- Bitcoin reclaimed $90K after practically per week under the extent, bouncing 12% from final Friday’s panic low.

- Choices merchants are betting on a decent buying and selling vary between $85K and $90K slightly than a breakout.

- Volatility is cooling and holiday-week buying and selling volumes are mushy, limiting huge worth swings.

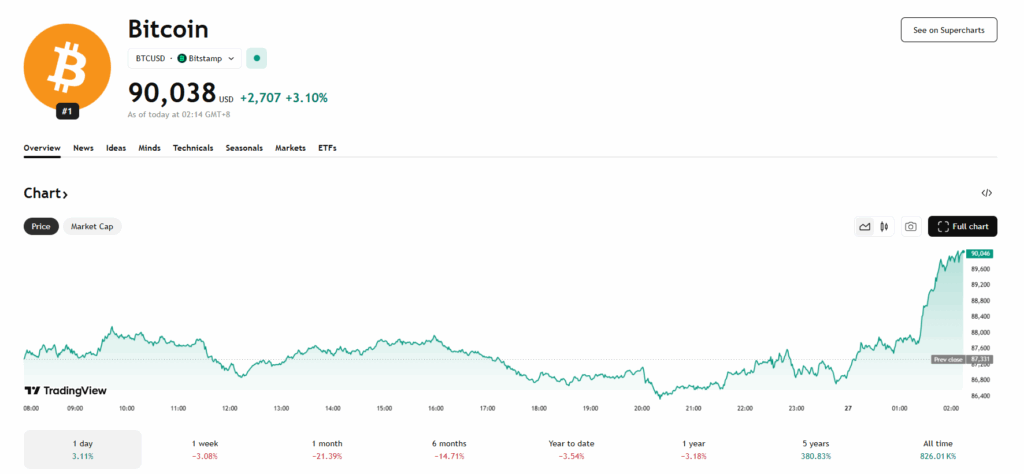

Bitcoin lastly pushed its method again above the $90,000 mark on Wednesday afternoon, snapping practically a full week spent grinding under that stage. The transfer comes throughout what’s usually a tough pre-Thanksgiving buying and selling day — traditionally, the Wednesday earlier than the vacation has produced declines in six of the previous seven years, together with brutal drops in 2020 and 2021.

This time, although, BTC confirmed some resilience. After plunging to a panicked backside close to $80,000 early final Friday, Bitcoin has now bounced roughly 12%. Even so, the broader image stays shaky: BTC remains to be down 3% this week, 21% this month, and stays 28% under its $126K all-time excessive.

A Bounce Regardless of the Bearish Headlines

The restoration comes as mainstream retailers — together with a contemporary trio of gloomy takes from the Monetary Occasions — proceed publishing crypto obituaries. But the market seems to be ignoring the noise for now. As of press time, BTC hovered simply above $90K, up virtually 3% within the final 24 hours.

Jasper De Maere of Wintermute famous that Bitcoin’s volatility has cooled after hitting its highest ranges since April. Decrease quantity throughout Thanksgiving week tends to melt main swings, making a quieter buying and selling setting.

Choices Merchants Anticipate Bitcoin to Keep Caught in a Tight Vary

Choices positioning reveals that merchants aren’t making ready for fireworks. As an alternative, many are promoting calls and strangles across the $85K–$90K zone — successfully betting BTC will keep trapped in a slender band. There’s additionally little or no draw back safety being purchased, signaling that merchants don’t count on a significant drop both.

“The market seems snug fading strikes on each side slightly than positioning for a breakout,” De Maere mentioned. With volumes thinning into the lengthy weekend, that equilibrium could maintain until an surprising catalyst emerges.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.