- XRP is holding above $2.20 after a burst to $2.286, supported by a bullish trendline and robust upward momentum.

- The primary U.S. spot XRP ETF noticed almost $25M in quantity in its first 90 minutes, with XRP now buying and selling round $3.11—15% beneath its July ATH.

- A number of main corporations, together with Bitwise and WisdomTree, have pending XRP ETF purposes as institutional curiosity accelerates.

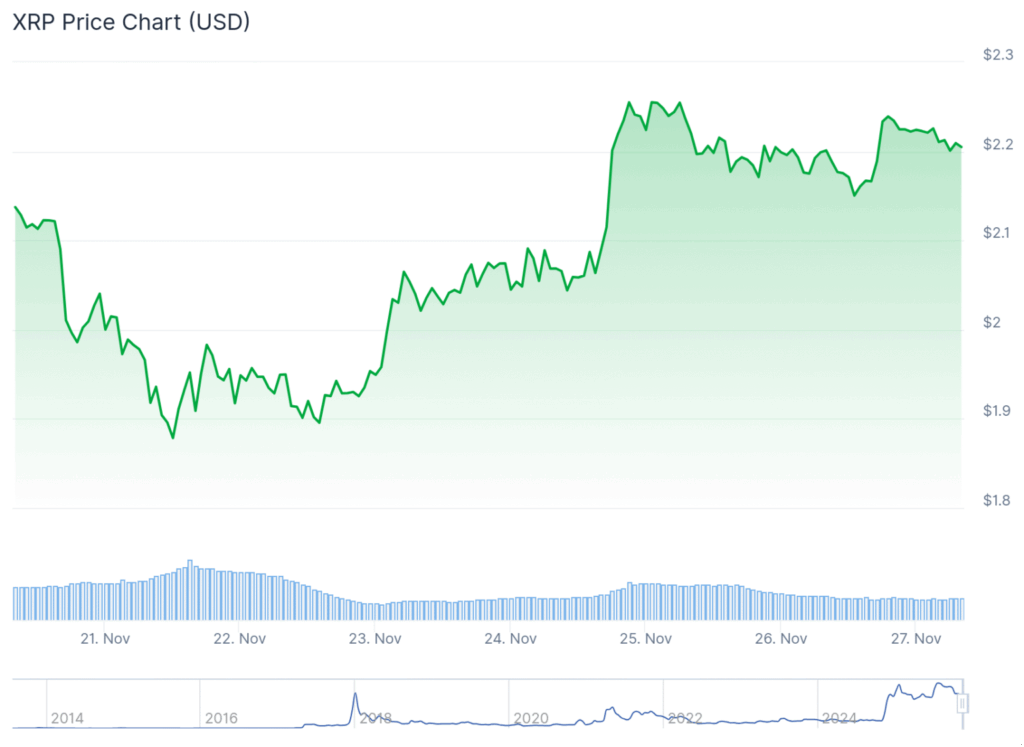

XRP kicked off the week with a burst of momentum, climbing above the $2.22 zone and tagging a excessive close to $2.286 earlier than slipping right into a slower, extra range-bound stretch. The transfer really outpaced each Bitcoin and Ethereum early on, helped by a clear breakout over the $2.10–$2.12 area that had capped value for days. XRP now trades above $2.20 and the 100-hour SMA, holding a bullish trendline that sits round $2.18—principally performing as the primary actual security cushion throughout pullbacks. Even after dipping beneath the 23.6% Fib degree from its $1.817 swing low, value nonetheless clings to key assist areas, which reveals bulls haven’t stepped apart simply but.

ETF Launch Sparks Institutional Curiosity

Fueling the thrill, the first-ever spot XRP ETF within the U.S. made a loud entrance, pulling in almost $25 million in buying and selling quantity inside its first 90 minutes. The Rex-Osprey XRP ETF massively outperformed expectations—by about 5x in comparison with XRP futures ETF debuts—which took even Bloomberg analysts abruptly. XRP itself now trades round $3.11, sitting roughly 15% beneath its July all-time excessive at $3.65, leaving room for upside if demand retains constructing. The construction of the ETF is a bit totally different, utilizing a Cayman subsidiary beneath the ’40 Act slightly than a standard spot ETF setup, however clearly that didn’t scare off early consumers.

Resistance Ranges and Quick-Time period Value Targets

If XRP begins climbing once more, the subsequent stress zone sits round $2.2650, adopted by a heavier block close to $2.28. A transparent breakout above that would open the door towards $2.35, and if consumers actually lean in, ranges like $2.45 and even $2.50 aren’t out of the query. On the flip facet, shedding the $2.18 trendline would weaken the construction a bit, however for now the chart nonetheless favors upward makes an attempt—particularly as ETF information continues pulling contemporary consideration into the market. Bulls are eyeing $2.55 as the subsequent main hurdle if momentum returns.

Extra XRP ETFs Are Lined Up Behind the First

Curiosity isn’t stopping with Rex-Osprey. Companies like Bitwise, Canary Capital, and WisdomTree all have pending spot XRP ETF purposes with the SEC, every following the extra conventional Securities Act route.

Choice home windows fall between October 18–25, and analysts suppose the SEC’s newly accredited itemizing requirements for commodity-style trusts might easy the method. Add in Ripple’s authorized readability—the place courts confirmed programmatic gross sales are not securities—and establishments all of the sudden appear extra snug dipping into XRP publicity. With CME getting ready to roll out XRP choices subsequent month, analysts say institutional confidence is hovering round 60% for a transfer towards $4.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.