DOGE reclaims $0.21–$0.22 on sturdy momentum.

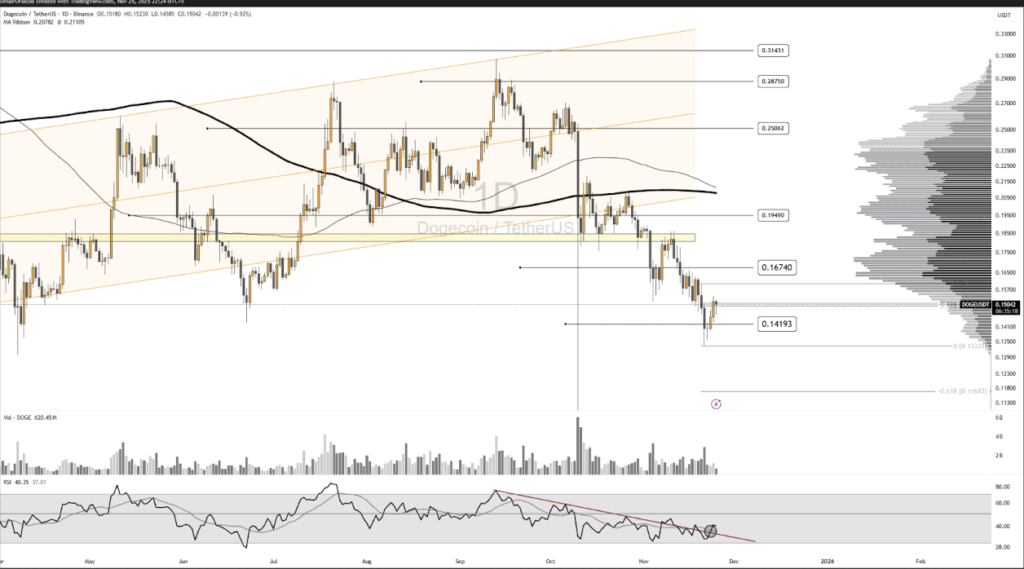

Dogecoin is as soon as once more exhibiting a cyclical sample that has traditionally appeared proper earlier than a few of its greatest rallies. On the weekly chart, DOGE’s long-term habits is nearly predictable: large surges, then lengthy, sleepy consolidation phases the place it seems like nothing is occurring in any respect. After topping out in early 2021, the coin slipped right into a multiyear downtrend, with volatility shrinking by 2022 and 2023 — the Bollinger Bands virtually narrowed to a pinch, signaling fading pleasure and skinny momentum.

Then, late 2023 into early 2024, one thing shifted. Bullish stress returned, volatility exploded outward because the Bands expanded once more, and DOGE ran straight towards the 1.618 Fibonacci extension round $0.35. That degree turned out to be heavy resistance, forcing worth right into a corrective drift. All through 2024–2025, DOGE saved making decrease highs whereas failing to remain above the 9-week DEMA and 20-week SMA — forming a stacked construction of resistance overhead whereas help held within the $0.14–$0.15 zone.

RSI breaks trendline with precise quantity — a uncommon sign for DOGE

Analyst Umair Crypto famous that DOGE not too long ago jumped about 7%, breaking its RSI trendline with actual quantity behind the transfer. This issues as a result of earlier spikes lacked conviction and pale shortly. Now the chart is approaching the 4-hour golden zone after already bouncing on its first take a look at close to $0.151. If DOGE pushes by $0.16, the following massive resistance waits at $0.182. But when the breakout fails… a drop again towards $0.135 is feasible, perhaps even forming a double-bottom sample that merchants like to latch onto.

Quantity nodes and transferring averages clustered between $0.16 and $0.18 will play gatekeeper for the following development. Maintain above them, and DOGE will get respiration room. Slip beneath, and we’re in all probability one other spherical of sideways drifting. Merchants insist that staying above the $0.14–$0.15 area is totally essential proper now.

Greater bullish targets rely upon reclaiming a significant vary

For DOGE to construct a convincing long-term bullish setup, it should reclaim the $0.21–$0.22 zone — a area the place the highest Bollinger Band meets cussed worth congestion. Solely a clear break above that space resets the higher-time-frame construction. If momentum holds, prolonged Fibonacci targets for the following leg of the cycle sit at $0.48 (2.618), $0.61 (3.618), and $0.69 (4.236). These numbers sound bold, however DOGE has hit wild extensions in previous cycles when volatility peaks.

Market nonetheless reveals indecision, however the cycle isn’t damaged

Bollinger Band habits reveals the decrease band increasing whereas the higher band slips downward — a combo that indicators rising draw back volatility and regular promote stress above. Towards the tip of 2025, Dogecoin’s candles present hesitation fairly than breakout vitality, suggesting the token is within the “center of the cycle” pullback section. Merchants are watching the $0.14–$0.15 degree carefully, since shedding that zone may reset your complete construction. Right here is the place DOGE both reloads for its subsequent wave or sinks deeper into consolidation.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.