Tether has quietly overtaken each central financial institution to turn into some of the aggressive patrons of gold in latest months.

Given Tether’s vocal dedication to the long-term way forward for crypto, its aggressive shift into gold has left folks questioning what has prompted the change.

Sponsored

Tether Outbuys Central Banks

Gold’s document 56% surge in 2025 is commonly attributed to issues about fiscal dominance, rising public debt, unfastened financial coverage, and declining belief in main currencies.

These issues have prompted central banks in nations equivalent to Kazakhstan, Brazil, and Turkey to enhance their gold purchases, thereby reinforcing the steel’s standing because the world’s most trusted safe-haven asset.

A latest Jefferies evaluation, nonetheless, revealed a stunning twist. Tether purchased 26 tonnes of gold within the third quarter — greater than any central financial institution. By the tip of September, the corporate’s complete holdings had reached roughly 116 tonnes, valued at roughly $14 billion.

Tether’s presence within the gold market extends far past its tokenized product, XAUt, which holds fewer than 12 tonnes regardless of a $1.6 billion market cap. Jefferies reported that the corporate has been increasing its bullion reserves to help each USDT and XAUt.

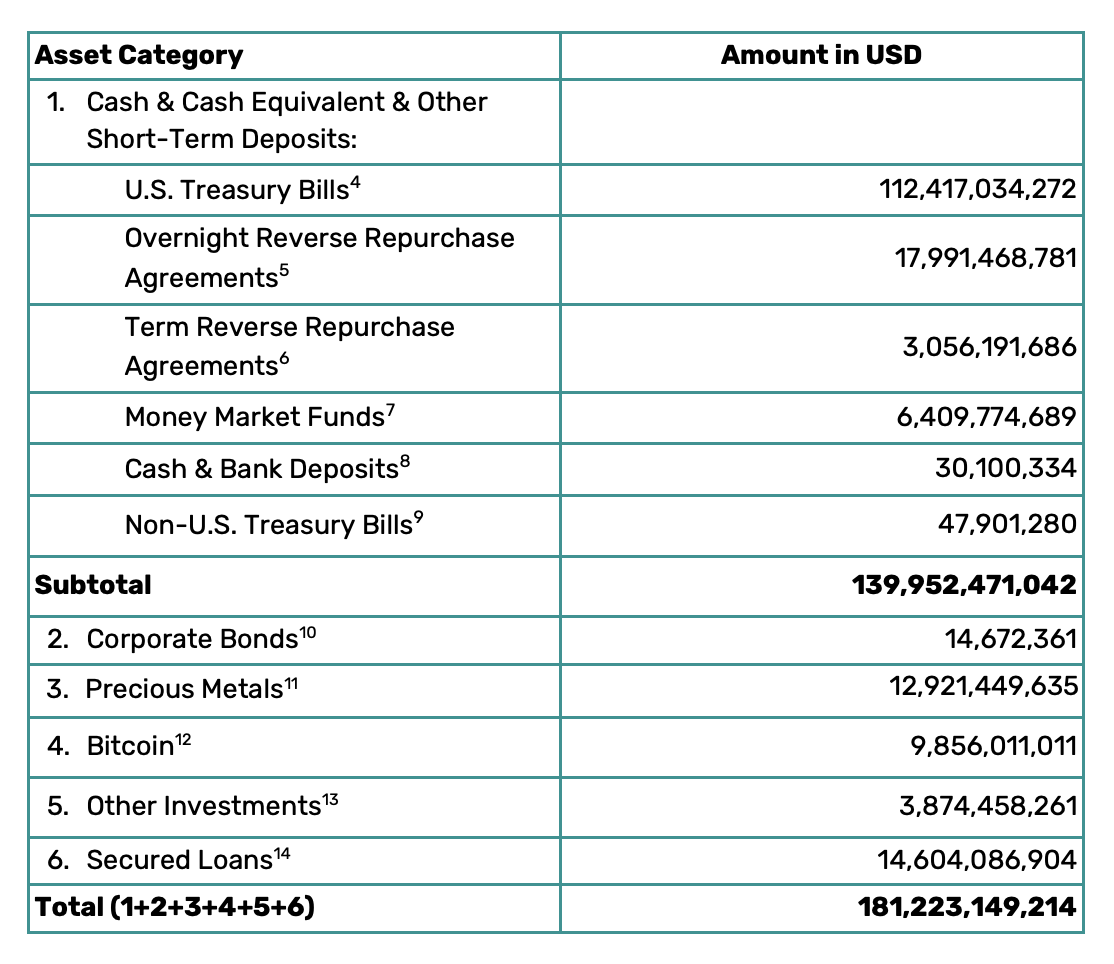

USDT’s circulation grew from $174 billion within the third quarter to $184 billion by mid-November, in accordance with Reuters. Gold has turn into a bigger a part of its backing as provide has elevated. Treasured metals now account for roughly 7% of Tether’s reserves, valued at round $13 billion.

Sponsored

In complete, Tether holds about 104 tonnes of gold for USDT and 12 tonnes for XAUt. The size and consistency of those purchases underscore its rising affect within the bullion market.

Nonetheless, the timing of this speedy accumulation has raised a brand new layer of controversy.

A Transfer at Odds With the GENIUS Act

Tether’s rising bullion place sits awkwardly beside the brand new US GENIUS Act. The legislation bars any compliant issuer from holding gold as a part of its reserves. It pushes corporations looking for approval to depend on money, Treasury payments, or different liquid and clear property.

Tether has already introduced a GENIUS-compliant token known as USAT, which can keep away from gold totally. But, the corporate continued so as to add to the bullion backing USDT even after the legislation was handed.

Sponsored

Why Tether doubled down on gold throughout this shift remains to be unclear. Gold costs have additionally cooled since hitting $4,379 in mid-October. The steel now trades greater than 6% beneath that peak.

Even so, Tether’s dedication to bodily gold highlights a deeper convergence of crypto and conventional safe-haven property.

Sponsored

Completely different Havens, Completely different Dangers

The convergence between gold and Bitcoin, also known as “digital gold,” will not be totally stunning. Each entice patrons who concern weakening main currencies. Many see finite-supply property as safety towards long-term debasement.

In observe, nonetheless, the 2 markets behave very in another way.

Bitcoin has grown quickly over the previous decade however stays extremely risky. Latest worth swings made that clear. The token plunged sharply over the previous two months, appearing extra like a high-beta tech asset than a financial hedge.

Stablecoins function on a unique promise.

They provide on the spot redemption at par and depend on reserves meant to remain secure. But the crypto sector continues to indicate vulnerability to sudden stress. A speedy shift in sentiment can occur at any time.

If demand for stablecoins had been to break down, strain would fall straight on the property backing them. That features Tether’s rising pile of gold. A pointy market reversal may immediate bullion gross sales, drawing a historically regular asset into the turbulence of crypto-driven markets.