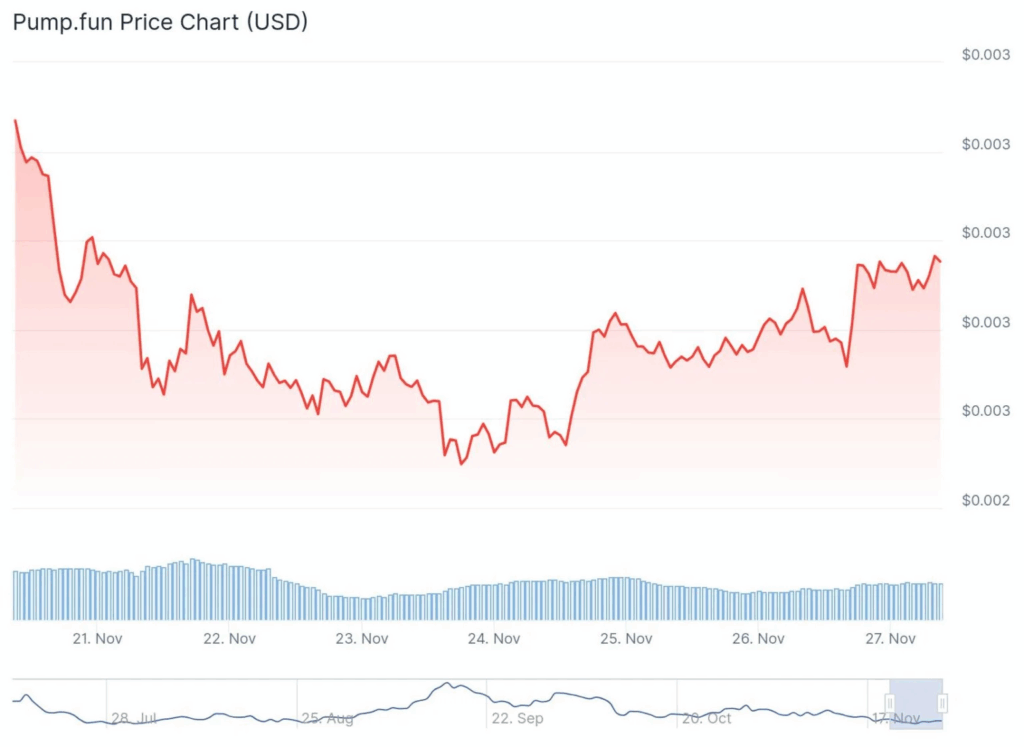

- Pump.enjoyable has transferred $480M in USDC to Kraken since November 15, together with one other $75M on November 27, reigniting fears of treasury dumping.

- PUMP has plunged practically 40% this month as insider allocations, lawsuits, and enormous treasury actions proceed to erode market confidence.

- Analysts anticipate additional weak point into December, citing excessive volatility and an Excessive Worry sentiment rating of 15.

Pump.enjoyable despatched one more big batch of USDC—about $75 million—over to Kraken on November 27, persevering with a string of outsized transactions that’s been freaking out the neighborhood for nearly two weeks. Blockchain sleuth EmberCN reported that complete transfers have now hit roughly $480 million since November 15, all sourced from the mission’s authentic ICO treasury. And identical to the sooner actions, this one adopted the identical odd sample: as soon as the funds reached Kraken, practically the identical quantity flowed out towards Circle. It’s not the primary time this sequence occurred both—on November 24, $405 million moved in, and round $466 million rapidly went out, which sparked chatter about USDC redemptions.

Group Denies Dumping Allegations

Co-founder Sapijiju pushed again towards the rumors, saying the staff isn’t dumping tokens or cashing out, and as an alternative described the transfers as “routine treasury administration.” He emphasised that Pump.enjoyable has by no means labored immediately with Circle and that the treasury is solely reorganizing ICO funds throughout wallets for operations and future growth. Nonetheless, the timing and scale of those transfers have left merchants uneasy, particularly as PUMP has cratered practically 40% within the final month and sits round $0.00294, far beneath its August peak close to $0.009.

Token Distribution and Revenues Draw Criticism

Pump.enjoyable has taken warmth for its token construction since launch. The personal spherical handed 18% of the 1 trillion PUMP provide to early traders at $0.004, elevating an estimated $720 million. Analysts famous insiders and early patrons managed greater than half the availability as soon as buying and selling opened, which many neighborhood members argue created a lopsided and unfair market from day one. Regardless of producing over $910 million in income since launch, month-to-month revenue has slipped sharply—from $136 million at peak to about $38 million lately. The platform additionally offered round $757 million value of SOL tokens between Could 2024 and August 2025, including to considerations that treasury actions, paired with insider allocations, could have weighed closely on value efficiency.

Authorized Strain and Market Sentiment Darken Outlook

Pump.enjoyable can also be coping with class-action lawsuits in New York, accusing the staff of unregistered token gross sales and deceptive revenue expectations. The authorized cloud, mixed with large ongoing treasury actions, has fueled a particularly bearish temper.

Analysts from Coincodex mission extra draw back into December, flagging PUMP’s volatility and an “Excessive Worry” rating of 15 on the Worry & Greed Index. Even the September launch of Venture Ascend—meant to enhance charge buildings and creator incentives—hasn’t been sufficient to offset sentiment. And with the newest $75 million switch tied as soon as once more to ICO wallets, merchants fear volatility might worsen earlier than it will get higher.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.